Ameresco and United Power will hold a ribbon-cutting ceremony for the completed projects later in July, Ameresco said in a media advisory last week (18 July). The two firms entered into the contract for the projects around a year ago, reported by Energy-Storage.news at the time.

The system integrator built four BESS arrays of 11.75MW each, and another four of 7.84MW each, at eight substations across Adams, Broomfield and Weld counties owned by United Power, a not-for-profit electric cooperative.

United Power will use the BESS to balance its load as it brings more renewables online, particularly during peak demand periods. The utility is active across Colorado’s Northern Front mountain range, and is one of around 50 smaller utilities that operate in areas not covered by the state’s two large investor-owned utilities, Xcel Energy and Black Hills Energy.

The utility was behind what was, at the time, Colorado’s largest BESS, when independent power producer (IPP) Engie deployed a 4MW/16MWh system for it using Tesla Megapacks in 2018.

Ameresco, meanwhile, is active in the US grid-scale BESS market as a system integrator across numerous projects but is also looking to move into owning its own projects, as we covered last year in a Premium piece.

Its most notable project has been a 2.1GWh order from California utility Southern California Edison (SCE), although that has been beset by delays as recently covered in another piece (also Premium access).

Sodium-ion startup Peak Energy closes Series A, targets mass production in 2027

The investment round was led by Xora Innovation, an early-stage tech venture capital (VC) arm of Singapore government-owned investment group Temasek, with participation from critical infrastructure industries investor Eclipse, strategic partner TDK Ventures and other parties.

Sodium is a much cheaper and more abundant material than lithium. Na-ion batteries are not capable of energy densities as high as lithium-ion (Li-ion) and are expected to last fewer cycles.

However, they have the potential to be low-cost if produced at scale, coupled with an expectation of a lower risk of thermal runaway.

Na-ion batteries can also use many of the same production methods as Li-ion batteries. They have been identified as a potential solution for less demanding applications, such as shorter-range electric vehicles (EVs) and stationary battery energy storage systems (BESS).

Peak Energy, led by CEO Landon Mossburg, who was formerly with the North American arm of Swedish battery startup Northvolt and Tesla Energy before that, emerged from stealth mode in October 2023, announcing the raise of US$10 million in a round led by Eclipse and participated in by TDK Ventures.

At that time the company said it wanted to offer grid-scale BESS technology at 50% lower cost than incumbent Li-ion solutions.

It will manufacture its products in the US, Peak Energy said, with a group of six customers set to be involved in the pilot programme it hopes to launch next year. While the customers were not named, they include three of the country’s biggest independent power producers (IPPs), and an electric utility, the company claimed.

It aims to open a large-scale factory in 2027 and achieve the industry’s lowest cost per kilowatt-hour by 2030.

Peak Energy not the only horse in sodium-ion race

The company will have some competition. Despite Peak Energy’s claim to be an American first, rival Natron Energy opened a manufacturing plant in Michigan, US, in April.

Once ramped, the Natron factory will have 600MW annual production capacity of patented battery technology featuring ‘Prussian Blue’ electrodes. Like Peak Energy, Natron sees data centres as a potential high-demand end market for Na-ion batteries.

In China, the country which currently leads the world for Li-ion production as well as technology development, the first 50MW/100MWh phase of the first grid-scale sodium-ion BESS project in the world went into operation earlier this year.

That project now comprises 42 BESS containers utilising 185Ah Na-ion batteries with 21 power conversion system (PCS) units and the plans are for it to be expanded to 100MW/200MWh.

Various other startups and established battery manufacturers are targeting supremacy in the sodium-ion space. Germany’s Varta in May announced it was leading an R&D consortium supported by the German government.

Peak Energy’s former employer Northvolt is also looking into the technology, two other European startups, Tiamat, and Altris, raised funding in January, while the world’s biggest battery manufacturer, CATL, again based in China, is also developing Na-ion batteries and a gigawatt-hour scale factory was opened in the Asian powerhouse by state-owned power company China Three Gorges Corporation late last year.

UK’s Harmony Energy to build France’s largest BESS

The project site was previously occupied by the Cheviré oil, coal and gas power station which operated until 1986. Retired legacy power plants make ideal locations for clean energy projects thanks to their existing grid infrastructure.

Harmony Energy COO for France Clément Girard said: “It’s an exciting location given the historical importance of the fossil fuel coal power station, but looking ahead, the delivery of the Cheviré BESS will transform the site into exactly the opposite, facilitating the green electrification of the French energy system, whilst offsetting several hundred thousand tonnes of CO2.”

