Securing approval of the development application is a key milestone on the project’s development. The application is a formal process for permission to build a new development in a designated area in ACT.

According to Eku Energy, the BESS is expected to enter the construction phase later this year and will be located in close proximity to the Williamsdale substation.

Eku Energy is responsible for developing, constructing, operating, and actively managing the Williamsdale BESS. Under an innovative revenue share agreement, it will share 50% of the net revenue with the Territory.

The Williamsdale BESS will also be registered to participate in the National Electricity Market (NEM), the main interconnected electricity network covering the east and south coasts of Australia.

Eku Energy partnered with the ACT government last year to develop, build, and operate the 250MW BESS. At the time, this was deemed a significant step in delivering the Big Canberra Battery ecosystem.

The initiative was first announced as part of the state’s 2020-2021 budget with AU$100 million (US$67 million) in funding pledged towards it. The government ran a procurement process for the grid-connected BESS which began in mid-2022 before its award to Eku just under a year later.

Eku Energy is an energy storage development platform that was launched through the Macquarie Asset Management-owned Green Investment Group (GIG) in late 2022

Eku Energy discusses business model variety

Eku Energy discussed how its Australian projects are developed under a variety of different business models, such as merchant, in an exclusive interview on Energy.Storage.news Premium last month (10 June).

Rachel Rundle, Eku Energy’s senior manager for policy and regulation in the APAC region, said that Eku Energy takes each project on a case-by-case basis, stating that it’s impossible to say what the commercial and revenue for schemes may look like. But the contribution the schemes could bring to the decarbonization of the country is unparalleled.

“We definitely see that with all the system challenges that we as a sector are aware of, through all these thermal plants coming out of the system, batteries are really well-placed to provide those services: whether it be system strength, whether it be synthetic inertia, voltage support, batteries are sort of that multi-tool asset,” Rundle said.

Most LDES projects set to be 8-hour systems, says California Energy Commission

The goal of the CEC report was to provide policymakers and stakeholders with a greater understanding of the role and costs associated with long-duration storage facilities within the state of California.

The report came shortly before the California Public Utilities Commission (CPUC) revealed on Friday (19 July) it has determined that the state bodies should conduct a centralised procurement of some 2GW of LDES, both multi-day and 12-hour-plus, alongside 7.6GW of offshore wind and 1GW of geothermal, covered in a separate article here.

‘Significant progress’ towards state net-zero goals

The report acknowledged that California had already made “significant progress” towards its net-zero goals, with 50% of electricity coming from renewable sources in 2023 with 28% coming from solar sources.

With the move away from dispatchable fossil-fuel resources such as gas-fired peaking plants, battery storage facilities will become increasingly important by providing electricity to the grid during times of critical need such as cloudy days and during the nighttime.

California is leading the way in the US in terms of energy storage deployment and already has over 10GW of storage capacity connected to the California Independent System Operator (CAISO) grid, as reported by Energy.Storage-News in April earlier this year.

However, the majority of currently operational storage facilities are only able to discharge for up to a maximum of four hours, meaning they aren’t able to supply electricity from sunset to sunrise when it’s often needed most, leading to the motivation behind LDES facilities.

With the demand for long-duration batteries increasing, companies specialising in LDES have been cropping up over the past decade with bespoke solutions such as Hydrostor with its patented advanced compressed air energy storage (A-CAES) system, Energy Vault with its gravitational storage technology and Form Energy with its iron-air battery.

Key findings: 8-hour duration facilities to make up majority of storage projects

The CEC report concluded that storage facilities with a range and mixture of durations from four to 100 hours would be needed to support the California grid, but facilities with an 8-hour duration would likely make up the largest proportion of LDES facilities. However, this would be heavily dependent on the US$/kW cost of energy and efficiency of the projects.

The report found that facilities with an 8-hour duration and an efficiency greater than 80% would be competitive with 4-hour facilities with a higher 85% efficiency for only a slightly lower US$/kW cost.

