Fires at two of three approved BESS facilities in San Diego County

Jim Desmond’s concerns surrounding battery storage technology stem from recent high-profile fires at two of three BESS facilities green-lit for construction by San Diego County officials.

As reported in Energy-Storage.News, a battery unit at Terra-Gen’s 140MW/560MWh Valley Center BESS caught fire on 18 September 2023, causing a quarter-mile evacuation area that lasted until later in the evening, when the fire had been contained.

This incident was then followed by a much more significant fire at Rev Renewable’s Gateway Energy Storage facility that first ignited on 15 May 2024. An evacuation order was deployed by the California Department of Forestry and Fire Protection (CalFire) for San Diego that lasted until 28 May, while it worked to contain the fire.

In daily statements posted on X (formerly Twitter), CalFire reported several instances of thermal runaway at the Gateway site, deploying up to 40 fire personnel during the height of activity. The causes of both fires are currently unknown amidst ongoing investigations.

The third BESS facility approved by San Diego County officials is San Diego Gas & Electric’s (SDG&E’s) Fallbrook energy storage facility that was brought online in 2022. Ownership of the 40MW BESS was transferred from AES Corporation to the California public investor-owned utility (IOU) upon completion of the project under a build-own-transfer agreement.

Dozen active BESS applications in San Diego County

During the meeting, Desmond stated that there were currently 12 active BESS applications with San Diego’s Planning and Development Services department at various stages of the approval process, including another development from AES known as the Seguro energy storage project.

It was recently reported by local news outlet Coast News that the Palomar Health Administration had denied an easement which would have allowed the 320MW/1,280MWh BESS to connect to SDG&E’s Escondido substation via land owned by the Palomar Medical Center.

According to an AES website, the project was initially envisioned as having 400MW/1,600MWh of storage capacity but had been “reduced due to stakeholder and community feedback”.

San Diego BESS standards could incentivise use of industrial zones

During the meeting, Desmond explained that the development standards should stop developers locating BESS facilities in residential areas but also incentivise developers to locate facilities within industrial zones.

He also requested that at the next meeting, the board instate a temporary 45-day moratorium (with up to two 1-year extensions) on the approval of any new BESS facilities until the new standards had been adopted.

The development of BESS standards is expected to cost San Diego County up to US$1.25 million.

‘Really big problem’

The Vice Chair of the San Diego County Board of Supervisors Terra Lawson-Remer expressed concerns surrounding a potential two-year moratorium on the installation of new BESS facilities.

Lawson-Remer, also on the Board of Directors for California Community Choice Aggregator (CCA) energy supplier San Diego Community Power (SDCP), said that although she wanted to “move expeditiously” to create the new standards, it was her understanding that it could take up to two years or more for them to be developed, and that the county would have a “really big problem with local energy needs” if no new sites could be built during this period.

Instead of instating a blanket moratorium, the board passed a motion agreeing to adopt new standards but also decided that at the next meeting it would discuss several potential stopgap measures to incentivise BESS safety whilst the standards were being developed.

The board agreed that the discussion points should include a temporary moratorium on new BESS applications, mandatory board review of all new BESS projects and interim standards within six months.

Watch the 17 July 2024 Board of Supervisors meeting below, discussion of Item #8 on establishing development standards for siting of BESS begins at 1 hour 20 minutes.

[embedded content]

12-month moratorium for New York town

Elsewhere in the US, the Town of Wilson in Niagara County, New York recently enacted a 12-month moratorium on the processing of any new permits for projects with BESS facilities, whilst town officials drafted new local laws for battery siting.

At the Wednesday 17 July 2024 meeting, town supervisor Tony Evans said that the town would “take their time” drafting the new laws and would extend the moratorium if required.

Like California, there have been several high-profile fires at BESS facilities within the state of New York, including incidents at three separate facilities which occurred last year during May and July.

This led to the formation of the New York State Inter-Agency Fire Safety Working Group, which released its first set of recommended changes to the New York fire code during the first quarter of this year, as reported by Energy-Storage.News.