The firm didn’t give an expected commercial operation date (COD) for the French project.

Harmony Energy is a developer and investment advisor to the Harmony Energy Income Trust (HEIT), a UK-listed fund which owns and operates BESS projects in the UK/GB market, including the two largest operational units in Europe, sized similarly to the Cheviré project. Harmony Energy is a separate entity that develops projects which can be sold to HEIT or to other owner-operators, and its team manages HEIT.

Like other UK BESS owner-operators, it has sought to diversify internationally as revenues on home soil plummet. In February, Harmony Energy chief investment officer Paul Mason told an audience at Solar Media’s Energy Storage Summit 2024 in London that it had a ready-to-build portfolio in France, Germany and Poland. Its Poland head discussed that market with us a year ago although it has yet to announce major projects there.

The market outlook in the UK has become so negative – rightly or wrongly – that HEIT said it was considering selling its portfolio entirely.

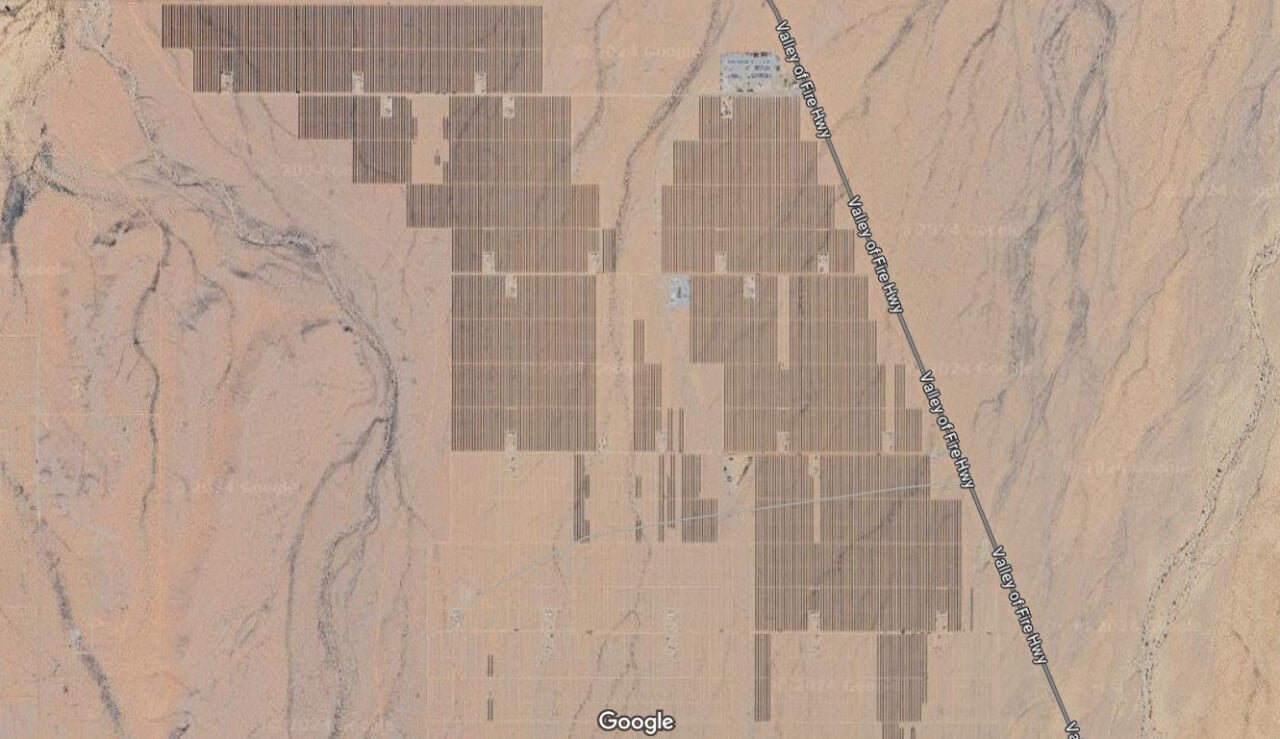

‘US’ largest’ solar-plus-storage project, Gemini, comes online in Nevada

It was developed and built by investor Quinbrook Infrastructure Partners and independent power producer (IPP) Primergy Solar, which sold a 49% stake in the project to Dutch pension fund manager APG in late 2022.

