The companies claim the BESS will use domestically manufactured batteries, modules and supporting systems, with a spokersperson telling Energy-Storage.news:

“We will be supplying Excelsior with our Gridstack Pro product that is positioned to qualify for the Inflation Reduction Act’s (IRA’s) domestic content bonus. Those Gridstack Pro products will utilise contain cells that will be produced by our supplier in Tennessee and modules that will be manufactured at the Utah facility. Final production of the Gridstack Pro enclosures will also take place at the UT facility.”

Fluence is not revealing the name of the Tennessee-based supplier, while it discussed its Utah facility with Energy-Storage.news in late 2022. Several companies are setting up lithium-ion gigafactories in the state, including Ford, in partnership with SK Innovation via joint venture (JV) BlueOval City, and General Motors (GM), in partnership with LG Energy Solutions via JV Ultium Cells.

Although those gigafactories are likely to have been developed with an EV production focus, the EV market’s recent slowdown led LG Energy Solution to tell Energy-Storage.news today that it is considering converting production lines to serve the energy storage system (ESS) segment.

Fluence claimed that the BESS it will provide Excelsior with will qualify for the domestic content adder to the investment tax credit (ITC) for downstream clean energy projects under the IRA. It said that it would have US-made modules this year when releasing its quarterly results in May.

ERCOT revenues for battery storage more concentrated, volatile – but down on last year

Investors, IPPs and developer-operators there are capitalising on some of the highest revenues anywhere in the world, but the picture has shifted this year as market intelligence firm Modo Energy’s ERCOT market lead Brandt Vermillion explained.

Revenues down on last year

Vermillion said that due to a combination of factors revenues in 2023 haven’t been as high as last year.

“Summer 2023 weather was pretty extreme meaning a significant jump in overall demand as well as net demand. And that drove some significant overall energy price increases and ancillary service prices last summer, resulting in some pretty significant 2023 revenues for storage. The ballpark for the year was about US$200,000 per MW,” he said.

“2024 hasn’t necessarily been the same. We’ve had a fairly mild summer so far. Peak demand is definitely up year-over-year but net demand isn’t. The data isn’t finalised yet, but I don’t think revenues for June will be all that significant either, compared to last year.”

(Net demand is peak demand minus solar generation, and is the more relevant of the two metrics in terms of scarcity, which is pivotal to BESS revenues.)

However, there could still be an uplift with some of the hottest periods – and peak demand with it – still to come in August and September.

“A lot of that is really just going to be dependent on what happens with the weather, which is ultimately the main driver. It’s about how high demand gets and how much congestion is on the system,” Vermillion said.

Revenues in ERCOT becoming more concentrated and a changing stack

One big trend is for revenues to become more ‘spikey’ throughout the year, Vermillion said.

“One thing we are seeing is a continuation of a trend from 2022 and 2023 towards revenues becoming every more concentrated into a small number of days. That means an increase in volatility where prices are either going through the roof or batteries aren’t making much money at all.”

That means even more is resting on trading decisions and deciding when to bid into different markets, especially as the market shifts towards energy trading.

“Generally, high energy prices means high ancillary service prices. If scarcity is higher than expected by the day-ahead market, then people will do more energy arbitrage instead of ancillary services. One day in April saw BESS earn nearly two-thirds of revenues from energy arbitrage,” Vermillion said.

“It’s a big ongoing challenge for asset owners and optimisers to understand which of the real-time and day-ahead markets will finish ahead of the other. It’s an additional layer to the optimisation challenge and is becoming more and more prevalent. Combined with revenues becoming more concentrated into fewer days, that intensifies the pressure on getting it right. Getting it right in terms of whether predicted scarcity will show up, and whether to bid into the real-time or day-ahead market.”

Market saturation

One big question in ERCOT has been when the ancillary services market will saturate as the BESS buildout accelerates. In the UK, last year saw revenues fall by more than 50% as BESS increasingly set the clearing price for ancillary services, sending shockwaves through the industry.

