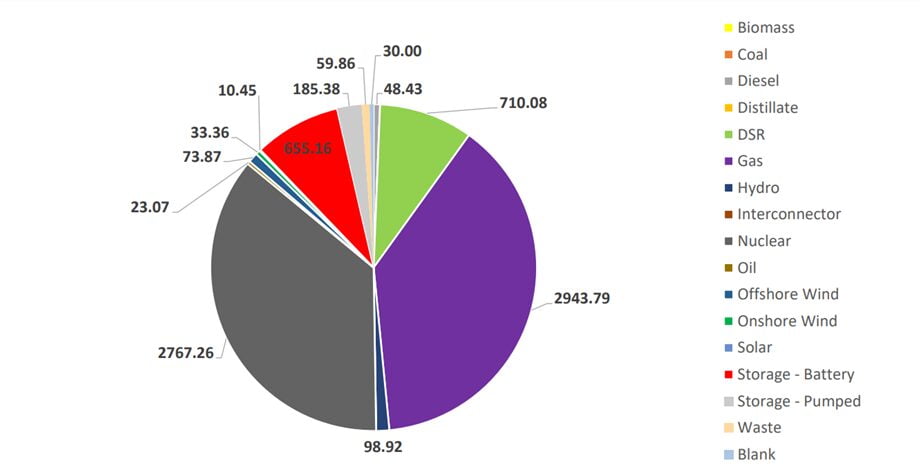

The majority of capacity was awarded to gas as a primary fuel type 2,943.79MW (38.53%), closely followed by nuclear 2767.26MW (36.22%) Demand-Side Response (DSR) was then awarded the third largest volume of capacity at 9.29%.

The provisional results show that roughly 9.5GW of de-rated capacity entered this year’s auction with less than 300MW exiting in the first seven rounds.

Jake Thompson, data scientist at energy data analyst’s Montel EnAppSys pointed out that the c.819MW Sutton Bridge and c.850MW Severn power stations (the two largest units in the auction) both exiting, removing their collective c.1.5GW of capacity from the auction and causing it to clear. This meant that the 7.6GW of capacity was awarded across a total of 277 capacity market units (CMUs).

Georgina Morris, head of capacity market policy – low carbon technologies for the Department of Energy Security and Net Zero (DESNZ), confirmed that the T-1 auction 2024/25 has cleared at £35.79/kW/year (40% less than the £60/kW/year cleared in the 2023/24 auction) on the second day of Solar Media’s Energy Storage Summit 2024.

Explaining what she believed these results mean for the UK BESS sector Morris said: “What I’m seeing from various commentators is that the Capacity Market is starting to become a more important part of the [BESS] revenue stack.”

The T-4 auction for delivery year 2027/28 will take place next week.

To read full version of this story visit Solar Power Portal.