Primergy reported that same year that lithium-ion battery and BESS manufacturer CATL would provide its technology for the BESS portion of the whole project, while system integrator IHI Terrasun put the project together.

“Gemini creates a blueprint for holistic and innovative clean energy development at mega scale, and we are proud to have brought this milestone project to life and to have delivered so many positive impacts across job creation, environmental stewardship, and local community engagement,” said David Scaysbrook, co-founder and managing partner of Quinbrook.

Primergy said that as part of the project it implemented an ‘unprecedented’ framework for ecosystem management, including leaving vegetation in place, matching the solar’s installation with the ground’s natural contours and reducing land footprint by 20%.

‘Largest solar-plus-storage project in the US’

Quinbrook and Primergy claimed the Gemini is the ‘largest co-located solar plus BESS project in the US’.

That claim may be contested by IPP Terra-Gen which reached full completion on its 875MWdc solar PV and 3,287MWh BESS Edwards & Sanborn solar-plus-storage project in California, at the start of this year.

Gemini could be making the claim based on the DC (direct current) size of the solar PV portion, or that it was brought online in a single phases whereas Edwards & Sanborn was brought online in multiple phases. It could also be claiming to be the largest DC-coupled solar-plus-storage project, a difference explained in the next section.

Primergy also said its US$1.9 billion financing for Gemini back in 2022 was the largest financing of its kind.

Energy-Storage.news has asked Primergy and Quinbrook to comment and will update this article if and when a response is received.

DC-coupled architecture

The solar and BESS at Gemini are DC-coupled, which the companies said allows the BESS to charge directly from the solar and increases the efficiency and capture and storage of the solar energy. That is because the solar energy does not need to pass through a DC-AC inverter, which involves some loss of energy, to go from the solar to the BESS.

However, DC-coupling is a less flexible configuration for a solar and storage project and can result in the BESS being unable to charge from the grid. Generally, projects in the US were DC-coupled in this way as co-located BESS could not charge from the grid to qualify for investment tax credit incentives (ITCs).

However, the ITC for standalone energy storage under the Inflation Reduction Act (IRA) changed this and ended the need for such solar-charging only projects, projects which a lawyer at the time of the IRA’s passing in August 2022 described as ‘dumb’. DC-coupling has generally only been used to capture specific subsidies or incentives, with AC-coupling – generation and storage sitting independently behind a DC-AC inverter – opted for in most other market-driven use cases.

Edwards & Sanborn’s grid connection of 1.3GW – higher than its solar PV – implies it is AC coupled, meaning the solar and BESS can discharge to the grid independently of each other.

Tesla signs 15.3GWh Megapack BESS supply deal with US developer

The deal was announced in a short social media post by Tesla, which famously doesn’t engage with the press. It was also separately announced in a little more detail by the customer in a press release.

The systems will be deployed at Intersect Power solar-plus-storage projects in the US. To date, the company’s projects have concentrated in California and Texas, the country’s two leading energy storage markets by state.

The agreement builds on an existing relationship between the pair, with Intersect Power having already ordered 2.4GWh of systems from Tesla to date, for projects already in operation or currently under construction.

That represents what Intersect Power called its Base Portfolio, through which it developed 2.2GWdc of solar PV alongside the BESS assets, financed in 2021 through a variety of structures with big-name financiers including Morgan Stanley and Deutsche Bank.

Energy-Storage.news reported yesterday (18 July) that the developer has raised a further US$837 million for three 160MW/320MWh Texas BESS projects, all set to comprise Megapacks. Two of those will be optimised by Tesla’s Autobidder software platform.

The biggest Intersect project brought online to date with Tesla battery hardware appears to be Oberon, a California solar-plus-storage project featuring 679MWp of solar PV and 250MW/1000MWh of battery storage. It went into commercial operation in late 2023.

Size of deal exceeds Tesla’s 2023 storage shipments

To give an idea of scale for the latest deal, Tesla’s full-year energy storage shipments for 2023 totalled 14.7GWh. The company’s Megapack factory in Lathrop, California, is scheduled to ramp up to 40GWh annual production capacity by the end of 2024, according to the company in its Q1 2024 results announcement.

More than half of the 15.3GWh order will be utilised across four projects in California and Texas which are expected to be in operation by the end of 2027, according to Intersect Power.