As others have told Energy-Storage.news, there is some evidence this is already starting to happen in ERCOT, as Vermillion explained.

“I wouldn’t say that saturation has happened yet, but it’s happening. In the last few years we’ve definitely seen a decrease in the price of ancillary services relative to energy prices. That is ultimately resulted in us seeing more revenues for BESS coming from energy arbitrage.”

“Asset owners are allocating less and less of their capacity to ancillary services, perhaps in an effort to get ahead of the game in the knowledge that energy arbitrage will be the name of the game at some point. And BESS deployments aren’t slowing and that will increase that gap.

Last year energy arbitrage was around 15% of revenues, whereas this year so far it’s well above 20%, possibly approaching 25-30%, Vermillion added.

Third-party optimisation of BESS in ERCOT

The other question is what this all means for optimisation of BESS in ERCOT. In the UK, it’s been typical for an outside company to do route-to-market (RTM) and optimisation and trading on projects, while in ERCOT this has primarily been done in-house.

“Who is optimising what, is hard to know because it isn’t necessarily public information. I would agree that the majority of BESS in ERCOT are being optimised in-house. A lot of the time they have their own trading arm. They may not be the ones doing the actual physical operations, but they are usually the ones making the decisions and setting the strategy,” Vermillion said.

“I would say it might be changing, to some extent. Habitat Energy made a pretty big announcement. I don’t know if third-party optimising will become the majority though. A lot of the big owners have been pretty successful. Jupiter Power has been one of the highest performing revenue wise, and they do everything in-house.”

Energy-Storage.news’ publisher Solar Media will host the 1st Battery Asset Management Summit USA in San Diego on 12-13 November 2024. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on Connecting Asset Owners and Optimizers to Maximize Strategies for Storage Assets. View the website today.

Spain publishes regulatory framework for clean energy manufacturing support scheme

The Institute for Diversification and Energy Saving (IDAE in Spanish) will be in charge of the programme, with the auction starting soon, although a concrete date has not been disclosed yet.

Solar PV and battery energy storage systems are among the technologies included in the scheme. In the case of solar PV it will be for the manufacturing and assembly of solar panels, while for BESS it will be for the manufacturing and assembly of batteries, battery cells and battery packs. Batteries aimed primarily for electric vehicles are not included in the scheme.

The scheme was announced earlier this year with a public consultation. At the time, MITECO announced that future rounds could add other aspects of the supply chain.

The maximum amount a project can receive will be dependent on the location of the plant based on the article 107, part 3 of the Treaty on the Functioning of the European Union (TFUE) with a maximum of €150 million – 15% of the project’s cost – for projects in general.

The guidance about the scheme can be accessed here (in Spanish). The regulatory basis will be implemented once in force and until the end of 2025.

The Net Zero Industry Act (NZIA), which came into force on 29 June 2024, includes a provision which requires the European member states to build an annual manufacturing capacity of net zero products that meets at least 40% of the 27 members’ annual deployment needs by 2030.

To read the full version of this story, visit PV Tech.

Philippines renewables-plus-storage auction to be held in Q4 2024

It confirmed what Department of Energy assistant secretary Mario C. Marasigan had said earlier this month in a keynote speech at the Energy Storage Summit Asia 2024, hosted by our publisher Solar Media in Singapore.

Assistant Secretary Marasigan had noted the significant role energy storage must play in the Philippines energy sector, “in our goal towards a sustainable and resilient energy future.”

Under the Philippines Energy Plan 2023-2050, the country is targeting a 35% share of electricity from renewable sources by 2030 and 50% by 2040, continuing to increase steadily after that point.

GEA-4 will be open to Integrated Renewable Energy and Energy Storage System (IRESS) project bids. In response to increasing variable renewable energy (VRE) generation in the nation’s mix, the DOE is also “exploring” liquid natural gas (LNG) technologies, it said.

