The Uusnivala project is just shy of being largest BESS project being built currently in the Nordic country, which at present would be a 56.4MW/112.9MWh system from IPP Neoen (Premium access article). OX2 didn’t reveal when the project is expected to come online.

The BESS will participate in Finland’s ancillary service and wholesale energy markets, being located near an interconnection point with a high penetration of wind energy. The market is still predominantly ancillary services, as most wind-dominated renewables markets are, but projects have started to move to 2-hour durations recently.

Around 300MW of grid-scale BESS is expected to come online in Finland over the next two years according to research firm LCP-Delta.

It is OX2’s first sold BESS project in Finland, and comes shortly after it sold its first BESS project anywhere, in Sweden, earlier this year. The company is primarily active in wind and solar but is expanding into BESS, and an executive discussed its approach to the new sector in an interview with us last year (Premium access).

L&G is a UK-based investor and asset manager which has not yet moved into renewables at scale yet, while NTR is a Ireland-based renewables developer and infrastructure investor. Go to our sister site Solar Power Portal for coverage of NTR’s activity.

Liquid metal startup Ambri back in business after Chapter 11 bankruptcy

Ambri had entered Chapter 11 bankruptcy protection with the US Bankruptcy Court for the District of Delaware in early May. It said at the time that an agreement for lenders to buy up assets was already in place.

The company, founded by MIT professor Donald Sadoway in 2010, makes high-temperature batteries based around liquid calcium anodes and molten salt electrolyte, while the cathode materials contain solid antimony particles.

Ambri has claimed that its raw materials are abundant and low-cost, while the technology is suitable for providing long-duration energy storage (LDES).

It has been able to attract some big name backers to date, including Microsoft founder Bill Gates’ Gates Frontier venture capital (VC) fund, and India’s Reliance Industries. A pilot deployment at a Microsoft data centre was commissioned in 2022, and in the same year, a pilot project with Reliance was announced.

Other key developments for the company included plans for a pilot project with utility Xcel Energy in Colorado, US, of which details were provided around a year ago and on which construction was expected to begin this year.

Ambri’s systems received UL1973 certification in 2022 and the company signed a deal in Q3 2021 for 13GWh of key materials supply with an investor in a successfully closed US$144 million funding round.

The company said this week that a competitive sale process was conducted in accordance with Section 363 of the Bankruptcy Code, after its board decided that the sale would be the best avenue to recapitalise the company and secure its future.

Sadoway’s co-founder and co-inventor of the proprietary liquid metal battery, Dr David Bradwell, will assume the position of CEO, having been CTO since Ambri was launched, while Prof Sadoway remains Chief Scientific Advisor.

“The team at Ambri has continued to make impressive progress towards a commercial long-duration battery system, including developing our third-generation cell product. We look forward to offering our unique, safe, and low-cost commercial product to our customers at scale, to meet the strong customer demand for our battery systems, and for a cleaner energy future,” new CEO Bradwell said.

“As we embark on this fresh start with a stronger balance sheet and new capital, we are focused on positioning Ambri to play a leading role in the long duration energy storage market for the benefit of our stakeholders.”

Will degraded batteries be a resource or liability? Industry hedging bets on BESS end-of-life question

However, right now the statutory rules in the UK which designate responsibility for disposing, recycling or re-using end-of-life batteries is largely irrelevant for the grid-scale BESS market. This is because the responsibility elapses one year after the batteries are placed into the market, law firm Freeths’ construction and engineering partner Suriya Edwards said, and no project is decommissioned after a year.

However, contractual parties in BESS projects are still having to think about the topic and even including contractual language around the end-of-life, but who the responsibility falls on is an open question, to be decided between those parties.

Lithium-ion batteries contain precious metals like lithium and sometimes nickel and cobalt, meaning potential value to be extracted after their use in BESS – especially considering the Batteries Regulations’ minimum recycled content thresholds.

“How that longevity piece is going to fit into your commercial model is something to think about,” Edwards said.

Level of end-of-life focus depends on contract type

Edwards said that grid-scale BESS in the UK are procured either via a single contract between a developer and engineering, procurement and construction (EPC), known as ‘full wrap’, or via multiple contracts for EPC and battery procurements separately, sometimes with a system integrator sitting in between.

The real thought is given to end-of-life solutions for BESS in the battery procurement contracts: between EPC and BESS supplier in the first example, or between system integrator or developer and BESS supplier in the latter.

