However, with grid infrastructure often taking five to fifteen years to plan and permit, in comparison to one to five years for new renewables projects, the current speed of grid build-out is nowhere near fast enough to manage an effective energy transition.

We certainly still need new poles and wires but transmission-connected batteries can be part of the solution, offering a game-changing solution for grid stability and decarbonisation.

Transmission-connected batteries are large-scale energy storage systems directly linked to the high-voltage transmission network. Unlike behind-the-meter batteries serving individual buildings, these powerhouses operate at a national level, providing crucial balancing services to the entire grid.

Energy Superhub Oxford: the first transmission-connected battery project

An innovative model, with a transmission-connected battery at the heart, is Energy Superhub Oxford (ESO) – a project that provides an example for cities looking to expand green transportation, energy, and heating simultaneously, without overburdening the grid.

Spearheaded by EDF Renewables UK, ESO installed the UK’s first transmission-connected battery, coupled with one of Europe’s most powerful EV charging networks – supporting Oxford’s ambition to reach net zero by 2040.

ESO’s battery is a unique asset in several ways: it was the first battery in the UK to be connected to the National Grid transmission network and it is the first hybrid battery of its type anywhere in the world, with both a lithium-ion and vanadium flow battery playing a part in the project.

The 52MW hybrid transmission-connected battery provides balancing services such as frequency response to National Grid, enabling improved flexibility and ultimately greater amounts of distributed renewable generation on the grid of the future.

ESO has also become a key piece of the puzzle in scaling up green transport in Oxford, with a 7km private cable network offering 10MW of power directly from the UK’s overhead electrical network. This has allowed companies like Oxford Bus Company to bring a brand-new fleet of 104 electric buses to the city– a major win for air quality for Oxford residents.

This is groundbreaking territory for the battery storage industry, opening up the transmission network to other battery storage developers, who have since been applying to National Grid for similar connections.

Their role in the market

At the outset of ESO, it was expected that the transmission-connected battery would spend most of its time trading in the energy markets, and this would deliver most of the revenues, with a smaller contribution from ancillary services like Firm Frequency Response (FFR).

In reality, however, frequency response services have provided the majority of the project’s revenues. This was primarily due to the introduction of new services, particularly dynamic containment (DC), that resulted in a new market for these batteries.

Additionally, since ESO’s inception, the energy crisis has resulted in very high prices for the provision of non-battery assets, as well as high price volatility. In this environment, the battery has provided both back up in significant grid stress events, and reactive power.

In recent years, concern has been raised by the industry that BESS was being consistently overlooked in the Balancing Mechanism (BM), with skip rates for large-scale batteries at 80% on average between November 2022 and May 2023. Since the Electricity System Operator launched the Bulk Dispatch tool in January of this year, there has been significant improvement in weekly dispatch volume for batteries in the BM. Though Bulk Dispatch has certainly improved things for batteries, the Electricity System Operator has some way to go, with the introduction of the 30-minute dispatch rule in the BM and Fast Dispatch set to further improve battery uptake in the BM.

Change is needed to achieve targets

The future of a decarbonised UK demands a smarter and more flexible grid. Transmission-connected batteries are not just a supporting act – they are a vital technology that can help accelerate the UK to a net zero future.

However, the UK cannot fully realise its net zero potential without action from the top. ESO highlighted that in order to ensure successful integration of transmission-connected batteries, we must create an agile and responsive market structure. This demands a regulatory environment that fosters innovation and empowers stakeholders to adapt to the evolving needs of the electricity system – paving the way for more efficient and effective grid management.

Transmission capacity needs to be vastly expanded, and Ofgem empowered to enable anticipatory grid investment. With delays in getting projects online becoming longer, National Grid and DNOs need to be held to promised timelines.

The connections queue now stands at 701GW with estimates this could rise to 800GW by the end of 2024. We welcome the work that is currently underway to reform the transmission connections process (with implications for both transmission and distribution connected projects), with the aim of reducing the existing queue and reforming the process for new applicants.

However, a great deal of uncertainty remains surrounding the infrastructure needed to deliver connections and the specifics of the reformed connections process currently under development and its implications for developers of BESS.

Only with a regulatory environment that supports the growth of renewables can we deliver a smarter and greener grid.

1,200MWh state-owned BESS begins construction in Queensland, Australia

The BESS is central to the government’s plans to transition the site, which is about 22km from the nearest city, Rockhampton, to clean energy resources. The government-owned company intends to transform the power station into the Stanwell Clean Energy Hub.