Two rounds of GEAs held to date have awarded 5,306MW of renewable energy capacity to go into operation between 2024 and 2026.

A third round will be held shortly ahead of GEA-4’s launch. It will be specifically open to renewable technologies not eligible for feed-in tariffs (FiTs), such as run-of-river hydroelectric, geothermal, and pumped hydro energy storage (PHES), with around 4GW to be tendered for.

While the Philippines has been an early leader in the deployment of battery storage among Southeast Asian countries, this has been driven by the country’s handful of major power producers seeking to improve the efficiency of their generation fleets.

That has meant a limited investment landscape for energy storage to directly integrate renewable energy, which the DOE is now seeking to readdress.

The department’s announcement yesterday inferred that the new GEA-4 competitive solicitation could be open to renewables paired with a range of storage technologies giving the examples of batteries, flywheels and PHES.

The DOE is currently studying “the design and economic viability” of integrated renewable energy and energy storage resources, it said.

At the Energy Storage Summit Asia, DOE assistant secretary Marasigan said regulators would treat energy storage systems paired with renewables awarded in the auction as a component of the complete integrated resource rather than as a separate asset.

This means they would not lose priority “must-run” dispatch status, Marasigan said.

Read more Energy-Storage.news coverage of the Philippines.

LG Energy Solution eyes ESS pivot in light of EV slowdown

LG Energy Solution primarily attributed the fall to slower-than-expected growth in the market for electric vehicles (EV), a market that most of its lithium-ion batteries are sold into. The slowdown, noted by our sister site Current, is primarily because of concerns amongst buyers about driving range and access to charging infrastructure.

For the European market specifically, some have attributed it to high prices and the removal of certain government subsidies.

The company has subsequently revised its full-year guidance to a 20% year-on-year decrease.

ESS offsets fall, company may convert production lines

LG Energy Solution also sells batteries into the energy storage system (ESS) market, including via its own ESS integrator arm LG Energy Solution Vertech, and it said that the ESS business will continue to benefit from increased demand. Furthermore, it may pivot existing capacity towards ESS to make up for lower EV sales, as the company said in a statement provided to Energy-Storage.news.

“To maximise the utilisation rate at each production site, LG Energy Solution is exploring the possibility of converting existing battery production lines for different applications such as ESS and new products. Discussions on the possibility of investing in energy storage batteries in Europe including our facility in Poland are ongoing.”

The Poland facility they are referring to is its Wrocław lithium-ion gigafactory, the largest in Europe with an annual production capacity of 86GWh, and the impact of the slowdown on the facility has been a big talking point in Polish press. The company’s reporting of the gigafactory to-date implies it manufactures primarily, maybe even exclusively, for the EV market.

In its earnings release, LG Energy Solution attributed its nominal quarterly growth to a combination of a new EV model launch by some of its customers and revenue growth from the ESS division. One highlight in the quarter was a 4.8GWh supply agreement for ESS in Arizona via Vertech.

In a section of its earnings report titled ‘Key action plans to counter slower EV market growth’, it said it would prioritise optimising operation and improving profitability and expanding ESS production.

“Also, the company will secure competitive edges in both products and future technologies. It will first establish differentiated product portfolio by launching 4680 cells and expanding the production of ESS LFP (lithium iron phosphate) batteries,” it said.

It also said it would expand it scope of service within the ESS segment and “seek opportunities for software-based new businesses, including battery-as-a-service (BaaS) and battery management system (BMS)”.

Meanwhile in the US, LG Energy Solution hit ‘pause’ recently on its production line in Arizona dedicated to cells for stationary BESS applications. LG Energy Solution Vertech CEO Jaehong Park explained to Energy-Storage.news Premium that this was due to a strategy to try and get ESS products to market faster.