But parties are not committing to specific agreements, but typically laying out the different options in writing, Edwards explained, keeping their options open for whether the batteries will be a liability or a resource.

Contracts include provisions for either scenario

“An EPC firm will typically tell its battery supplier ‘we will require it to eventually take the batteries back at your own cost’, but if later it proves to be a liability then it might offer to pay the supplier money to take those batteries away. Essentially, they are still determining if it’s going to be an asset or something that will cost money to recycle and dispose of,” Edwards said.

“Similarly, a battery manufacturer selling batteries will say ‘my contract does not include the price of taking the batteries back, and we will want money to do it’. But it will also include a provision that works out a way of you getting some money back from them if they decide it’s a resource they are keen to get back.”

Some contracts however make no mention of end-of-life BESS solutions at all. “It’s not a mainstream discussion, but the battery procurement contracts are the ones with the most advanced understanding of how risk is apportioned,” Edwards added.

It may however be a larger topic of discussion between battery manufacturers, BESS manufacturers and system integrators, for whom the battery technology is a key part of their long-term business model, but Freeths primarily works with developers and asset owners. More recently, the firm has been working with some mainstream BESS manufacturers.

The ambiguity over whether lithium-ion batteries will be a resource or a liability is unsurprising considering how quickly the technology moves and how fast prices have dropped (bar the blip in 2022).

Battery recycling companies even today tell Energy-Storage.news that whether they have to pay for batteries or are paid for batteries to recycle depends hugely on the type and quality of the battery, and battery pricing trends also likely play a role even today.

The related topics of insolvencies and ESG in contracts are also really important, Edwards said, and there are big questions around how to deliver these into procurement contracts.

Bigger players more ready for this than smaller ones

“The big guys are clearly on top of it and are looking at the Battery Passport, and speeding ahead with the supply chain focus and the due diligence focus around the end-of-life topic, but the smaller companies have potentially no clue that this will hit them,” Edwards said.

“I would say the smaller battery companies coming in from the Far East will need to quickly upscale themselves in order to work out the whole question of producer responsibility.”

UK likely to follow EU’s Batteries Regulation

Edwards and her colleague Kirstin Roberts (waste and renewables specialist), speaking on a recent webinar hosted by Freeths on the topic, both said that the UK is likely to follow in the EU’s footsteps and update its battery rules to something similar to the bloc’s Batteries Regulation.

The key pieces of the Batteries Regulation are minimum levels of recycled content for batteries as well as the Battery Passport, a digital register of every single battery made using a QR code, which will contain the necessary information to make reusing or recycling batteries easier.

“The UK is likely to follow up with something similar, it’s not certain but it’s more than a hunch. We are in an exceptionally globalised industry and the supply chains extend well into the Far East and China.”

“I would be very surprised if we did not have a consistent approach which mirrors the EU in this respect, both in terms of perhaps even establishing our own in-house internal industry to recycle or working cross-border with the rest of Europe on it. And if you look at all the different reporting and disclosures standards coming into the UK it will be useful to have a mechanism that records that stuff for batteries, like the EU’s Regulation does.”

Eolian, BrightNight and esVolta raise more than a billion dollars from financiers

The total US$390 million financing builds on a previous US$515 million green loan transaction the developer made in mid-2023 with the same six banks: Spain’s Santander, Japan’s MUFG and SMBC, National Australia Bank, Natixis (France) and Lloyds Bank (UK).

Eolian invests in energy storage and renewable energy projects, although its focus to date has largely been on battery energy storage system (BESS) assets in the US, with projects such as the 100MW Chisholm Grid and 200MW Madeiro and Ignacio Grid in Texas developed by Eolian’s wholly owned energy storage power producer subsidiary Astral Electricity.

The loan was secured under Green Loan Principles against a group of Eolian projects, of which further details were not given in a press release. Other financial backing the company has received to date includes US$925 million in early 2022, again by a consortium that included banks Santander and MUFG.

In early 2023, Eolian made headlines as it claimed to be the first to complete an investment using the investment tax credit (ITC) for standalone energy storage brought into the US market by the Inflation Reduction Act (IRA). This was for its twin Madeiro and Ignacio BESS assets.

esVolta raises financing for 980MWh ERCOT portfolio

esVolta, a pure-play developer, owner and operator of utility-scale energy storage projects, also announced its financing on Tuesday this week.

The company has closed senior secured credit facilities worth US$258 million for a portfolio of standalone BESS projects in Texas, totalling 980MWh of capacity.