Construction of the Stanwell BESS. Image: Stanwell.

In May 2024, Energy-Storage.news reported that around AU$448 million of the project’s funding will come via a direct investment from the Queensland government via the Queensland Renewable Energy and Hydrogen Job Fund, which was established in 2022 with AU$4.5 billion by Queensland premier Steven Miles’ predecessor Annastacia Palaszczuk.

Mick de Brenni, the Queensland minister for energy and clean economy jobs, said the project would deliver 80 jobs across its construction period and emphasised the potential of state-owned batteries, stating it means “Queenslanders themselves benefit, not overseas shareholders”.

“This battery project is the largest of its kind in Queensland and will create around 80 jobs in construction. What batteries deliver to the Queensland SuperGrid is reliable power. We want to ensure we maintain downward pressure on power bills for all Queenslanders by building more renewable energy and storage,” Mick de Brenni said.

Construction on 600MWh Tarong BESS reaches halfway point

Stanwell also confirmed that its 300MW/600MWh Tarong BESS had reached the halfway mark on its construction timeline. The AU$514 million system will be an addition to the Tarong Clean Energy Hub.

Construction on the standalone battery storage asset being built at the Tarong Power Station site started in August 2023, with hopes to be fully operational mid-2025. Like the Stanwell BESS, it will use Tesla Megapack 2XL battery units, 164 in total.

Work is now underway to connect the battery units to the transformers.

Michael O’Rourke, CEO of Stanwell, said dispatchable energy assets like its Stanwell and Tarong battery projects are “critical as we transform our energy system”.

“The big batteries will play a crucial role in the energy transformation by stabilising energy supply from clean renewable sources, meaning they’ll be able to be charged by sources like wind and solar and pumped back into the grid during periods of high demand,” O’Rourke said.

“This will ensure affordable and reliable electricity for our commercial and industrial customers in Queensland and the Eastern Seaboard. They are a key piece of our commitment to achieving 5GW of energy storage by 2035 and highlights Stanwell’s vision for a sustainable and innovative energy future.”

The Queensland government has been supporting upstream battery manufacturing and materials refining plans within Queensland, in particular seeking to leverage its advantages as a holder of vast natural vanadium resources, the key ingredient in electrolyte for vanadium redox flow batteries (VRFBs) via its Energy and Jobs Plan, an AU$62 billion overhaul and injection of stimulus into the energy sector and local economy.

First project in 20GW solar, 20GW storage plan for ‘challenged land’ in Fresno County, California

The Valley Clean Infrastructure Plan aims to repurpose up to 130,000 acres of drainage-impaired or water-challenged lands in the Westlands Water District in Fresno County. The District is the largest agricultural water district in the US at 614,000 acres, or 2,400 square kilometres, and serves the agricultural sector.

At full buildout, the plan would include up to 20GW of solar and 20GW of energy storage, which, if achieved, would cover one-sixth of California’s electricity requirements in 2035, MCE said.

In the nearer term, MCE and GCSE have entered a memorandum of understanding (MOU) for 200-400MW of solar and BESS. The 200-400MW BESS would be a 4-hour or 8-hour system. That project would help MCE meet existing mid-term and long-term procurement needs, and the utility is aiming for a commercial operation date (COD) in 2028-2030.

GCSE’s Valley Clean Infrastructure Plan would enable family farms to lease land for clean energy projects and increase water efficiency of the overall region, by concentrating water resources on more productive farmland, it said. Land use, and the perceived threat to farmable land that clean energy projects pose, are huge topics in the industry.

MCE will be the first customer in the programme. It could build the project itself or purchase the resources through power purchase agreements (PPAs). The Inflation Reduction Act (IRA) has made direct ownership of clean energy projects more attractive for non-profit co-operative utilities and aggregators like MCE, because they can benefit from tax credits via direct payments from the IRS.

Fresno County, central California, has been the site of numerous large-scale BESS projects. A year ago RWE connected a 548MWh BESS to an existing solar project there, while last month EDP Renewables did the same (albeit at a smaller scale). Last month we also brought you an exclusive update into a 3GW BESS being developed in Fresno County by NextEra Energy Resources (Premium access).