Opportunity for energy storage in Australia’s Capacity Investment Scheme

In the first published instalment from Energy-Storage.news Premium’s conversation with Salim Mazouz, head of the policy and design branch office for the CIS at the government Department of Climate, Energy, the Environment and Water (DCEEW), we learned how the scope of the procurement scheme was devised, and its aim to mitigate a “high level of uncertainty” that persists for investors.

Our interview took place a few weeks after Mazouz gave a presentation on the Capacity Investment Scheme as a keynote speech at the Energy Storage Summit Australia 2024, hosted by our publisher Solar Media.

The government effectively underwrites revenues for successful projects against agreed revenue ‘floor’ and ‘ceiling’ prices, through 10–15-year Capacity Investment Scheme Agreements (CISAs).

At the same time, it is negotiating Renewable Energy Transformation Agreements (RETAs) with the states participating in the schemes to agree funding allocations.

As we heard previously from Salim Mazouz, the idea is to support project revenues that will remain robust in low-price environments. The more renewables come onto the system, and the more thermal plants retire, average electricity prices are expected to fall, which could impact revenues for renewable energy generators in particular when exposed to merchant risk.

Conversely, if renewables don’t come onto the system and coal plants aren’t retired fast enough, electricity prices stay high and Australian billpayers would lose out. The scheme was designed to mitigate risks for both scenarios, rather than “trying the second guess what the market needs,” Mazouz says.

He explains further that some inspiration was taken from procurements held in New South Wales (NSW) under the NSW Electricity Infrastructure Roadmap which set out the 20-year plan for state-owned EnergyCo to broker Long-Term Energy Service Agreements (LTESAs) for renewable capacity.

“What they were trying to do [in NSW] is get the risk adjusted rates of return into a space where people can do this commercially without really needing an actual top-up. When you’re pushing in less renewables that works. When you are pushing in more and more, and all prices start to drop, if the view of investors is that they’re not going to get sufficient money to cover their levelised cost of energy (LCOE), then you need some gap financing,” Mazouz says.

“Instead of trying to second guess what the market needs, we’ve designed a tender system whereby the market tells us what it needs through the cap and the floor, and the annual payment cap through the bidding process.”

Hybrid projects also eligible for Capacity Investment Scheme VRE tenders

The Capacity Investment Scheme will support 32GW of new renewable capacity, equivalent to about half the current generation capacity of the National Electricity Market (NEM) which covers Australia’s southern and eastern states.

While the majority of that, 23GW, will be variable renewable energy (VRE), 9GW will be dispatchable capacity backed with energy storage.

At the same time, VRE bids that include energy storage will also be accepted and the DCEEW branch office head says these hybrid or co-located projects can be competitive against standalone renewable energy bids. Those bids will be assessed in terms of benefits to the system as a whole, as well as in terms of cost.

“We’re not assessing projects just on the basis of dollars-per-megawatt-hour generated. If we did that we would end up with solar and nothing else, pretty much,” Salim Mazouz says.

“There are all sorts of other things we care about,” besides just lowest-cost generation, he says, such as reliability and the ability to deliver energy when needed, not just when it is generated.

So, during the day, prices that solar-generated power could fetch would be extremely low, resulting in the government needing to pay out big subsidies to projects with the same floor price as, say, a solar-plus-storage project that can shift capacity from a low-price dispatch period to a high-price one.

“When it comes to the cost, it’s not a simple proposition of what the floor price is. It’s what the floor, the ceiling, and the annuity cap are, against the expected dispatch-weighted prices, evaluated in a sort of stochastic environment about future prices, Mazouz says.

“The other thing is that you’ve got other benefits from adding storage. One of the benefits you get is that the project enhances reliability more than if you just had a standalone VRE project.

“They’re enhanced by potentially reduced curtailment; they are enhanced by providing more reliability than otherwise would be the case. They’re the kinds of considerations that go into looking at what the benefit of a project is.”

Arbitrage and FCAS revenues factored in

One of the complexities of energy storage, which is also one of its greatest strengths, is the ability to capture revenues from different sources by stacking applications and contracts, often for a single battery asset as well as across portfolios.