However, it found that when the efficiency of 8-hour facilities dropped to 50%, the US$/kW cost would need to be roughly half that of 4-hour duration facilities with an 85% efficiency in order to remain competitive within the market.

When considered on a “per watt” basis, the US$/kW cost targets to enter the market for 100-hour duration facilities are similar to the 8-hour storage facilities (for example, a 50MW/100-hour must have a similar cost to a 50MW/80-hour facility). However, if the efficiency of the 100-hour facility dropped from 80% to 50%, a 40% lower US$/kW cost would be needed in order for it to remain competitive.

Daytime EV charging could reduce cost of needed storage by US$1 billion

With the sale of new petrol-powered cars and light-trucks set to be banned in California from 2035, the report analysed the additional storage needed for 15 million EVs, averaging 40 miles/day, which results in a total load of 55 trillion watt-hours per year (TWh/y).

The report looked at three distinct charging scenarios: nighttime charging where EVs commence charging at midnight, unconstrained charging where a spontaneous pattern occurs with peak demand during the evening and finally daytime charging which incorporates a main peak demand during the morning but also a secondary one at midnight.

With vehicles charging during the daytime when renewable generating facilities such as wind and solar would be available, the CEC found that the daytime scenario would require the least storage capability, corresponding to cost differences compared to the nighttime scenario up to US$1 billion.

The full CEC report with all its findings can be found here.

California Energy Commission investments in LDES

The CEC has already made investments in LDES technology, including issuing Form Energy a US$30 million grant for the development of a 5MW/500MWh storage project at a substation owned by public utility PG&E in Mendocino County, California.

Form Energy claims that its iron-air batteries work on the principle of reversible rusting, with electrical energy being stored through the rusting of iron which can then be discharged for up to 100 hours.

Washington-based utility Puget Sound Energy (PGE) has also signed a Memorandum of Understanding (MOU) with Form Energy for the deployment of an iron-air battery within its service territory, as reported in January 2024 by Energy.Storage-News. The pilot project is expected to have 10MW/1,000MWh of capacity and be online by the end of 2026.

US DOE’s Loan Programs Office to support Puerto Rico utility-scale solar PV and BESS

The projects themselves will comprise two utility-scale solar-plus-storage projects and two further standalone BESS projects located in the municipalities of Guayama and Salinas. Collectively, they are known as Project Maharu. The solar projects are projected to produce 460,000MWh of power annually.

The LPO said that the projects would help to support Puerto Rico’s grid reliability and energy security. In particular, it highlighted the role that BESS projects can play in maintaining power supply during extreme weather events; Puerto Rico’s power grid was severely affected by two hurricanes in 2017 and the country has since been hit with multiple earthquakes.

Project Maharu falls under numerous DOE and Federal government initiatives. It is part of the Biden administration’s Justice40 Initiative, which requires that 40% of the benefits of federal financing, including LPO investments, end up with “disadvantaged” communities. Most of Puerto Rico falls into this bracket.

The project will also be funded by the Energy Infrastructure Reinvestment (EIR), which was created as part of the Inflation Reduction Act (IRA) to support the replacement, repowering and repurposing of energy infrastructure which has either ceased operations or can be replaced to reduce carbon emissions.

The LPO said that the projects will help the replacement of Puerto Rico’s coal-based energy infrastructure, which the company has committed to ceasing entirely by 2028 before reaching a 100% renewable energy mix by 2050.

Energy-storage.news published an interview with the Director of the LPO, Jigar Shah, in October last year, which explored how the organisation funds renewable energy projects (Premium access). Shah said that the LPO supports companies that have met the commercial criteria to apply for debt financing support, rather than “picking” the companies to back. Shah has overseen something of a “resurrection” of the LPO, which was largely dormant during the Trump administration.

To read the full version of this story, visit PV Tech.

California eyes central procurement of 2GW of LDES to help scale novel technologies

The LDES portion is split between 1GW of multi-day energy storage, and another 1GW of energy storage with a discharge duration of 12 hours or more. The CPUC has said it wants resources that do not use lithium-ion batteries or pumped hydro energy storage (PHES) technologies, which are already commercialised and deployed at scale.