Energy Storage Awards 2024: Submission Deadline Extended

Organised by Solar Media, the publisher of Energy-Storage.News and the host of the Energy Storage Summit series, the awards aim to recognise the innovation, dedication, and pioneering spirit that drive the industry forward.

Since its inception in 2014, Energy-Storage.News has been at the forefront of documenting and supporting the rapid growth of the energy storage sector. The awards offer a platform to acknowledge the significant advancements made and inspire further progress toward a cleaner, more efficient, and smarter energy system. The awards currently have over 20 categories and are set to attract over 500 attendees, including the most influential figures in energy storage.

The winners will be celebrated at a prestigious ceremony on 21 November 2024, at the Hilton London Bankside, where industry leaders will gather to honour the exceptional achievements of their peers.

This extended deadline is your opportunity to apply for one of the 20+ categories and ensure that your hard work and contributions to the energy storage industry receive the recognition they deserve. Whether you are a seasoned veteran or a newcomer, this is your chance to shine and be acknowledged as a leader in the field.

You can submit your entry here, before the deadline of Friday, 16 August at 23:59 BST.

1,200MWh solar-plus-storage project in New South Wales, Australia, seeks approval

The project is set to be developed on an area of approximately 1,200 hectares consisting of mostly cleared grazing land, about 20km southeast of Dunedoo, in the NSW Central-West Orana region, the location of one of the Renewable Energy Zones (REZ) being developed in the state. The REZ recently transitioned into the delivery phase, as reported by our sister site PV Tech.

Acen Australia said the BESS will enable excess electricity generated by the PV facilities to be captured and released during periods of high demand. The system will also provide grid stability services and backup capacity to ensure the security of supply.

According to documents observed on the EPBC website, the project will look to install approximately one million solar PV modules and associated mounting infrastructure. The site will also include an on-site substation with a connection voltage of up to 500kV.

Construction of the project, which will have an average workforce of 360 throughout the development phase, will last 28 months, with the construction of the BESS expected to take around 16 months. Throughout operations, a workforce of up to 20 people will be required.

It is worth noting that the Birriwa solar-plus-storage project will be located next to two other solar projects developed by Acen Australia, as seen in the image above. These are the 400MW Stubbo solar PV project, at which construction began in November 2022, and the 320MW Narragamba solar project. These projects will connect to new transmission infrastructure developed by the Energy Corporation of NSW (EnergyCo) as part of the Central-West Orana REZ.

Once the Birriwa solar project receives approval, it will be able to transition into the construction phase. It will connect to the Merotherie Energy Hub and the transmission line proposed by EnergyCo NSW.

This article first appeared on our sister site PV Tech.

CS Energy’s Chinchilla 200MWh BESS goes into commercial operation in Queensland, Australia

CS Energy worked with Tesla and Downer to deliver the Chinchilla BESS, the first operational project in the Kogan Clean Energy Hub.

CS Energy’s Chinchilla BESS comprises 80 Tesla Megapack 2 systems. The Megapack is based on Tesla’s integrated solution, which includes lithium-ion (Li-ion) batteries, power conversion system (PCS), thermal management and controls.

Alongside the Chinchilla BESS, the Kogan Clean Energy Hub includes the Kogan Renewable Hydrogen Demonstration Plant. The hydrogen plant includes the co-location of a 2MW solar farm, a 2MW/4MWh battery, a hydrogen electrolyser, a hydrogen fuel cell, hydrogen storage, and an out-loading facility.

The demonstration plant will have an on-site hydrogen storage capacity of about 750kg. Through an offtake deal with Sojitz Corporation, hydrogen produced at the plant will be exported to the Republic of Palau.

CS Energy CEO Darren Busine emphasised the potential the project could have for the Western Downs community, sharing that CS Energy is “here for the long-term”.

“Getting the Chinchilla Battery ready for commercial operation has taken a large effort from many people and teams across our entire business, from the team at the site who will operate and maintain the asset to our traders in Brisbane who will dispatch its output into the grid,” Busine said.

“This project, along with our other projects planned for the Kogan Clean Energy Hub, shows that CS Energy is here for the long-term in the Western Downs community.”

Tesla Megapack’s influence in the Queensland BESS market

It should be noted that Tesla’s Megapack system is being utilised across a number of sites in Australia, including RWE’s 50MW/400MWh Limondale BESS in New South Wales.