UAE utility EWEC seeking proposals for 400MW/800MWh BESS project

It follows its call for expressions of interest (EOI) in building the project earlier this year, which saw 27 parties qualified for the RFP out of a total 93 EOIs submitted. Parties have until the fourth quarter of 2024 to submit their response to the RFP.

The BESS will provide ancillary services, such as, frequency response and voltage control to help EWEC balance the grid as it increases its solar capacity to 7.5GW by 2030.

EWEC said the project will follow the model of the emirate’s existing Independent Power Producer (IPP) programme, where developers enter into a long-term agreement with EWEC as procurer.

Deploying the project will involve the development, financing, construction, operation, maintenance, and ownership of the BESS system and all associated infrastructure.

EWEC didn’t say when it expects the project to come online but has previously said the emirate needs 300MW/300MWh of energy storage online by 2026 to integrate its growing renewable generation portfolio, possibly giving an indication to the timeline for this project too.

Neighbouring emirate Dubai has been notably more quiet for large-scale BESS announcements in recent years. The last piece Energy-Storage.news published looking at it in 2021 covered a 8.61MWh system deployed by EWEC’s equivalent there Dubai Electricity and Water Authority (DEWA) using Tesla batteries. A large pumped hydro energy storage (PHES) is however underway, set to enter commercial operation this year.

TotalEnergies takes FID on 100MW/200MWh Germany project using Saft BESS

The oil and gas firm will invest €75 million (US$81.4 million) in the project which is expected to enter commercial operations in the second half of 2026.

Another TotalEnergies subsidiary, system integrator Saft, will provide its ‘iShift’ lithium iron phosphate (LFP) battery containers for the project, as Energy-Storage.news speculated it might when the transaction occurred in February. Saft has in the past deployed projects for TotalEnergies in the US, France and Belgium.

Another subsidiary, startup Quadra Energy, will provide optimisation services on the BESS project, operating its charging and discharging activity in the electricity market to maximise revenues.

France-headquartered TotalEnergies has been busy buying up companies across the renewable energy value chain in Germany, having also acquired Nash Renewables last year, a firm involved in optimising the design and operating parameters of renewable projects.

The 100MW/200MWh project in Dahlem is the joint-largest in Germany on which FID has been taken, with others including a system being built by developer MW Storage and system integrator Fluence.

The sector has picked up in Germany in the last few years as high ancillary service prices and wholesale arbitrage have substantially improved the business case, leading even companies from tangential segments to enter the space.

That includes commercial & industrial (C&I) focused provider Tesvolt launching its largest ever project recently and vehicle-to-grid (V2G) software specialist The Mobility House announcing it would go into the grid-scale segment.

The ‘Innovation Tender’ subsidy scheme for solar-plus-storage projects, which pays out an operating grant per kWh discharged, is also helping drive deployments with 512MW of co-located projects awarded contracts in the last round.

US IPP BrightNight gets grid connection approval for Australia hybrid solar project

“Australia’s increasing energy demand, alongside that of the broader region, presents vast opportunities for us to provide our cutting-edge renewable energy solutions to drive the adoption of clean energy,” said Jerome Ortiz, BrightNight APAC CEO.

Projects such as these will help Victoria meet its renewable power generation targets, which include the goal of renewable power accounting for 40% of the state’s electricity generation share by 2025. Victoria is well on track to meet this target – the share of renewable power in the state’s energy mix has increased from 12.2% in 2013-14 to 37.8% in 2022-23 – and currently has over 1GW of utility-scale solar capacity in operation, with more than 5.3GW of capacity approved and a further 190MW of capacity currently under construction.

The Mortlake project will also help meet the state’s energy storage goals, with the government aiming to install 6.3GW of energy storage capacity by 2035. Planning documents submitted by BrightNight to the Victorian government note that the Mortlake project will meet up to 11% of the state’s 2030 storage capacity target, and up to 5% of the state’s 2035 storage capacity target.

To read the full version of this story, visit PV Tech.

Australia: Origin Energy’s 2GWh BESS expansion plan for Eraring coal power site approved

This will complement Origin’s existing 460MW/1073MWh 2-hour duration BESS currently under construction as part of Stage 1 of the overall project.