Other technologies are being targeted by the procurement by DWR because those technologies could help the state achieve its decarbonisation goals but are “not currently being procured by individual LSEs (load-serving entities, i.e. utilities) in significant enough amounts to achieve cost reductions,” the CPUC said.

California already has over 10GW of lithium-ion BESS online, primarily grid-scale, and that number will continue to grow substantially in the future. Project sizes are going up, with gigawatt-scale projects being progressed recently by NextEra Energy Resources and Avantus (both Premium access articles).

The determination comes after the Energy Research and Development Division of the California Energy Commission (CEC) issued a report highlighting the importance of energy storage resources with a discharge duration of eight hours or more recently.

DWR to act as central procurement body, resources for 2031-37 delivery

The CPUC will request the procurement of those resources, on behalf of the state’s electricity customers, by the Department of Water Resources (DWR), the state body responsible for the storage, management and regulation of the California’s water usage.

An ‘informal request’ may be sent to the DWR to initiate procurement within six months of the CPUC’s decision adoption. The CPUC’s schedule for solicitations would see the DWR, acting as a central procurement entity (CPE), launching solicitations for LDES in 2026 (as well as geothermal) with offshore wind the year after. The resources would then come online between 2031 and 2037.

See the CPUC’s decision document, in full, here. It clarified that the figures were maximum amounts, and that no procurement may happen if the prices offered by developers to the DWR were not cost-effective.

California is already providing US$380 million in grants for LDES projects, which it started paying out in November 2023.

Lithium-ion and PHES to be excluded

As part of the determination making process, the CPUC collected comments from a range of industry stakeholders including regulators and project developers.

Several were opposed to including lithium-ion in the procurement and, as such, the CPUC appears to have agreed, saying that both of the LDES procurement should not include lithium-ion batteries or PHES.

One of those was Hydrostor, the firm building large-scale projects in California and Australia using advanced compressed air energy storage (A-CAES) technology. Its comments were paraphrased in the CPUC’s decision document:

“Hydrostor is particularly concerned about technology neutrality in the LDES category, especially those technologies that are not lithium-ion batteries. In reply comments, Hydrostor points out that manyparties arguing in comments that LSEs can procure LDES on their own appear to be referring mainly or exclusively to lithium-ion batteries, and that this is not true for other diverse and emerging LDES technologies.”

The ‘100-hour, iron air battery’ company Form Energy also responded to the consultation, as did numerous utilities and developers and IPPs.

The UK government’s proposal to exclude lithium-ion from its LDES support scheme was also criticised by some stakeholders, primarily developers active with lithium-ion BESS project development (perhaps unsurprisingly).

Corporate funding for energy storage more than doubles year-on-year in first half of 2024

The sum raised across 64 corporate funding deals in total represented a 117% increase from the equivalent period of 2023 when US$7.1 billion was recorded from 59 deals.

It is short of the US$15.8 billion raised in H1 2022, although at the time it was noted by Mercom that the US$10.7 billion IPO by LG Energy Solution ‘distorted’ year-on-year comparisons.

It will be interesting to see how the rest of 2024 stacks up. 2022 went on to be an all-time high year with US$26 billion raised, up from US$17 billion in 2021. Although last year finished with a stronger second-half performance after a quiet start, the final total stood at US$19 billion in corporate funding for energy storage sector companies.

VC funding top five

Meanwhile, VC funding activity was dominated in dollar terms by money raised by lithium-ion (Li-ion) battery and energy storage companies.

Mercom’s top five VC deals for H1 2024 did, however, include three companies focused on non-lithium technologies: metal-hydrogen battery startup Enervenue, sodium-ion (Na-ion) company Natron Energy, and thermal heat and power storage company Antora Energy.

Company nameTechnologyVC deal amount (US$)Sila TechnologiesSilicon anodes for Li-ion batteries375 millionEnerVenueNickel-hydrogen batteries and storage systems308 millionNatron EnergySodium-ion batteries 189 millionAscend ElementsLithium battery recycler162 millionAntora EnergyThermal heat and power storage150 millionMercom’s Top Five VC funded deals for H1 2024

The top five represented a significant portion of the US$2.4 billion in VC funding raised from 28 deals during the period. This total was a 37% drop from H1 2023 when storage companies got US$3.8 billion from 43 deals.

