All data and analysis in this article refers to the Republic of Ireland, and comes from our in-house market research at Solar Media, specifically our Republic of Ireland Battery Storage Project Database Report.

Size of energy storage projects

With at least 720MWh of energy storage deployed – and 1GWh in construction – the growth of the energy storage market in Ireland has been rapid, considering the first project was only energised in 2020.

In particular, the pipeline increased by over 4GWh in 2023, a growth of 75% compared to 2022. The first half of 2024 shows further promise that this strong growth will continue, with 2.5GWh already submitted and over 1.5GWh of additional storage forecast to be connected to the grid by the end of 2025.

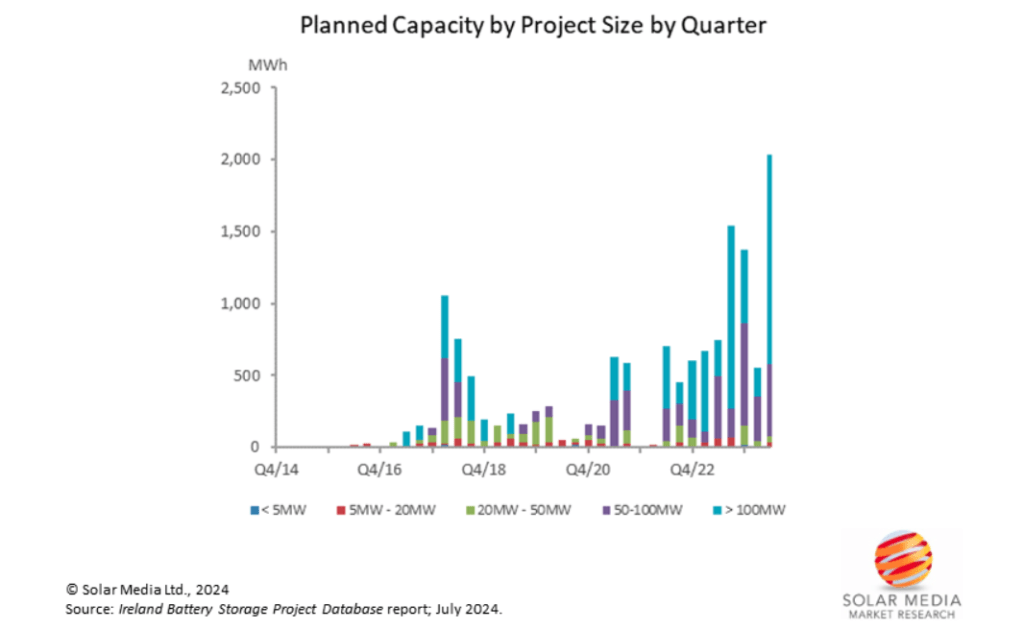

Figure 1 above shows the pipeline of energy storage in Ireland, where the total applications submitted between 2015 and H2 2024 has a cumulative capacity of 14.41GWh.

The stronger incentives in Ireland during 2018 enticed new companies into the market, particularly those that already had solar farms in the country and were diversifying their portfolios. There was a lull in 2019 and 2020, which soon picked back up in 2021 with the pipeline increasing by 1.3GWh.

The second quarter of 2024 saw the highest number of applications submitted, at over 2GWh. On an annual basis, 2023 showed a growth of 92% from 2022, compared to a growth of 42% from 2022 to 2021 when comparing capacity in MW.

2020 saw a more mixed capacity scale, but it is clear that going forward that larger projects are at the forefront of Ireland’s goal to halve its greenhouse gas emissions by 2030.

Seven applications submitted in 2023 (17%) were over 100 MW, compared to only two applications (9%) in 2022. However, due to the small number of applications, these larger projects contributed to more than half of the capacity submitted in both years.

The average project size from the first half of 2024 was 80MW/160MWh and the averages for 2023 and 2022 were 56MW/110MWh and 54MW/80MWh, respectively.

The largest known projects delivered were both 100 MW/100MWh sites, completed in 2020 and 2021. Since then, the number of projects has only marginally grown in size each year and the capacity installed has not shown any significant advancements either.