Stage 1 of the Eraring project is expected to cost around AU$600 million (US$392 million) and be delivered by Wärtsilä, a Finnish marine and energy technology company, via an engineering equipment delivery (EED) contract with Origin. It is expected to come online at the end of 2025.

Origin has already signed equipment supply and construction agreements for Stage 2 of the project. Wärtsilä has again been employed to deliver the battery equipment, with Enerven Energy Infrastructure providing design and construction services. Construction will begin in early 2025 and be completed in Q1 of 2027.

Wärtsilä revealed that the BESS will operate in virtual synchronous machine (VISMA) mode. This will enable short-circuit current capabilities, such as reactive current, droop control, and synthetic inertia, to support grid stability and security. This will be achieved via Wärtsilä’s energy management system, GEMS Digital Energy Platform.

According to Greg Jarvis, head of energy and supply at Origin Energy, the project affirms the company’s belief that “storage will play an important role in the changing grid by helping to firm up variable supply from wind and solar”.

“The second stage of the Eraring battery will be over 4-hours duration and it will be capable of absorbing excess solar generation during the day to support reliable energy supply when needed, such as through the evening peak,” he added.

Project significant in withdrawing Australia’s biggest coal-fired power plant

Readers of Energy-Storage.news may be aware that the Eraring battery energy storage project is part of Origin’s plans to withdraw Australia’s largest coal-fired power station from service and instead contribute to the uptake of variable renewable energy generation technologies, such as wind and solar.

Located on the shores of Lake Macquarie, southwest of Newcastle, the black coal power plant provides 2,880MW to the National Electricity Market (NEM). In early 2022, Origin said it would be retiring the coal-fired power plant in 2025, yet in May 2024, the New South Wales government controversially extended this by an additional two years to “guarantee a maximum of electricity supply”. The new expected closure date is scheduled for August 2027.

This was in light of the Australian Energy Market Operator (AEMO) stating that, without Eraring, New South Wales would face energy reliability risks from 2025. As such, the state government is subsidising the power station to ensure it can remain operational.

Although the decision remains controversial, global market research organisation Cornwall Insight revealed that extending Eraring’s service will cut New South Wales’ power prices by 44%, dropping from a predicted AU$153/MWh to AU$86/MWh in 2026. However, question marks remain over the power station’s use and impact on New South Wales and Australia’s climate goals.

Roadblocks in delivering infrastructure to transition from coal

The extension of the Eraring coal-fired power station could have been avoided had infrastructure been scaled sufficiently in the state, yet despite an appetite to scale this from a developer perspective, “roadblocks” remain, Stephanie Bashir, CEO of energy policy and regulation specialist Nexa Advisory, said at Solar Media’s Energy Storage Summit Australia in Sydney earlier this year.

“These types of roadblocks are fairly and squarely in the hands of government to expedite and then make sure that we’re not just building to the timeline to close power stations (which we’re failing miserably as a result) but also to have a bit more ambition to be the energy superpower we actually can be.”

The good news is that Australia has the policy mechanisms in place and the technologies available to achieve that more ambitious goal.

“We just need to get on with it,” Bashir said.

Equis secures grid approval for 200MW BESS

In other Australian news, Equis Australia, the regional subsidiary for Asia-Pacific market infrastructure developer Equis, has secured grid approval for its 200MW/800MWh Lower Wonga BESS in Queensland.

Based around 0.8km southwest of the Woolooga Substation, around 100km northwest of Sunshine Coast, the 4-hour duration BESS was granted development approval in July 2023.

According to the project’s website, construction will commence in 2024 and be operational in 2026. Once construction begins, the BESS project will create up to 115 regional jobs.

Earlier this year, Equis Australia, alongside the State Electricity Commission (SEC) for Victoria, secured AU$400 million in financing for their Melbourne Renewable Energy Hub (MREH) battery storage project. The project will comprise three BESS assets with a total output of 600MW and a capacity of 1.6GWh.

Utility offtake agreement signed for gigawatt-hour scale BESS project in Arizona

The 4-hour duration lithium-ion (Li-ion) battery asset will be constructed in Mesa’s Elliot Road Technology Corridor, an industrial development hosting high-tech manufacturing and tech companies.