In H1 2024, there were 16 debt and public market financing deals totalling US$13 billion, which was a massive 294% increase from US$3.3 billion from 16 deals during the same period of last year.

M&A activity into energy storage companies was up year-on-year, but there were fewer project-related M&A deals: there were 14 M&A transactions for companies in H1 2024 versus just eight in H1 2023, while there were 13 project M&A deals in the first six months of this year compared to 19 in H1 2023.

IPP Decci Group inaugurates largest BESS in Czech Republic

The project in Vraňany, Mělník, combines 30MW of BESS with another 22.4MW of gas generators to provide grid balancing services to the transmission system. Construction started in April last year and a May 2024 operation date was targeted.

Darina Merdassi, Decci’s director said the project would be able to provide the same balancing services as a 300MW lignite power plant, and that projects like it were key to moving away from coal, which still provides 60% of power in the Czech Republic (sometimes referred to as ‘Czechia’).

Specifically, Energy Nest will provide automatic frequency regulation backup (FCR), automatic activation power balance regulation backup (aFRR+) and manual activation power balance regulation backup (mFRR+), the announcement said. It will initially only bid in up to 30MW of its capacity, but this may increase to the full 52.4MW in future.

Merdassi added that the system could easily be expanded in future and that green hydrogen production is also being considered.

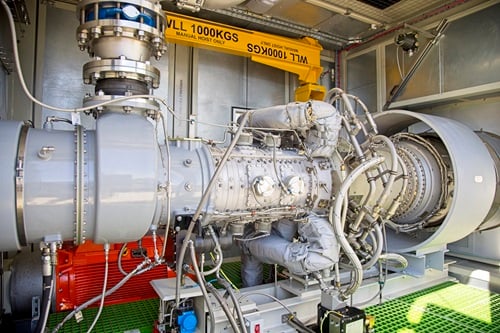

Technology company Siemens built the project while the main technology suppliers were turbine manufacturer Centrax and inverter company SMA. Local consulting firms Euroenergy, Nano Energies and OSC were also involved in the project while the Czech Institute of Informatics, Robotics and Cybernetics developed a customised control system.

Decci received a 750 CZK million (US$32 million) loan in November last year from Czech banks České spořitelny and Komerční Banka for the project.

It comes seven years after Energy-Storage.news reported on the first grid-scale lithium-ion BESS in the Czech Republic, deployed by system integrator Alfen.

See images and renders of Decci Group’s project below.

Images: Decci Group.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Central Eastern Europe on 24-25 September this year in Warsaw, Poland. This event will bring together the region’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place, as the region readies itself for storage to take off. Visit the official site for more info.

Alinta receives approval for 300MW BESS in Western Australia

The new BESS asset is the second to be approved for the site. The organisation is already constructing a 100MW/200MWh BESS, which aims to provide further stability and facilitate the increasing number of variable renewable energy technologies being connected.

Commenting on this, Russell Slaughter, head of project development at Alinta Energy, said the project will specifically “support the introduction of solar and other intermittent renewable energy sources into the existing network”.

“With the continued increase of intermittent energy sources into the state’s main electricity network, the need for dispatchable energy sources that can react quickly to changes in the electricity market is increasing,” Slaughter added.

Alinta said the project is expected to be completed by October 2027 and is being delivered by Shanghai Electric Power Design Institute (SEPD) Australia, a local subsidiary of SEPD, which is in turn owned by Power Construction Corporation of China (POWERCHINA), and Australian solar PV and battery provider Sunterra.

Western Australia CIS tender opens

In other news, Western Australia’s first Capacity Investment Scheme (CIS) tender opened yesterday (22 July). The tender aims to secure 2GW of clean dispatchable capacity across the Wholesale Electricity Market (WEM).