MUFG was again involved, as Coordinating Lead Arranger and Green Loan Coordinator. Fellow Japanese finance group Nomura Securities was also a Coordinating Lead Arranger, as was US investment bank KeyBanc Capital Markets. Also involved were Joint Lead Arranger Investec while Cadence Bank also participated.

The credit facility comprises construction and tax equity bridge financing, letters of credit and a long-term loan for three esVolta projects: its 240MW/480MWh Anole project in Seagoville, the 150MW/300MWh Desert Willow project in Midlothian, and Burksol, which is in Dickens County and will be 100MW/200MWh.

According to esVolta’s website, the developer has hedge contracts in place for each of the three projects, although it has kept customer names confidential. Each will be in the ERCOT market which spans most of Texas’ electricity networks.

Most of esVolta’s existing operational projects are in the California market, although it has projects in development, construction or operation in other US states, including Arizona, Virginia, Washington and New Mexico, as well as Texas. The company, founded in 2017, was acquired by sustainability investor Generate Capital in 2022.

Goldman Sachs Alternatives backs hybrid IPP BrightNight

BrightNight, an independent power producer (IPP) specialising in hybrid solar PV, wind and battery storage projects, has secured a US$440 million strategic investment from Goldman Sachs Alternatives.

The financing was announced today, with the transaction expected to close in September.

Goldman Sachs Alternatives is the alternative investment platform of Goldman Sachs Asset Management. It is claimed to have invested around US$16 billion in infrastructure projects since its establishment in 2006.

BrightNight markets its hybrid power plants to utilities and commercial and industrial (C&I) entities seeking firm dispatchable renewable energy resources as well as large landowners looking to put renewable power projects on their real estate.

It has developed its own AI-driven proprietary software, called Power Alpha, which the company uses to ‘optimise the design, development and operation’ of its renewable power plants.

The company is active in the US, India and Australia, and while it appears to be yet to bring any projects into commercial operation from a claimed 31GW global development pipeline, it recently secured grid connection approval for a large-scale solar-plus-storage project in Victoria, Australia, and a US$414 million construction credit facility for Box Canyon, a 300MW solar PV plant in Arizona, US.

Box Canyon will also feature a 600MWh BESS, and Brightnight signed a power purchase agreement (PPA) offtake contract for the project’s output in 2022 with Southwest Public Power Agency (SPPA), representing a group of Arizona municipal utilities and local authorities.

Energy-Storage.news’ publisher Solar Media will host the 1st Battery Asset Management Summit USA in San Diego on 12-13 November 2024. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on Connecting Asset Owners and Optimizers to Maximize Strategies for Storage Assets. View the website today

Ark Energy developing 2.2GWh, 8-hour co-located BESS in Australia

Ark Energy, a subsidiary of Korea Zinc Co, a zinc smelter, confirmed that the BESS would use lithium-iron phosphate (LFP) technology and be eight hours in duration.

On the solar aspect of the project, either crystalline silicon or thin-film technology would be used, mounted on an east-west tracking system. It will consist of up to 730,000 bifacial solar modules.

See the full original version of this article on PV Tech.

Statera gets planning consent for 6-hour, 2.4GWh UK BESS project with BYD batteries

Energy-Storage.news is expecting comment from Statera and will update this article in due course.

The project had been controversial amongst locals for its size and the fire risk that lithium-ion batteries present, but neither the Dorset & Wiltshire Fire and Rescue Service nor the national Environment Agency had objected.

Supporters of the project said its contribution to the UK’s efforts to decarbonise, by helping to integrate renewable energy, made it necessary, and that urban development had a worse impact on the local environment.

Chickerell may include an extension of a nearby substation, pictured to the right of the BESS containers in the above project map from a Statera planning document. The project would comprise 600 BESS containers, 30 inverter houses, 60 small transformers, six control room kiosks, a customer substation and an underground electrical connection to Chickerell substation. The BESS containers would be painted with a matt zinc finish.

Statera hasn’t publicly said which BESS or system integrator it plans to use, but a council document said it had committed to using China-based EV and BESS firm BYD’s MS Cube ESS container product. Amongst the planning documents is a safety manual from BYD for the MS Cube ESS. BYD is one of the largest BESS providers globally, as well as the largest EV firm by units sold, ahead of Tesla.

While receiving planning consent is obviously a fundamental part of getting projects to see the light of day, Statera still needs to make a final investment decision (FID) for the project, at which point the choice of BESS provider would be firmed up.