Indeed, just last week (8 August) energy storage developer Akaysha Energy said it had started construction of its 205MW/410MWh Brendale BESS, also located in Queensland. The project will incorporate Tesla Megapack technology, with Consolidated Power Projects Australia Pty Ltd (CPP) set to deliver the Balance of Plant.

Aypa Power, Hunt Energy Network raise US$573 million for US BESS projects

The developer said the combination of debt and tax equity financing will go towards its Kuna project near Idaho’s capital city, Boise.

The 150MW/600MWh asset is scheduled to go into commercial operation in mid-2025 and is expected to be the northwestern state’s largest BESS project to date when it does.

The new financing package comprises US$90 million in tax equity funding, alongside a US$233 million green loan including construction and term loans, a tax equity bridge and a letter of credit facility.

As with other recent financings, the investment has been participated in by a raft of major global finance institutions. ING Capital, Société Générale and the New York branch of the Industrial and Commercial Bank of China led debt financing.

Deutsche Bank Trust Company Americas and US Bank were also involved, as coordinating lead arranger and lender, and depositary and collateral agent, respectively.

Meanwhile, the tax equity investment was led by UK Bank subsidiary US Bancorp Impact Finance, which the bank launched in 2023 to make tax credit investments and other financial solutions to impact-focused customers.

Aypa has secured a long-term offtake agreement for the Kuna BESS project with utility Idaho Power. Idaho Power, the state’s monopoly electricity supplier, modelled 1,373MW of energy storage in its preferred resource portfolio from its most recent integrated resource plan (IRP) in 2023, including resources already contracted for to come online this year and next, like Kuna.

Its first two build-own-operate BESS facilities were constructed in 2023 by BESS system integrator and manufacturer Powin Energy.

For developer Aypa Power, the finance raise follows recent progress on its 400MW/1,600MWh San Gabriel standalone BESS project in California and 100MW/200MWh Stargazer solar co-located BESS in Texas, as reported in depth by Energy-Storage.news Premium in late June.

The company claims to have more than 22GW of energy storage projects in development including standalone and hybrid facilities across the US.

Manulife invests in dispatchable storage and peakers

Hunt Energy Network, a developer of dispatchable energy resources including energy storage and fossil fuel peaker plants, has secured a US$250 million funding commitment from Manulife Investment Management.

The investment arm of global insurance company Manulife is contributing to financing a network of resources which Hunt Energy Network will develop and operate across the ERCOT Texas market.

While details of specific projects were not given, the developer said the portfolio will include energy storage and thermal peaking capacity.

There would also be ‘significant’ onsite fuel storage at the peakers, which Hunt claimed would be able to run on a variety of fuel types and therefore would not be dependent on natural gas supply chains.

The new projects could also be leveraged as customer-sited backup power when not participating in ERCOT markets.

The new commitment follows a previous, separate one, made by Manulife three years ago, as it committed US$225 million to create a joint venture (JV) with the developer.

That JV, HEN Infrastructure, develops and operates distribution-level energy storage resources in ERCOT. To date, 270MW of storage has gone into operation through it, with a further 80MW in development pencilled in for completion early next year.

Over US$3 billion financings announced since mid-July

The announcements follow other financings for energy storage and solar-plus-storage in the multiple hundreds of millions of dollars reported by Energy-Storage.news and our colleagues at PV Tech over the last few weeks alone.

RPlus Energies, a developer of renewables and storage including both batteries and pumped hydro energy storage (PHES), raised more than US$1 billion for a solar-plus-storage in Utah, and Intersect Power closed two financing deals worth US$837 million for three ERCOT projects. Both items were reported on the same day (18 July) by Energy-Storage.news.

Then, Clearway Energy Group closed a US$700 million construction financing transaction on a portfolio of California solar-plus-storage plants (reported 24 July), before just under a week later, independent power producer (IPP) Enlight Renewables said it had secured US$400 million towards a solar-plus-storage project in New Mexico which will feature 1.2GWh of BESS capacity.

At the beginning of this month, we reported that a trio of IPPs and developers, Eolian, BrightNight and esVolta, raised over a billion dollars between them for hybrid and standalone projects around the US.

IPP Ørsted targets 1GW of BESS in US Midwest

The pair have submitted interconnection applications for the projects which total 1GW, in the Central and North regions of the Midcontinent Independent System Operator (MISO).

MISO Central includes Wisconsin, Masachussetts, Illinois and parts of Indiana, Kentucky and Missouri, while MISO North covers Minneapolis, Iowa, North Dakota, part of Montana and South Dakota, and the Canadian province of Manitoba.