As noted a few days ago from a report by the Australian Energy Market Operator (AEMO) which oversees the NEM, Australian battery storage assets are moving more towards an increasing share of revenues coming from arbitrage.

Until fairly recently, Frequency Control Ancillary Services (FCAS) had comprised the majority of the revenue stack.

This market is considered shallower than the arbitrage opportunity, especially as VRE growth drives more volatility in electricity pricing—the difference between peak and off-peak energy prices essentially—but both FCAS and arbitrage revenues will remain an important part of the typical revenue stack for large-scale battery energy storage system (BESS) assets.

In turn, forecasts for both of these merchant opportunities will be factored into DCEEW’s revenue calculations for selecting projects.

For energy storage, including hybrid renewables-plus-storage, the growth in VRE generation and the diminishing importance of thermal generation means greater arbitrage opportunities to capture volatility, even in an environment of lower average prices.

“When it comes to energy storage, if you’ve got a low-priced environment but it’s all driven by solar and wind, you probably have huge arbitrage opportunities, compared to a world where you continue to have a lot of coal and potentially flexible gas that doesn’t allow the fluctuations to be as high as they would otherwise be,” Mazouz says.

“The arbitrage opportunity for storage is not necessarily directly related to the average price. It’s related to volatility, and the volatility of prices is more likely in a world where you have a lot of variable renewables, but you don’t have as many flexible thermal resources.”

Scheme inspired by, but different to, CfDs

Australian energy minister Chris Bowen announced that a tender scheme for dispatchable and variable renewables would be forthcoming in December 2022. From there, looking from the outside, it appears the Capacity Investment Scheme emerged very quickly, with pilot schemes rolled out mid-2023 and procurements now already underway.

The DCEEW’s CIS office had to move fast, Salim Mazouz says, noting that energy markets and policy design in Australia have been themselves subject to rapid change over the past few years. A proposed capacity market scheme was rejected in late 2022, which left a “huge gap,” he says, leading to the government’s decision to create the tenders instead.

It was a lot of work, but the DCEEW was able to take some inspiration from other schemes around the world and Australia, including the New South Wales LTESAs, tenders in the Australian Capital Territory (ACT) and Victoria, and the UK’s Contracts for Difference (CfD) scheme.

At the same time, applying a “traditional” CfD scheme where, Mazouz says, the floor and ceiling are essentially the same would not preserve market signals.

“When you’ve got a CfD, locational decisions, technology decisions, all of those are fully made by the offtaker, namely the government in that case. Whereas with our scheme, you actually have a number of incentives that retain the market incentives for locational decisions, technology choices and so forth,” Mazouz says.

The CIS is also technology-neutral by design and it was important not to proscribe solutions, especially when technologies are changing so fast, from the advances made within existing technology sets like lithium-ion (Li-ion) BESS or pumped hydro energy storage (PHES) to newer technologies like sodium-ion (Na-ion) or flow batteries, according to Salim Mazouz.

Rather than asking the market to deliver particular technologies, the scheme asks it to deliver specific services.

“Can you enhance reliability in this market? Can you provide arbitrage so that you’re buying when it’s low, and you’re selling when it’s high, which improves the economics of the VRE as well and enables higher penetrations of renewables, without having the reliability problems that you would otherwise get?”

Nonetheless, Mazouz says his personal view is that it’s likely lithium-ion will dominate energy storage bids over at least the next couple of iterations of Capacity Investment Scheme auctions, although the future beyond that is less certain.

ERCOT clears 650MW of BESS for COD, record peak demand approaches

Texas sits in second place behind California in terms of US states with the most operational BESS capacity and still has some way to go if it wants to take the number one spot, after the Golden State recently surpassed 10GW of cumulative installed BESS capacity.

As indicated in the Texas system operator’s most recent Monthly Outlook for Resource Adequacy (MORA) report, ERCOT currently has 4,738.8MW of operational BESS capacity.