Projects by build status

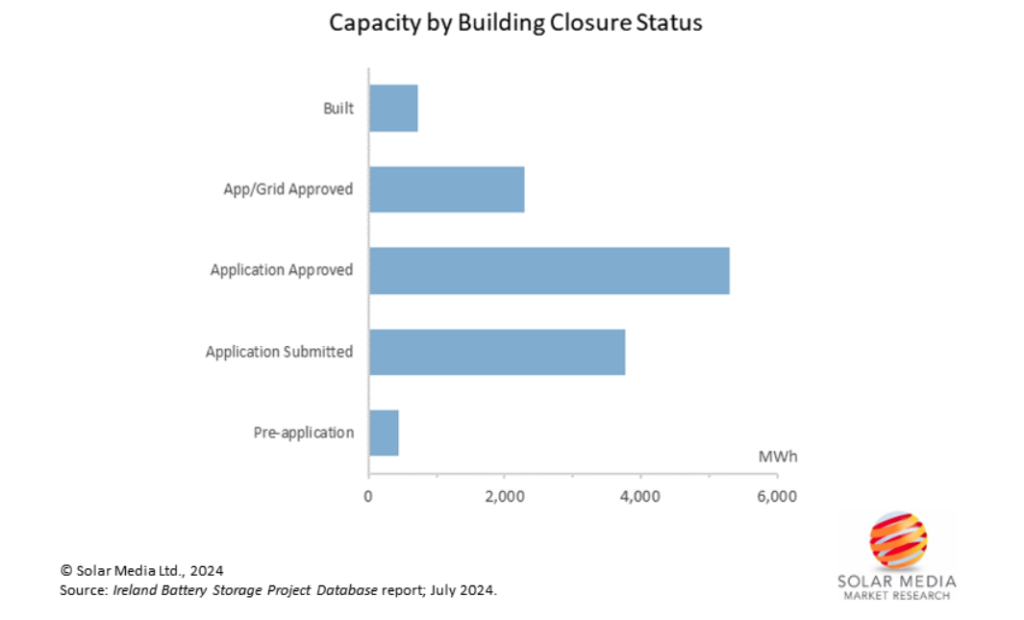

Figure 2 below shows all energy storage projects in Ireland, in terms of their build status. This includes tracking projects from the initial pre-application stage, through to full build-out (operational).

Despite the relatively low deployment level today, the pipeline remains promising, with 448MWh in pre-application, 3.7GWh having been submitted or at appeals (with decisions in the coming months), 5.3GWh of planned capacity approved, as well as 2.2GWh with grid connection approved awaiting construction. It is safe to say the number of operational sites will be increasing markedly in the next few years.

Statkraft delivered the first energy storage project in Ireland with Fluence in 2020, at its Kilathmoy wind farm and the company has continued to have a strong presence in the Irish energy storage field since then. The company is also lining up another milestone project soon, with the country’s first four-hour duration energy storage system.

Going forward, long duration energy storage is certainly a driving factor, with newly submitted projects having an average duration of two hours.

Co-location of energy storage in Ireland

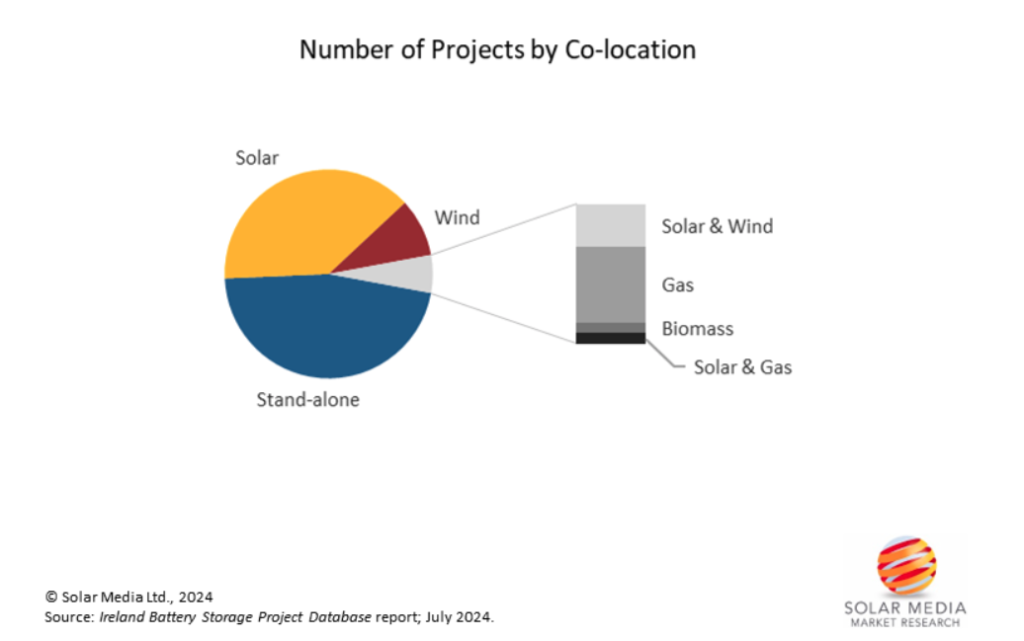

Figure 3 shows the co-location status of submitted applications, where the most common co-located energy generator is solar (particularly in 2023). Although the number of standalone projects is slightly larger than co-located solar and storage sites, co-located projects tend to have smaller capacities (an average of 29MWh for solar and 19MWh for wind).

Highfield Energy has been one of the most active in Ireland, when incorporating energy storage alongside solar farms, with at least 15 applications submitted with this pairing. The company also has a few standalone projects with Aura Power; however, these predominantly date back to 2018. In addition, both Lightsource bp and Terra Solar are planning to utilise storage systems in their solar farms in Ireland.

Counties Cork, Meath, Kerry, and Offaly currently have the most application submissions, with Meath having the most projects completed.

While the energy storage pipeline in Ireland remains strong, it is unlikely to see a similar growth in built capacities until a few years from now. The potential cut-backs in DS3 tariffs may also pose risk in the development of this market. However, until now the market has shown great promise and the increase in co-located projects recently proves energy storage is well on the way to assisting Ireland to meet its net-zero goals by 2050.