Projects entering into the CIS Tender 2 must have a minimum storage duration of two hours, a minimum size of 30MW, and meet all eligibility criteria. The tender will close on 12 August 2024.

Salim Mazouz, branch head of the energy division at the Department of Climate Change, Energy, the Environment and Water, told Energy-Storage.news in an exclusive interview available for Premium subscribers that energy storage will be a key element of Australia’s energy transition. It is also a technology that the CIS aims to support.

“The more variable renewables we push in, the more there’s opportunity for arbitrage, for storage, and as that accelerates the retirement of thermal assets, that also potentially opens additional revenue sources in terms of some of the ancillary services that batteries and also storage more broadly can bid for.”

Japanese government selects battery aggregators for JPY9 billion subsidy scheme

It is being run alongside a scheme to also increase demand response participation from existing resources, which may also include things like air-conditioning units, onsite power generation from solar, industrial production units and battery storage systems.

The scheme is being administered through the Sustainable Open Innovation Initiative (SII), set up by the government Ministry of Energy, Technology and Industry (METI) and its Agency of Natural Resources.

SII’s other areas of focus include zero-energy buildings and homes (ZEB, ZEH), energy efficiency programmes, building decarbonisation, electrolysers, microgrids and more.

For the scheme ‘Support for the introduction of energy storage systems for home, commercial and industrial use’, the Japanese government has allocated around JPY9 billion (US$57.48 million) from the FY2023 supplementary budget.

The idea is that behind-the-meter (BTM) distributed batteries installed at homes, commercial premises and industrial facilities can be used to adjust supply and demand on the electricity grid.

This will be useful especially in managing peak demand, and also in enabling greater utilisation of renewable energy capacity. Internet of Things (IOT) devices will be placed onto distributed energy storage and demand response resources to coordinate their aggregation.

Earlier this month (2 July), a list of nine aggregators was published, and a few days later (12 July), an approved list of residential energy storage systems featuring 95 different models from 14 manufacturers was published.

Aggregators were selected either for home battery systems or C&I systems, with no companies selected to do both scales of BESS.

Up to JPY300 million per C&I project

One of the chosen C&I aggregators, Eneres Power Marketing, said on Friday (19 July) that companies could apply for subsidies towards battery storage equipment purchases and project construction costs by entering a demand response (DR) agreement with approved aggregators.

Subsidies will fund up to one-third of the capital expenditure (Capex), with up to JPY300 million available per project for C&I batteries. The majority of the total JPY9 billion funding is, however, expected to go towards residential systems, with about JPY1.5 billion for C&I.

The application period is open until 6 December, but it could close sooner in the event that funding is fully allocated.

The full list of aggregators can be found here (in Japanese).

See the residential energy storage system product list, as well as a grant calculator tool (in Japanese).

Japan, which targets renewable energy representing 36% to 38% of the electricity mix by 2030 and 50% by 2050, is seeking to promote energy storage technologies as an enabler of that goal. At the same time, electricity demand forecasts for the coming years have risen due to the expected increased adoption of AI and the growth of data centres.

The market for utility-scale BESS in Japan has opened up through policy and regulatory support, energy trading opportunities, an early-stage ancillary services market for frequency regulation, and a recent low-carbon capacity market auction for which batteries and pumped hydro energy storage (PHES) were eligible.

Italy’s Redelfi spots US BESS opportunities, US’ Bluestar Energy Capital goes in opposite direction

The pair is targeting the development of up to 2.4GW of battery energy storage system (BESS) projects in the US by the end of 2026. Five early-stage development projects totalling 920MW have already been acquired in four states: Texas, Tennessee, Alabama, and Kansas.

Redelfi is listed on the Italian Stock Exchange’s Euronext segment. In addition to developing renewable energy and storage assets, it has a business line in digital technologies for marketing and other sectors.

It acquired its five initial projects from BESS Power Corporation, a US-based developer that the Italian company founded, together with JV partner Elio and another Italian publicly listed developer, Altea Green Power. Publicly announced project activity has included the early 2023 acquisition of a 400MW project in Texas from Aelius Solar Corp.