Forecasted 86GW August peak electricity demand

The 640MW of new BESS capacity comes at an ideal time for Texas, as it approaches the month of August where ERCOT has historically witnessed its peak electricity demand.

Evidently, the system operator expects this year to be no different, and has forecasted a peak electricity demand of 86,017MW, which would be an all-time high for ERCOT.

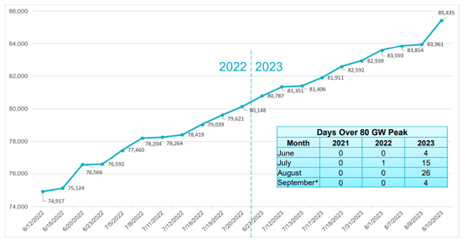

Last year was a record-breaking year for ERCOT as the Texas grid operator saw demand for electricity surpass 80GW on 49 different days throughout the summer, something that had only ever occurred once before 2023.

Not only this, but the grid operator saw its record peak electricity demand broken on ten separate occasions throughout the summer, culminating in a 85,435MW record peak on 10 August 2023 (as illustrated in the graph below).

A graph showing ERCOT’s summer peak demand records for 2022 and 2023. Source: ERCOT Summer 2023 Operational and Market Review.

650MW of new BESS capacity in ERCOT

In total, five new battery storage projects were cleared for commercial operation dates (COD) during the month of June, including Engie’s Five Wells BESS facility located in Bell County and co-located with the company’s 320MW Five Wells solar project that was brought online last year.

Rated at 221MW, Engie’s Five Wells battery storage facility became the largest operational storage facility in terms of capacity on the grid. The title was previously held by the 200MW Libra BESS facility, also owned by Engie, following the French multinational IPP’s acquisition of Broad Reach Power which carried out initial development of the project.

Two standalone battery storage projects owned and developed by Plus Power were also cleared for operation – Anemoi Energy Storage located in Hidalgo County and Ebony Energy Storage in Comal County, rated at 205MW and 204MW, respectively.

The remainder of the capacity was made up by two projects developed by HEN Infrastructure – a venture formed between developer Hunt Energy Network and the global wealth and asset management arm of Manulife.

The two projects, known as Farmersville West BESS 1 and Mainland BESS, each comprise 9.9MW of storage capacity and were processed through ERCOT’s less stringent interconnection process for projects smaller than 10MW – which ERCOT refers to as “small gen” projects.

Progress for NextEra Texas project

Utility-scale renewable energy developer NextEra Energy Resources (NEER) is one of many developers looking to grow its energy storage footprint in ERCOT over the next few years, and recently obtained a tax abatement for a BESS development in Texas.

At a 9 July, 2024 meeting, commissioners at Hill County approved a reinvestment zone and tax abatement agreement to NEER-owned subsidiary Hubbard Energy Storage II, LLC for the development of a 100MW BESS – expected to cost the developer US$115 million.

The Hubbard site located east of Bynum in Hill County is also expected to include a 300MW wind facility, as reported on a NEER website for the project.

NEER has yet to submit an ERCOT interconnection request for the storage portion of the project but holds three queue positions for the wind portion (queue numbers 22INR0499, 27INR0052, 27INR0053) under the name Aquilla Lake Wind which the facility is also known as.

Frosty reception for Black Mountain BESS facility

Elsewhere in Texas, representatives from Black Mountain Energy Storage (BMES) received a somewhat frosty reception from commissioners at Kerr County, as the developer introduced plans for its 120MW/240MWh East West BESS facility at a taxable value of US$86 million.

After the brief presentation during the 22 July 2024 county meeting, Kerr County commissioner Jonathan Letz addressed the BMES representatives stating that the project didn’t “make much sense” to him, describing the 2-hour duration facility as a “band-aid” when it came to addressing power outages in the area.