Tenants include Apple, Meta, Amazon, and others. Google is also due to set up some operations at the development. The city of Mesa has provided utilities infrastructure, speedy permitting processes, and a Foreign Trade Zone, with Salt River Project providing power to the industrial park.

Aypa Power, formerly known as NRSTOR C&I before its acquisition by private equity giant Blackstone in 2020, took over the project from another developer, Eolian. The pair jointly bid Signal Butte into SRP’s 2023 all-source request for proposals (RFP).

Aypa Power, which bought the project during late-stage development from Eolian, will continue to own it, while utility SRP has full rights to control the dispatch of stored energy into its grid.

It marks Aypa’s first BESS project in Arizona. The company’s other major announced projects are in the US battery storage hotspot states of California and Texas, with two further projects in Indiana, one of which was purchased also from Eolian.

The project is due to go into commercial operation by mid-2026. Eolian CEO Aaron Zubaty commented last week that its location in Signal Butte was chosen strategically in 2018 due to the presence of a substation serving “multiple operating and under-construction data centres”.

“The continued growth of our economy now depends more than ever on deploying fast-responding and flexible resources in the right locations to provide critical instantaneous capacity, and battery energy storage projects like Signal Butte can be built at a speed that matches and enables continued rapid growth in electricity demand,” Zubaty said.

Arizona utilities adding BESS resources through RFPs

Meanwhile, SRP and the desert Southwest state’s other main electricity supplier, Arizona Public Service (APS), have signed a number of similar agreements for large-scale battery storage projects in recent months.

Earlier this month a tolling agreement between APS and developer Strata Clean Energy was announced for a 150MW/600MWh standalone BESS project, and in June SRP held a celebration event to officially ‘open’ two projects from Plus Power, adding a combined 340MW/1,360MWh of battery resources to the utility’s portfolio.

These projects have all earned their utility contracts through participation in utility RFPs. SRP is currently hosting its 2024 peak power all-source RFP (PDF), launched in April. Through it, the company wants to add 200MW of peak generation capacity by May 2026, and at least another 300MW the start of May 2027, as well as 500MW of new carbon-free energy resources.

In addition, SRP recently launched an RFP specifically for the procurement of long-duration energy storage (LDES) resources from non-lithium storage technologies for deployment in the early 2030s.

US renewables developer Clearway raises US$700 million for solar-plus-storage and BESS projects

Clearway has also started construction on the two projects, a solar PV and a standalone battery energy storage system (BESS), located in the Californian counties of Fresno and San Bernadino.

The Solar PV plant in Fresno – the Luna Valley Solar Project – has a 200MW capacity, while the Dagget storage in San Bernadino has an output of 113.5MW. The storage project in San Bernadino is the final phase of a solar-plus-storage project with a PV capacity of 482MW and a storage output of 394MW.

Both projects are expected to reach commercial operations in 2025, while construction is carried out by renewables contractor Blattner Energy.

Moreover, the company has already secured a 15-year virtually paired hybrid power purchase agreement (PPA) with utility San Diego Gas & Electric for both projects. The remaining capacity of the Luna Valley PV plant is contracted under a 20-year PPA with utilities Southern California Edison and Power & Water Resources Pooling Authority.

“Luna Valley and Daggett 1 represent two major steps forward in California’s path to a reliable, affordable, and clean electric grid,” said Brooks Friedeman, VP of capital markets at Clearway.

In the past five years, the renewables developer has put over 2.3GW of solar and storage projects into construction and operation in California.

This story first appeared on PV Tech.

Japan: Expert panel discusses BESS market growth, opportunities and challenges

Speakers:

Shunsuke Kawashima, deputy general manager, Itochu Corporation

Ross Bennett, managing director and head of structured finance, NORD/LB

Joost van Acht, managing director, ib vogt

Dr Mahdi Behrangrad, head of ESS/VPP business development, Pacifico Energy

Nick Morely, APAC technical lead, Eku Energy

Drivers for energy storage in Japan

Itochu is one of Japan’s biggest wholesale trading companies (‘sogo sosha’). That means it is active in a wide range of business activities, including energy storage, where it has been a leader in residential battery sales.