The Chickerell project involves a fire liaison framework between Statera and the Fire and Rescue Service as well as enhancing wildlife corridors, landscape features and biodiversity. Agricultural land at the site has been classified as Grade 3b/4 (51%), which is considered poorer quality and less productive, with 44% Grade 3 while 5% is Grade 2 (higher quality).

The 6-hour duration would be far higher than most projects online in the UK today, which are around 1- or 2-hour systems. The project has a grid connection date in 2028 but one of this size could presumably take even longer to come online, by which point the UK market may have moved to longer durations.

Statera said that at full capacity the project would discharge about one cycle a day, i.e. its entire capacity over the course of the day.

Many projects are being built with the space to augment further down the line as revenues more towards more energy-intensive activities. The largest UK BESS owner-operator Gresham House discussed this in an interview last week (Premium access).

The agenda for the 29 July meeting, which spells out the major details and arguments for and against the project, can be accessed here while a full list of planning process documents is here.

The existing Chickerell substation. Image: Statera / National Grid.

Continue readingNADBank says Recurrent Energy Texas BESS ‘carries acceptable risk’ for construction loan

The document is now subject to a 30-day public comment period. Once this closes, Canadian Solar’s development arm Recurrent will submit its final proposal to NADBank’s Board of Directors, which will decide whether to issue the loan or not.

US$60 million construction loan

NADBank has offered Recurrent a market-rate loan of up to US$60 million for the construction of the Fort Duncan project, after the financial institution deemed the project to be financially feasible and presenting “an acceptable level of risk”.

The document states that Recurrent is expected to earn revenue through its Fort Duncan BESS from the sale of electricity and ancillary services in ERCOT’s wholesale market which it will use to pay back the loan.

However, Recurrent may find this to be less lucrative than previous years as the market appears to be reaching a saturation point, as recently reported in Energy-Storage.News.

Construction on the project—which commenced in June 2024—will be funded using equity provided by Recurrent, the NADBank loan, and funding from other lenders.

Acquired from Black Mountain Energy Storage

Initial development of the Fort Duncan BESS facility was carried out by Black Mountain Energy Storage (BMES), before Recurrent Energy acquired the development as part of a two-project portfolio in June 2022, as reported in Energy-Storage.News.

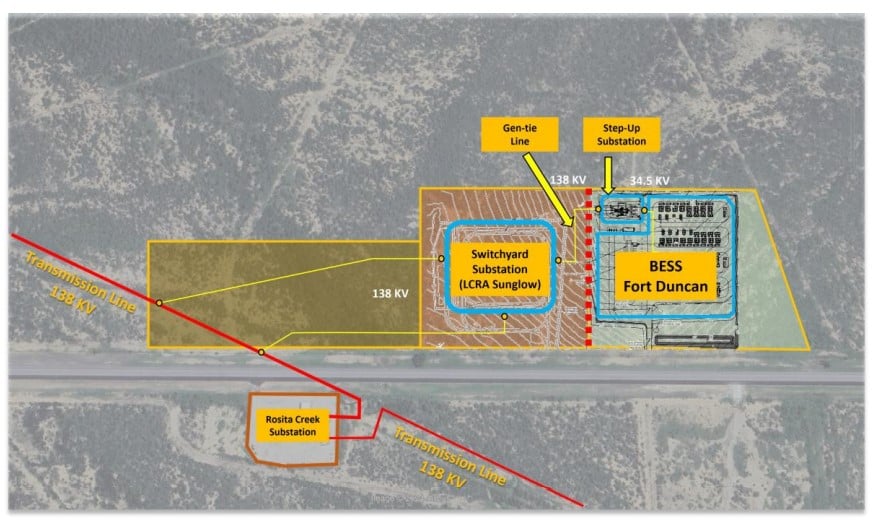

The Fort Duncan facility will comprise 88 individual lithium iron phosphate (LFP) battery units located across 31.8 acres of privately owned land approximately six miles east of Eagle Pass in Maverick County, Texas.

Interconnection to the ERCOT grid will be via Lower County River Authority’s (LCRA’s) new 138kV Sunglow Substation.

Project milestones and vendor contracts

Recurrent has secured a standard generation interconnection agreement with ERCOT and LCRA for the Fort Duncan project (queue no. 23INR0350) that was posted to the Public Utility Commission of Texas site in February 2023.

The developer also recently secured two engineering, procurement, and construction (EPC) agreements for the project—one relating to the BESS portion of the development and the other to the construction of the switchyard. However, the name of the EPC firm was not disclosed in the document posted to the NADBank site.