Rich Paces, another commissioner at Kerr County and volunteer firefighter, went on to say that he’d heard a lot of concerns from residents surrounding battery fires, and made reference to recent fires at BESS facilities in California.

After representatives from BMES attempted to address commissioners’ concerns, Letz rounded off the discussion stating that although BMES is welcome to submit an application for an abatement, he didn’t see it being successful.

Letz went on to say that he was struggling to see how the facility would benefit Kerr County, even suggesting BMES “go to Houston” for the abatement instead.

BMES holds an ERCOT interconnection queue position for the project (queue number 25INR0202) and expects to commence construction on the project during the third quarter of 2025, with commercial operation scheduled for the end of 2026.

New York Fire Code updates to provide ‘added BESS safety and standardisation’

The Working Group recommended updates as well as additions to the existing Fire Code of NY (FCNY), adopted in 2020 when battery storage installations were in their nascency. There are also additional considerations that the group put forward for instances where issues identified did not fall into either category.

Among them is that the state should mandate peer reviews for all BESS installations that exceed established capacity thresholds for lithium-ion (Li-ion) batteries, to be paid for by the industry.

It also calls for the availability of staff with knowledge of each BESS installation to respond within 15 minutes to an incident, extended safety signage, central monitoring of fire detection systems, and regular safety inspections, also to be industry-funded.

Meanwhile, every BESS installation should have an Emergency Safety Response Plan in place, and a Fire Code exemption for electric utility-owned or operated projects should be removed, the Working Group said.

More information on the Working Group, including its draft recommendations in full, can be found here.

‘Working diligently to ensure concerns of the fire service, public, and overall industry are accounted for’

The Working Group was led by state agencies Division of Homeland Security and Emergency Services (DHSES), New York State Energy Development and Research Agency (NYSERDA), Office of Fire Prevention and Control (OFPC), New York State Department of Environmental Conservation (DEC), Department of Public Service (DPS), and the Department of State (DOS).

It also consulted with various industry and otherwise interested stakeholders, subject matter experts and organisations.

One of those expert organisations was Energy Safety Response Group (ESRG), which specialises in safety and risk mitigation for energy storage technologies and projects.

ESRG told Energy-Storage.news yesterday that the Working Group “has worked diligently to ensure that the concerns of the fire service, public, and overall industry are accounted for, allowing for continued progress while also bolstering safety.”

“As a contributing member of the Governor’s Interagency Fire Safety Working Group, ESRG is proud to leverage our experience in battery energy storage safety, large-scale fire testing, and emergency response to ensure the greatest level of safety for BESS across the New York State,” the company said.

The Working Group was convened after three fires happened in relatively quick succession from March to June in New York’s Jefferson, Orange and Suffolk Counties.

While New York, particularly New York City, already has some of the US’ strictest fire codes, it was deemed necessary to both evaluate the state’s existing installations and prepare for a massive growth in installed capacity: from a couple of hundred megawatts of installations today, New York’s Climate Leadership and Community Protection Act (CLCPA) policy calls for the deployment of 6GW of storage in New York Independent System Operator (NYISO) territory by 2030.

“The incidents which occurred last year were unfortunate, but we have learned a great deal from them and the associated Working Group efforts which will benefit the industry as a whole,” ESRG said.

Learnings that came directly from those fires were that the fire service needs better support, in both training and during emergency response, developers and AHJs must continue their due diligence in ensuring code and standards compliance, “and must continue to be educated on the current state of codes and enforcement,” ESRG said.

Meanwhile, the Working Group’s investigation of those fires found no significant off-site environmental impacts had occurred as a result of them.

Consultation period open

The proposals are a revision of the initial recommended changes which emerged from the Inter-Agency group towards the beginning of this year.

One interesting aspect is that when Energy-Storage.news reported on those back in February, the group had recommended provisions to allow stakeholders, including authorities having jurisdiction (AHJs) and first responders, access to the battery management system (BMS) data of battery storage assets.