It is now among the many Japanese and international players seeking to develop large-scale battery energy storage system (BESS) assets, and is partnered with the UK’s Gore Street Capital to manage a fund promoting storage and renewable energy in collaboration with the Tokyo Metropolitan Government.

Shunsuke Kawashima, who works across Itochu’s BESS business at all scales including residential, commercial and industrial (C&I) and utility-scale, opened the discussion by highlighting the drivers for energy storage adoption in Japan, of which he said there are two: increasing renewable energy generation and increasing demand for electricity.

With the grid’s share of renewables and low-carbon energy, not including nuclear, at about 20% today, the government is seeking to get to 36-38% by 2030, and to 50% renewables by 2050, its net zero target year. There will also be a commensurate decrease in generation from coal, Kawashima said.

On the second point, electricity demand, it is well known that Japan’s population is ageing, and decreasing, and the government had forecast that demand for power would not increase significantly.

“So the government felt, this is very easy. Increase renewable energy, decrease energy from coal power supply, but it will still be okay, because of the total demand decreases, in this original scenario,” Kawashima said.

However, in May of this year, “the government changed their minds, because of AI, data centres, everything,” he said. “The government is forecasting right now that demand will be increasing more than 35-50% to 2050,” and has identified energy storage as a key technology to enable better balancing of supply and demand.

“One of the key things that we see in terms of more renewables coming in, we’re seeing in many markets around the world, that creates other difficulties in the grid, in the market and batteries can solve a lot of that,” said Ross Bennett, of German state-owned bank NORD/LB.

More variability in generation between different times of day requires shifting energy to better meet morning and evening demand peaks, while more uncertainty in generation output means a greater need for backup.

Kyushu, the furthest south of Japan’s three main populated islands, is already seeing about 10% of renewable generation economically curtailed, “wasted energy that’s not being dispatched,” Bennett said.

There is so far also only one ancillary services market for frequency response open to energy storage assets in Japan. Bennett said that is another area with high growth potential, while more projects with corporate power purchase agreements (PPAs) are coming into the Japanese market, leading to more trading in the spot market.

“With more trading in the spot market, there’s more volatility and opportunity for arbitrage players, which of course much further down the line is future opportunity for battery storage as well,” Bennett said.

‘Tough nut to crack’

While preventing curtailment is a valuable potential use case for energy storage in Japan as renewable generation increases, developing solar PV projects in Japan can have much longer lead times than in other markets, said Joost van Acht, managing director of ib vogt.

Van Acht is responsible for the European renewable energy developer’s development, investment and commercial transactions in the APAC region.

That includes setting the company’s strategy towards BESS development for both standalone ESS and batteries co-located with renewable generation.

“What makes it more complex for us in Japan is that generally the development cycles for renewables are quite long. So, we’re looking at the current grid situation, but then if you add the three, four years to develop a solar project, that situation might have changed quite considerably and that feeds then into your investment case,” van Acht said.

“We do find it quite challenging, but we do also see that if you can be smart about it, then you can combine batteries and solar together; there’s actually a very good opportunity to make some good money out of that.”

There’s a reason why Japan is a notoriously “tough nut to crack,” for foreign businesses, said Dr Mahdi Behrengrad ,of Singapore-headquartered Pacifico Energy, which currently has Japan’s largest operating solar PV portfolio.

“Japan’s sheer size and reputation, the establishment of the organisation and infrastructure, everything attracts lots of companies,” Behrengrad said, but noted that the number that succeed once there is relatively small.

That has been the case in solar, and in offshore wind too. One main reason for that is that renewable energy and storage markets are largely driven by auctions and subsidies, which are “notoriously single-buyer” procurements, “heavily impacted by regulations and which can evaporate in a year,” Behrengrad said.

“If you want to sell to government or government-affiliated or government-covered agencies, you should consider the risk that they change their mind, because it’s a hugely political debate.”

That presents a regulatory risk at the central government level, but what many foreign companies also fail to recognise are the regulatory risks at local level.