Ørsted will have the option to acquire an ownership stake in the projects as they mature, it added. The company is mainly known for offshore wind but has been making a push into solar and storage in the last few years. But this partnership is its first foray into large-scale standalone energy storage with a portfolio of multiple projects.

It built its first standalone BESS, a 20MW system in the UK, five years ago, and two years later added a 40MW BESS to a solar project in Texas. More recently it added a 300MW/1,200MWh BESS to its Eleven Mile solar project in Arizona, for which it secured financing with JP Morgan earlier this year.

It is also starting to deploy large-scale BESS in Europe. In June it made a final investment decision (FID) on a 300MW/600MWh BESS (premium access) co-located with a 2.9GW wind project off the coast of England, UK.

Global BESS landscape became less consolidated in 2023, Tesla takes top spot

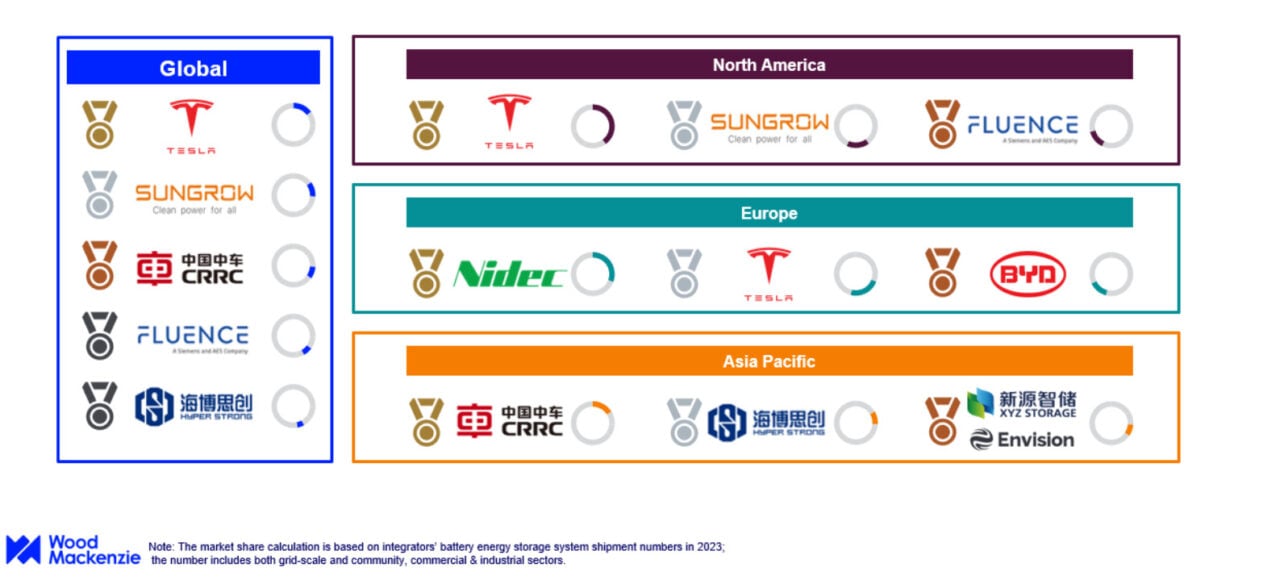

EV and BESS firm Tesla has taken the top spot from inverter and BESS company Sungrow, as shown in the left of the infographic above, while the third-largest is power and industrial solutions firm CRRC, followed by pure-play BESS integrators Fluence and HyperStrong. Sungrow, CRRC and HyperStrong are based in China while Tesla and Fluence are US-headquartered. Six of the global top ten providers are China-based.

Wood Mackenzie’s Kevin Shang, principal research analyst, energy storage technology and supply chain, said: “The global BESS integrator market is becoming increasingly competitive, especially in China, resulting in declining market concentration. As a sector with a relatively low entry barrier, the BESS integrator industry has attracted a significant number of new players.”

The firm’s data includes both grid-scale and commercial & industrial (C&I) projects. Energy-Storage.news has reported extensively on the falling price of BESS because of increased competition.

However, Wood Mackenzie’s research showed that the regional energy storage markets of North America and Europe have actually become more, not less consolidated by the top three providers. In Europe, power solutions firm Nidec, Tesla and BYD – Tesla’s biggest competitor, also China-based – increased their market share, from around 54% in 2022 to 68% in 2023.