Start of commercial operation of the Fort Duncan project is scheduled for June 2025.

NADBank elgibility criteria

NADBank was founded in 1994 by the governments of the United States and Mexico to provide funding for infrastructure projects addressing a wide range of human health and environmental issues including developments relating to waste management, water treatment and of course, renewable energy.

To qualify for funding from NADBank, projects in the US must be located within 100km north of the Mexico border in Arizona, California, New Mexico and Texas. To qualify in Mexico, projects must be situated within 300km south of the border in Baja California, Chihuahua, Coahuila, Nuevo Leon, Sonora, and Tamaulipas.

As well as being located within the border region, projects must also satisfy further criteria to qualify for funding from the NADBank, as outlined in the following document.

Fifth NADBank loan for energy storage

If approved by the board of directors, funding for Recurrent’s Fort Duncan facility would be the fifth loan handed out by NADBank to developments incorporating energy storage, according to the financial institution’s most recent quarterly status report.

Cypress Creek Renewables was the beneficiary of one of these funding packages, after the NADBank board of directors approved an up to US$65.7 million loan for the construction of its Zier Solar and Storage facility located in Kinney County, Texas.

The EQT Partners-backed developer held a ribbon cutting ceremony for the Zier development on May 2 2024, as reported in a recent company press release. Managing Director of NADBank, John Beckham, spoke at the event where he described co-located solar and storage projects like the Zier development as “vital for ERCOT’s grid reliability and energy availability”.

Arizona BESS US$513 million financing

Recurrent also recently secured a US$513 million financing package for its 1,200MWh Papago Energy Storage facility located Maricopa County, Arizona.

Construction on the Papago project, which comprises a BESS along with a 300MW solar farm, is scheduled to commence in the third quarter of this year with commercial operations slated for Q2 2025.

Portugal allocates €100 million in grants for energy storage

The government said that competition has been launched in light of the the need to optimise and manage the electricity grid in Portugal in a more flexible way. Power generation capacity is around 22GW.

Minister of Environment and Energy Maria da Graça Carvalho said: “This is a significant step towards Portugal’s energy independence and towards building a greener and more sustainable energy future. Energy storage plays a crucial role in the modernisation of our electrical infrastructure, enabling more effective management of resources and a more agile response to fluctuations in supply and demand, thus benefiting the economy and the environment.”

The deadline for applications is 2 September and they must be submitted on the Environmental Fund portal. The funding is part of the EU-wide Recovery and Resilience Facility (RRF), a pot of money aimed at helping EU economies transform structurally after the Covid-19 pandemic, and which several have used to fund energy storage.

Grid-scale BESS projects have been relatively limited in Portugal to date, although utility Iberdrola did bring online a huge, 40GWh pumped hydro energy storage (PHES) project there in 2022.

On the mainland, independent power producer (IPP) Galp is deploying a 5MW/20MWh project with system integrator Powin, peer Greenvolt has built a 5MW/5MWh system at a biomass plant, while system integrator Fluence has deployed similar-sized projects on the islands of Madeira and Terceira.

India: SECI launches tender for 2GW solar PV paired with 4GWh energy storage

SECI is seeking proposals for build-own-operate PV projects with aggregate capacity of the above figures. Power purchase agreements (PPAs) over 25-year terms will be entered into with successful bidders by SECI, with power then to be sold to unnamed Buying Entities.

Buying Entities refer to any third-party consumer of bulk power, and these could include utilities or electricity distribution companies (‘discoms’), corporations, or other customers.

The reverse auction will be held under the competitive bidding framework for the procurement of firm dispatchable power from grid-connected renewable energy power projects with energy storage resources, published by the Ministry of Power.

A pre-bid meeting will be held 12 August, and bids must be submitted by 2 September, 6pm IST. Projects must connect to the Inter State Transmission System (ISTS) and be in operation within 24 months of contract award.

0.5MW/2MWh ESS per 1MW of solar PV

The scope of work for developers involved will include setting up the transmission infrastructure required to connect their project to the point of ISTS interconnection, as well as constructing and putting the project into operation.

It is worth noting that the tender design is technology agnostic regarding ESS technology, unlike some other tenders which have specified for lithium-ion (Li-ion) battery energy storage systems (BESS), or pumped hydro energy storage (PHES).

ESS power output and capacity must match each megawatt of solar generation with 0.5MW and 2MWh (4-hour duration).