Behrengrad said that for one Pacifico project, land and grid connection had been secured, but when it came to construction, the local authority decided that it wanted to limit noise pollution from the asset to 40 decibels.

“I don’t say it’s rocket science, but all of this means money. It means cost, it means patience.”

Nick Morely of Eku Energy, which is the Australia-headquartered pureplay BESS developer set up by Macquarie Capital’s Green Investment Group to develop projects in territories including the UK, Australia and now Japan, echoed the sentiment that patience is key, as well as local partnerships.

“There are significant barriers, whether they be regulatory, as well as language and on the development front, the way that a lot of regulations are implemented, there’s a strong local layer as well,” Morely, who is Eku Energy’s technical lead for the APAC region, said.

“So, there’ll be federal laws, but then the prefectural governments are really the ones who are implementing them, and they have a certain amount of authority to make changes or require things above the federal regulation.”

On the technical side, getting grid connections for battery storage projects can be a challenge in many countries, but in Japan, the process can be even more complex than outside observers often appreciate, Morely said.

“In Japan, the primary challenge that we see is that the lead times to complete the grid connection are very significant and they’re also quite variable,” Morely said.

“You need to make an investment upfront, spend time with the utility and eventually you’ll get an answer back saying, ‘Okay, we need anywhere from two years to five or six years to make the connection ready for your project,’ and so if your capital isn’t patient, both to invest early to progress the grid connection with a significant risk attached, and patient to develop your project while you wait for that grid connection to be available, then you may find the market a bit unappealing.”

LTDA: ‘Not the only way to commercialise BESS projects in Japan’

One of two large-scale BESS units built and owned by Pacifico Energy, which were the first in the country to start wholesale market trading of energy. Image: Pacifico Energy.

The flipside is, of course, that both Japanese and overseas companies see the fundamental drivers for growth in the energy storage market, coupled with the government’s public announcements, as something it wants to support.

Much has been made of the recent first-ever low-carbon capacity market auction, called the ‘Long Term Decarbonization Auction’ (‘LTDA’).

This offered 20-year contracts underwritten by the government, and significant numbers of battery assets (1.1GW) and pumped hydro energy storage (557MW) were successful in the competitive solicitation process.

There are, however, “multiple pathways to commercialisation” of BESS in Japan, and the LTDA is not the only game in town, said Morley.

Eku recently announced what is thought to be a first-of-a-kind offtake agreement with utility company Tokyo Gas, for example.

“One of the things that’s attractive about Japan is that there are multiple commercialisation pathways there. It’s not completely dependent on the LTDA,” Morely said, although he qualified this statement by saying that strong policy support of the type offered through the auction is desirable, alongside the ability to pursue different business models.

Similarly, Behrengrad pointed out that Pacifico Energy was the first developer to put BESS assets into Japan’s wholesale electricity trading markets, one in the south in Kyushu, and one on the northern island of Hokkaido.

“We are the first company in Japan who built and now we own and operate fully merchant large-scale ESS in both Hokkaido and Kyushu, and it has been phenomenal. So that is the vibrancy that I like about Japan that you can do these things,” Behrengrad said.

Pacifico is also working to write up contracts that are “half-merchant, half-tolling,” and business models of this type may be what drives market activity in the long run, rather than single auction-led deployments.

The LTDA itself has two major issues, said Kawashima. The auction provided a “good signal” to the market that Japan is embracing energy storage, but the returns are too low, he said.

“It’s only 2% to 3% IRR, in this case, it’s better to put the money in the bank, to be frank,” Kawashima said.

Better money could be made from batteries if merchant revenue opportunities open up more, he said. Meanwhile, the risk is that the LTDA itself is not just a subsidy scheme to support energy storage.

Other low-carbon assets like nuclear, ammonia or hydrogen facilities could also participate, and with this year representing only the first staging of the LTDA, the scheme’s design could change year-on-year.

From a debt financier’s perspective, however, Bennett said the LTDA is an “attractive product,” characterised by long-term cashflow guarantees and a strong counterparty in the Japanese government.