The same trend was noted in the US, with Tesla, Sungrow and Fluence remaining market leaders and increasing their share to 72% compared to 60% in 2022.

Wood Mackenzie also said Chinese companies strengthened their position in the Asia Pacific market although didn’t provide numbers in its press release.

“Tesla has the energy storage industry’s most vertically integrated supply chain, from manufacturing hardware to providing energy storage solutions. This enables Tesla to deliver continued improvements and new features to clients quickly and helps customers maintain storage assets for their entire lifespan,” Shang added.

“Importantly, established companies have also been bolstering their competitiveness in terms of price, performance of products and solutions across all regions.”

While the BESS landscape is becoming more competitive, providers are increasingly converging on the same, 20-foot 5MWh-plus form factor as the standard product, as covered in a recent article (Premium access).

Brookfield commences permitting for Oregon 4GWh hybrid BESS facility

The NOI, filed 30 July 2024, is stage one of a seven-step procedure, typically taking one to two years and administered by the state regulator that integrates all permits, standards and requirements into one approval process for new energy-generating facilities in Oregon.

If the project is deemed suitable, the EFSC will grant Brookfield a Site Certificate, allowing for the construction and operation of its proposed Raceway Solar project located in Sherman County, Oregon (OR), US.

4GWh co-located BESS

Brookfield’s Raceway project will pair a 500MW/4,000MWh BESS with an up to 900MW solar farm across 8,782 acres of land approximately 0.75 miles east of the City of Grass Valley in Sherman County.

The project will interconnect to the local grid via a nearby transmission line owned by Portland, OR-headquartered utility Bonneville Power Administration (BPA).

Full application expected towards end of 2024

Within a NOI, applicants are required to provide basic details on the proposed facility and also begin to discuss potential impacts of the development during construction and operation.

Brookfield will disclose more detailed information on the project at the next stage of the EFSC review process when it lodges a full application, which the developer expects to submit towards the end of this year.

Brookfield expects to receive a Site Certificate for the project in the second quarter of 2026.

Oregon planners have 4.4GW of storage applications under review

Oregon’s EFSC currently has 5.125GW of energy storage capacity under its jurisdiction in the form of both standalone and co-located projects, with 56MW of this currently operational, 663MW approved but not yet operational, and just over 4.4GW still under review, according to the regulator’s monthly update document.

One of the largest projects currently under EFSC review is Savion’s Yellow Rosebush Energy Center that will pair a 800MW BESS with a 800MW solar farm occupying 8,075 acres of land across Wasco and Sherman counties in Oregon.

Savion, a wholly owned subsidiary of Shell New Energies, has submitted a NOI for the Yellow Rosebush project and is expected to submit a preliminary application for a Site Certificate by the end of the summer.

Brookfield Renewable: 200GW development pipeline

Headquartered in New York City, Brookfield Renewable US is part of Brookfield’s global renewables subsidiary, Brookfield Renewable Partners L.P. (BEP), which recently issued its financial results for the three- and six-month period ending 30 June 2024.

The first half of 2024 was a strong period for BEP in terms of energy storage milestones. It secured long-term storage capacity contracts totalling 400MW with the Ontario Independent Electricity System Operator (IESO) selected as part of the Long-Term 1 Request for Proposals (LT1 RFP), as reported in Energy-Storage.News.

The two projects, Fitzroy and Tailroad BESS, are being developed through BEP’s Canadian operating business, Evolugen, in a joint development partnership with the Algonquins of

Pikwakanagan First Nation.

BEP claims to have a renewable development portfolio exceeding 200GW consisting of hydroelectric, wind, solar and storage facilities across the Americas, Europe and Asia.

Brookfield approaching US$1 trillion in assets under management

Brookfield Asset Management (BAM), which owns a 60% majority stake in BEM, also recently posted its financial results for the past quarter, reporting that it now has US$995 billion in assets under management (AUM).

The 6-K filing, submitted to the US Securities and Exchange Commission (SEC) on 7 August 2024, highlighted recent commitments from the company including an agreement to acquire a majority stake in French independent power producer (IPP) Neoen, covered by Energy-Storage.News in May.

Through its wholly owned Shift Solar subsidiary, Neoen also secured a capacity contract in the recent Ontario IESO LT1 RFP covering 380MW from its Grey Owl Storage project located in the Municipality of Arran-Elderslie.