Earlier this month, Redelio Renewables approved a US$20 million budget over the next four years for the development of those projects, while Redelfi said the sale and handover freed up BESS Power Corporation to focus on more advanced-stage projects.

Redelio is 50% owned by each of Redelfi and Elio, while the Italian partner holds 65% of BESS Power Corporation to Elio’s 30%, with the outstanding 5% stake held by an Italy-based financial consultant Paolo Siniscalco.

European potential

It’s not perhaps surprising that European players like Redelfi are seeing fertile opportunity in the US, where deployment records across the utility-scale segment are consistently surpassed on a quarterly basis.

Redelfi’s Italian home territory is also a fast-rising battery storage market, and last week, the company said it had added six development projects to its portfolio in the country, totalling 500MW.

It did this through another 50:50 JV, called Ribess, formed with fellow Italian developer InfraLab. The pair target bringing their portfolio online within three years, Redelfi said last Thursday (18 July), the day after it announced the US JV’s progress.

On a somewhat related note, US-headquartered renewable energy investment company Bluestar Energy Capital has launched a new development platform, Noveria Energy, to work on European BESS projects.

Noveria is already putting a pipeline of development projects in Germany, where the platform will initially be focused, through interconnection and permitting processes. Bluestar Energy Capital said the pipeline totals more than 2GWh of projects.

Bluestar Energy Capital (BEC), was founded in 2022, the year Redelfi listed on the Italian Euronext exchange, and to date has been working to develop projects in the US and Australia.

Germany and Italy have been identified by various analysts and industry experts as being among the two European markets likely to see the strongest growth in energy storage deployment in the medium-term.

In the recently-published 2024 edition of the Renewable Energy Country Attractiveness Index (RECAI) from Ernst & Young (EY), Germany was selected as the fifth most appealing BESS market globally, and Italy sixth.

Drivers for those markets include the Italian grid operator Terna’s intention to tender for up to 71GWh of energy storage by 2030, and German regulators opening up day-ahead and intraday electricity trading markets to BESS assets.

Enel North America CEO: ‘US BESS industry ultimately needs local manufacturing’

Romanacci previously headed up Head of Enel Green Power North America, the clean energy IPP arm, before taking his current position in December 2023. The larger group he now leads also provides demand response, e-mobility solutions and services, energy trading, advisory and consulting services.

Our interview centres around the firm’s grid-scale BESS activity in the US and his views on the major trends affecting it. Most notably, he says the industry ultimately needs local manufacturing to overcome supply chain uncertainty and that further clarity is still needed for the standalone energy storage investment tax credit (ITC).

Enel North America overview and positioning

Energy-Storage.news: Can you give us an overview of Enel North America’s operational BESS portfolio and its pipeline?

Paolo Romanacci: Enel operates 9 utility-scale BESS with another 5 under final commissioning or construction, all in ERCOT. These 14 sites represent about 1.5 GW of capacity. We have stand-alone and hybrid renewables-plus-storage projects in development in markets across the US.

How much of the BESS development and operational process do you do in-house versus contracting out? Particularly around early-stage development, project design, EPC and optimisation/route-to-market.

Enel does all early-stage BESS development and siting in-house, capitalising on our years of experience in the field. Early project design is also done in-house along with much of our market strategy, while for EPC we work with leading technology providers. Our operations and maintenance is a combination of service agreements with BESS integrators and in-house personnel.

What do you think are the biggest challenges for the US BESS developer-operator industry as a whole in the coming few years?

Years-delayed interconnection queues, along with rampant supply chain uncertainty, are hindering BESS project development. The US BESS industry is still a nascent industry with growing pains. What we ultimately need is increased domestic manufacturing to enable a fast, localised industry, but that won’t happen overnight.

In the interim, we need rules that offer greater supply chain clarity and certainty. We also need regulations that consider the flexibility and the many grid benefits BESS offers compared to conventional energies and, in return, compensate developers and operators fairly.

And what are the solutions that you at Enel are bringing to the market?