“As we’ve seen in other auctions in Japan, the first round was very overbid, and the price or the ultimate outcome was perhaps sub-optimal for many developers,” Bennett said.

“But still, I think even with a low base IRR assumption, the cost of debt in Japan is very low,” he said, so if developers can combine their LTDA contracts with other revenue streams, it can improve their geared position.

Adapting to merchant revenues

Bennett agreed with Morely’s position that the LTDA is not the only way to commercialise a BESS asset in Japan, adding that it is also not the only way to get debt finance, as there are numerous potential large corporate offtakers in the country.

Hazelwood, a 150MW/150MWh BESS asset co-developed by Eku in Australia, where the company has benefitted from a variety of commercialisation options, Nick Morely said. Image: Eku Energy.

The banker made a comparison with the Australian market, which is starting to see more and more tolling agreements, as well as merchant business models, and projects or portfolios that blend both contracted and merchant revenues.

“There are various other ways that you can contract out the battery, of course. Many of these for Japan are maybe a little bit too soon at this stage, but I think all of that will likely come in time,” Bennett said.

“What we’ve seen in other markets is, this does usually come quickly, once it starts moving.”

Appetite for exposure to merchant risk will take time to develop in a market like Japan where renewable energy deployment and revenues have been so closely tied to a feed-in tariff (FiT) regime.

Behrengrad said that there are many companies in Japan that have the technical capability to deploy major infrastructure projects, and many companies with a strong background in energy trading in oil and gas.

The “comfort zone” provided by renewable energy FiTs, where the offtaker carries no credit risk and the prices are fixed, is not replicable in the more complex world of monetising the value of battery storage, he said.

Lessons from both those adjacent sectors can be readily applied to energy storage, but it’s the question of how to finance projects that needs to be answered, according to Behrengrad.

“I think the key difficulty that financiers have in Japan, when we talk about merchant exposure, is exactly as Mahdi was saying: to date, we haven’t needed to look at it,” Bennett said.

Bennett added that looking at the Australian market, an initial thirst for long-term contracted revenues has gradually given way to more merchant market exposure.

As contracts shortened from 20-year to 15-year and then 10-year in Australia, the “merchant tail,” the post-contract lifetime of the asset where there is freedom to play into merchant markets, increased.

“When you’re looking at a 15-year merchant tail, you obviously do a lot of merchant exposure analysis and there’s also more people playing in those markets as well from a trading perspective. So, there’s more liquidity, and there’s more comfort around that,” Bennett said.

“That’s also something that we’d see would be valuable in Japan to develop that merchant exposure, that merchant appetite.”

This article reported on a panel discussion from the Energy Storage Summit Asia 2024, hosted in Singapore earlier this month. Energy-Storage.news Premium subscribers can benefit from exclusive discounts to this and other events hosted by our publisher, Solar Media.

SSE Renewables plans 18GW/37GWh pumped hydro energy storage project in Scotland, UK

SSE Renewables, which is the renewable energy development arm of Scotland-headquartered multinational energy company SSE, announced its plans earlier this week (22 July).

If pursued, the project could produce around 37GWh of stored energy capacity, thus providing additional stability and flexibility to the GB grid. It would export energy for 20 hours at 1.8GW. A grid connection offer totalling 1.795GW has already been secured.

SSE confirmed the project could reach commercial operations in the mid-2030s, subject to reaching a final investment decision.

Gilkes Energy said the Fearna PHES project will complement the existing conventional hydro projects in the area and “represents the next chapter in Scotland’s rich hydropower heritage”.

Under the terms of the joint venture, Gilkes Energy will lead the project’s development under a development services agreement with SSE Renewables, leveraging the company’s experience in developing PHES projects in Scotland.

“The proposed Fearna project is a welcome addition to our development pipeline of pumped storage hydro projects, which also includes our proposal to develop what could be one of Britain’s biggest pumped storage schemes in 40-years at Coire Glas and our intention to convert our existing Sloy Power Station into a PHES facility,” Ross Turbet, head of investment management for hydro at SSE Renewables, said.

To read the full version of this story, visit Current.