The minimum bid would be 50MW, with project capacities to be provided in multiples of 10MW, and no bidder would be allocated capacity exceeding 1,000MW.

Bidders must declare their projects’ capacity utilisation factor (CUF), and while this number can be revised within a year of the start of operation, it can only be revised upwards and must be in a range of 25% to 27%.

After this period the declared CUF must remain the same throughout the contract duration. However, developers will meet the terms of their agreement if CUF stays within +10% and -15% of declared value for the first 10 years after the scheduled commencement of supply date (SCSD), and within +10% and -20% thereafter to the end of the 25-year PPA.

Crucially, projects must also provide energy to the Buying Entity during four peak demand hours each day, mandated at 2,000kWh of energy per megawatt of the rated project capacity in AC terms.

See here for SECI RFS and other documents including model PPA and power sale agreement (PSA).

SECI tenders pushing India’s renewable and storage agenda

As mentioned, this is the latest in a line of recent large-scale tenders from SECI, including both standalone energy storage and hybrid facilities paired with renewables.

The corporation’s tenders have been credited with helping bring down the cost of storage. One recent auction for 1,200MW of ISTS-connected solar PV and 600MW/1,200MWh BESS was described by one expert as a “game changer”.

Another recently concluded SECI tender for Firm Dispatchable Renewable Energy (FDRE) awarded 630MW of capacity about a week ago. Winning tariffs for that were higher at IR4.98/kWh and IR4.99/kWh, but this is due to that solicitation’s more stringent rules on supplying energy at specified peak times.

The corporation has also launched India’s biggest standalone BESS tender to date, seeking 1,000MW/2,000MWh aggregate output and capacity, as reported by Energy-Storage.news at the beginning of this month.

India’s recent Union Budget, announced by finance minister Nirmala Sitharaman 23 July, offered a commitment to policies promoting pumped hydro, in addition to incentives and subsidy schemes for rooftop solar PV.

It did not contain any major new support for other energy storage technologies, and while some industry stakeholders had requested exemptions or reductions to Global Sales Tax (GST) on battery equipment, this was not forthcoming.

However, the previous year’s budget included a pledge of Viability Gap Funding (VGF) to support standalone BESS tenders for 4GWh, hosted by SECI—which is administered by the Ministry of Power’s Ministry of New and Renewable Energy (MNRE)—and this was considered a big win for the storage sector at the time.

J-Power completes takeover of Australia’s Genex Power

The two companies had been jointly developing a 2GW solar-plus-storage project in Queensland dubbed Bulli Creek. The agreement signed last year (June 2023) granted J-POWER a 50% interest in the multi-staged solar power generation and battery project at Bulli Creek and provided Genex with a AUS$35 million corporate loan facility.

The two companies had also been jointly developing the 200MW Kidston Stage-3 Wind Project in Queensland, with operations expected to commence in 2025.

With the completion of this acquisition, Genex will apply for delisting from the Australian Securities Exchange (ASX) effective from the close of trading on ASX today (1 August). The acquisition was advised by Australian law firm MinterEllison.

Geread Dooley, partner at MinterEllison highlighted that Japanese investment has been “critical to Australia’s growth” and that further investment will be “critical for Australia in achieving its energy transition ambitions”.

“This is another excellent example of MinterEllison supporting its Japanese clients with their most important and complex deals in Australia,” Dooley added.

Genex’s diverse renewable energy portfolio

Genex has a diverse portfolio that spans wind, solar, battery energy storage, and pumped hydro energy storage. This includes the 50MW Kidston solar project, 250MW Kidston pumped hydro energy storage (PHES) project, 258MW Kidston wind project, 50MW Jemalong solar project, 50MW/100MWh Bouldercombe battery project, and the aforementioned 2GW Bulli Creek Clean Energy Park.

The 250MW Kidston PHES project is significant to the Australian market, given that it is the country’s first new pumped hydro plant in nearly 40 years. More commonly known as Kidston 2 Hydro, the project in northern Queensland is 8 hours in duration and thus can provide 2,000MWh of capacity. Construction began in May 2021 and is scheduled to be completed later this year.

Equally, the 2GW Bulli Creek Clean Energy Park is the joint largest of Genex’s ongoing developments and incorporates energy storage and solar PV. Stage one of the project, which is expected to reach a final investment decision in the second half of 2024, will see a large-scale solar development with a capacity of up to 775MW constructed. In the second phase of the project, a 400MW/1600MWh BESS will be constructed.