This site is aware that there had been some pushback on this from the industry. One source said at the time that BMS data would not necessarily be helpful or readily usable information for those stakeholders. The recommendation does not appear in the final Inter-Agency Working Group report.

The industry and other stakeholders now have their chance to comment on the draft proposal, with a consultation period open until 24 September 2024.

“Key proposed updates to the fire code – such as requirement for third-party peer reviews, site-specific Emergency Response Plans (ERPs), additional protections for cabinet-style enclosures, and timely on-site support for local fire departments – will provide added levels of safety and standardisation for BESS installations across the state,” ESRG said.

“New York State has been, and will continue to be, a leader in BESS safety across the country, and we look forward to continuing to support the Working Group in their efforts.”

A few months ago, California introduced legislation requiring safety and communications protocols to be put in place for all BESS installations.

Fortis Energy buys solar and storage project in Serbia

The majority of the company’s portfolio is in operation in its home country, but Fortis has sought to expand its offerings in other countries in recent years. The company currently has three solar-plus-storage projects under development in Serbia, with a combined solar generation capacity of 600MW, alongside three solar-plus-wind projects in the south of the country. Fortis now has close to 2GW of new renewable power capacity under development in Albania, Serbia and North Macedonia.

The deal is the latest encouraging development for the eastern European renewable power sector. Earlier this year, figures from Ember demonstrated that clean power generation exceeded that of coal in Central and Eastern Europe for the first time, and the continued investment into renewable power facilities will only continue to expand the sector.

To see the full original version of this article go to PV Tech.

Enlight secures US$400 million for 1.2GWh co-located BESS in New Mexico

The 1,700-acre project is already in the commissioning phase and will reach a full commercial operation later this year. It was developed by developer RES and the BESS is being provided by Tesla, and has a 20-year PPA with utility Public Service Company of New Mexico.

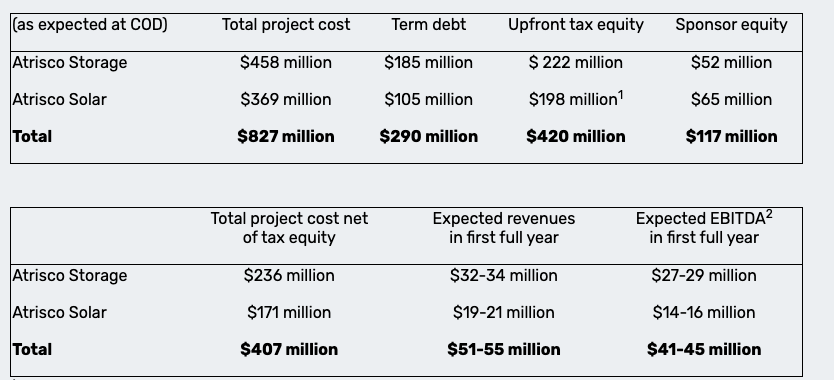

Enlight has secured US$290 million in term debt, US$420 million in tax equity and will invest the remaining US$117 million itself as sponsor equity for the whole project. The financing for the solar portion had already been secured in December 2023 and the storage financing has now also been completed.

Enlight, via the subsidiary Clenera, secured the loan from eight banks led by HSBC for the storage portion while tax equity was provided by US Bancorp Impact Finance. HSBC also led the consortium for the solar financing, while Bank of America provided the tax equity there.

The firm also provided the debt, tax equity and sponsor equity breakdown for the solar and storage separately, shown below. Debt is a larger portion of the storage financing, while tax equity and sponsor equity are larger for the solar.

Image: Enlight Renewable Energy.

New Mexico has an energy storage deployment target of 7GWh by 2034. The project is Enlight’s largest so far, but it is about to being construction on several other large-scale projects.

That includes the Country Acres (392MW solar and 688 MWh of storage) in California, Roadrunner (290MW and 940MWh) in Arizona, and Quail Ranch (128MW and 400MWh), which is a brownfield extension of the Atrisco project.