Enel’s scale enables us to navigate these headwinds and play a role in leading the BESS industry as it becomes a major component of the energy sector. Enel has tremendous in-house expertise and global relationships with leading suppliers.

We have a diversified BESS development pipeline across geographies, energy markets and plant configurations (standalone or co-located). We also possess the digital sophistication necessary to control our BESS solutions in compliance with grid rules, which improves grid reliability and the BESS unit’s performance and ultimately increases return on investment.

ERCOT, Texas market

Regarding the ERCOT market, what are the learnings you can share from being the biggest BESS operator there?

ERCOT has some of the highest BESS penetration in the world, but it’s still a young market. That means all participants are learning as we go. Developers, suppliers and grid operators are constantly sharing information and evolving. For example, we’re eager to see the outcome of ERCOT’s Real Time Co-Optimisation and Batteries program to more adequately value the unique role of BESS in the energy market.

Our experience as the largest BESS operator in ERCOT reaffirms how critical this technology is to grid operators. As we face increasing load from electrification and data centres, more frequent extreme weather events, and more renewables deployment, BESS plays a unique role in preserving reliability and affordability. When it counts, BESS steps in—Enel is frequently deploying ancillary services to stabilise the grid in periods of high demand.

Staying on ERCOT, what is your strategy to deal with market saturation which appears to be starting to happen already?

As we consider the significant projections of growth in both load and intermittent generation in ERCOT, it’s clear that there’s still a lot of room for new BESS projects. But we need non-discriminating market structures and favorable price signals for energy storage to reach the next level.

In the meantime, we manage the increasingly saturated environment by diversifying our value streams through qualifying for as many BESS-eligible markets as possible. Enel also uses our own proprietary bidding optimisation software and in-house trading desk, which offer a competitive advantage.

Augmentation, BESS providers and wider US market trends, including tax credit incentives

Augmentation is a big topic – have you started to augment BESS projects already, and what can you say about that process?

Augmentation isn’t part of our strategy at this time. However, it’s a young and evolving market, and we’re prepared to evolve with it if needed.

How do you approach choosing a BESS technology provider? It is a highly competitive and fast-moving space, with market forces and US policy measures moving prices around frequently recently. Which BESS providers have you primarily used to date?

At our scale, we don’t work with a single exclusive provider but regularly engage with many of the leading technology providers while monitoring both the regulatory and technology landscape.

The US BESS market appeared to suffer a blip in Q1 2024 – installations were down as well as revenues for most technology providers focused on the US – what would you attribute this to?

I can’t say whether these phenomena are specific to Q1 2024, but the industry is still immature and experiencing growing pains. Insufficient price signals, supply chain constraints, permitting challenges—these are things that can impact the industry’s rate of growth. At the same time, the long-term trajectory is clear: the value of BESS is undeniable and will be an increasingly crucial part of the energy mix.

Standalone storage investment tax credit (ITC): can you comment on how much you have utilised this for projects, how much of the investment it has been able to cover and whether the new guidance on the domestic content adder has given the necessary clarity to leverage it?

Young technologies need a thorough incentive structure to achieve meaningful scale. That’s certainly true with BESS. We welcome both the stand-alone investment tax credit and all ITC and PTC adders, including for domestic content, as necessary incentives to speed up the growth of storage technologies and allow more certainty for investors.

Notice 2024-41 offered a more simplified and streamlined approach to qualification; however, our sense is that there won’t be sufficient domestic content for stand-alone storage projects until more cell production is achieved in the U.S. We’ve also found that some of our suppliers prefer the previous direct-cost method that in some cases may increase the likelihood of bonus eligibility.

The Inflation Reduction Act is an enormously complex and consequential law. Enel is eager to continue leveraging IRA policies to help build a modern, low-carbon grid in the US. We welcome additional rulemaking on IRA provisions, including clarification on domestic content bonus parameters for storage co-located with wind. We are also seeking clarity from the IRS that the treatment of standalone storage, in its qualification for the ITC, would mirror the ITC requirements for storage that is coupled with wind and solar generation assets.