UK’s Gresham House discusses ongoing 328MWh BESS augmentation round

The firm’s New Energy assistant fund manager James Bustin was discussing its busy augmentation activities this year, with over 300MWh being added to its UK portfolio – activity which has come at the expense of its first international foray, as he explained.

“Going international has always been the plan, but this year we prioritised our cash focus on delivering duration upgrades in the UK. Augmentation provided the greatest returns right away, so we pulled away from that initial project in California, though we have others on the list,” Bustin said.

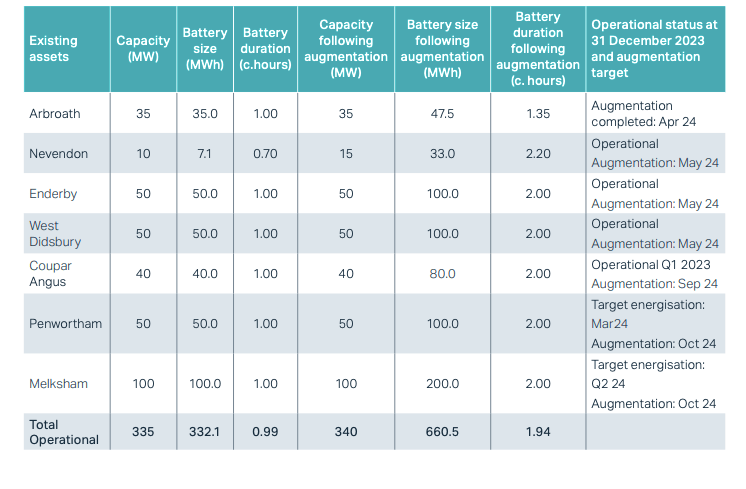

Between April and October this year, GRID is adding 328MWh of BESS capacity to seven existing projects, thereby increasing the average discharge duration of those projects from around one hour to around two hours.

The projects are Arbroath, Nevendon, Enderby, West Didsbury, Coupar Angus, Penwortham and Melksham.This table below, taken from the fund’s annual report, details the additions.

Image: Gresham House.

Bustin also discussed the company’s recent tolling deal with utility Octopus Energy, with those comments published in a separate article last week.

‘Using different parties does have challenges for augmentation’

The round of augmentations isn’t GRID’s first, after it turned most of its 30-minute duration sites – sometimes called 0.5C – to 1-hour ones, or 1C (1C meaning a 1:1 ratio between power and capacity) in 2018/2019.

“Each site has been designed with the idea of expanding, but there is never a pre-agreement with the provider. We’ve used two different battery types for the same project when augmenting and this is where our IP (intellectual property) comes in, having already done the augmentation five years ago which means we were familiar with the challenges,” Bustin said.

“The real advantage is around planning in advance, having the foundations laid for it. Having different providers for one project does have some challenges, but if you have experience augmenting it helps.”

“Not all providers are equal on this so we’re very careful about who we pick. Most parties should be able to deliver augmentation to some extent but we spent a lot of time choosing parties appropriately.”

He added that installing new BESS capacity can either involve adding that capacity ‘behind’ the inverter – what some might call DC augmentation – or ‘at’ the inverter – AC augmentation.

The latter potentially involves adding more more power conversion systems (PCS) alongside the additional BESS capacity which adds cost, while the former primarily involves shuffling existing BESS capacity behind inverters to maximise their usage.

The only of the seven projects above to have had its power capacity increased, which presumably required new PCS, was Enderby, going from being a 10MW/7.1MWh system to a 15MW/33MWh one.

System integrator Wärtsilä Energy Storage & Optimisation went into detail on augmentation in a technical paper for an edition of Solar Media’s PV Tech Power journal last year.

Bustin: “You can have different battery containers behind one inverter, if the control system is advanced enough. In our situation we’ve pooled like-for-like containers behind the inverter. In others we’ve done a sort of hybrid of the two types of augmentation.”

He also said that BESS solutions which provide both batteries and PCS integrated into one 20-foot container, increasingly popular so-called ‘AC blocks’, created a challenge for augmentation by limiting flexibility on design and structure. In other (admittedly very different) markets, like Chile, IPPs have said the opposite.