The current iteration of the Megapack features up to 3.9MWh energy storage capacity, as listed on Tesla’s site, a little short of the increasing trend for manufacturers to pack as much as 5MWh or even more into a 20-foot ISO standard containerised format.

Megapack does, however, come integrated with Tesla’s power conversion system (PCS) hardware. with Tesla Energy senior director Mike Snyder talking up the “plug-and-play” capabilities the company’s vertical integration enables.

ROUNDUP: UK BESS and pumped hydro projects in planning and progress

The 200MW/400MWh, 2-hour duration Harker project was granted “full planning permission for the construction and installation” for the system and “boundary dancing, access track, landscaping and other associated infrastructure” by local authority Cumberland Council yesterday (18 July), having been granted partial approvals last month.

The project, a joint development between Canadian Solar subsidiary Recurrent Energy and Northeast England-headquartered developer Windel Energy, will now be able to begin construction, although this is not expected to be until Q4 2029 unless an accelerated grid connection date is agreed. Located between the villages of Todhills and West Linton near Carlisle, the project will connect to the Harker National Grid substation via an underground 400KV cable.

Under the approvals, the developers have agreed to several conditions, including the use of specific paving materials, limiting construction to between 7:30am and 6pm on weekdays, the use of lighting design that does not disturb local bat populations, and strict noise mitigation measures.

In May, Recurrent Energy successfully landed a €1.3 billion (£1.1 billion) multi-currency revolving credit facility from ten major banks, to finance projects in the UK and across the EU.

By Kit Million Ross.

Ethical Power and Varco Energy build on development partnership

Ethical Power has partnered with Varco Energy to deliver an almost 50MW battery energy storage system (BESS) project in Cornwall, South West England.

Varco Energy’s 47.5MW Sambar Power BESS project, located near Newquay, Cornwall, is expected to come online by Q2 2025. Energy storage asset owner and operator Ethical Power will provide Balance of Plant (BoP) work to install BESS equipment on the site, which Varco Energy announced last week will be provided by GE Vernova. GE Vernova will provide its FLEXIQ Controls, FLEXINVERTER central inverters and Battery DC-Blocks products for the development.

A digital render of one of GE Vernova’s FLEXINVERTER systems, which it will supply for the Sambar project. Image: GE Vernova.

Ethical Power will also undertake the electrical, mechanical and civil infrastructure required for connection to the National Grid transmission network.

This is not the first time that Ethical Power and Varco have partnered for UK BESS projects, having previously collaborated on the Native River project near Liverpool and the Sizing John Project south of St Helens, each of which has a 57MW capacity.

By Kit Million Ross.

RES Group submits proposal for 49.9MW Scotland BESS

RES has submitted planning permission for the Corshellach energy storage proposal to Moray Council in Scotland.

If approved, the proposed 49.9MW BESS project will be situated on land adjacent to Berryburn substation near Dunphail. RES noted that this places it near existing transmission infrastructure, which minimises the need for additional construction. The proposal is expected to go before Moray Council’s Planning Committee in the next few months; if approved, it will take around a year to construct.

Environmental concerns sit at the heart of this planning application, with RES expressing how the Corshellach Energy Storage System had been designed to fit sensitively into the landscape, following multiple surveys and assessments surrounding environment, landscape, heritage and the welfare of local residents.

Milo Amsbury-Savage, development project manager for RES, remarked upon how the community consultation process impacted the final proposal, commenting: “We’ve taken time throughout the project’s development to listen to people’s feedback in order to improve the project; for example, using the same delivery route as Berryburn Wind Farm construction to avoid the narrow Divie Viaduct. Everyone who took the time to provide feedback following our community consultation exhibitions was either supportive or neutral towards the project, with many approving of the choice of location.”

By Kit Million Ross.

Planning application submitted for 1.5GW pumped hydro project

Scottish energy storage developer ILI Group revealed on 11 July that it has lodged a Section 36 planning application with the Scottish government for a 1.5GW pumped hydro energy storage (PHES) project.

Dubbed Balliemeanoch, the project aims to provide a flexible and renewable energy resource and bolster the grid’s stability, particularly as Britain increases the amount of variable energy entering the system. It will be located at Argyll and Bute and will be able to supply 45GWh of power, making it one of the largest PHES projects in Europe.

With a planned connection date of 2031, Balliemeanoch PSH is well-positioned to contribute to the UK’s long-term energy strategy.

Plans for the project first appeared in February 2022, with Solar Power Portal having previously reported that it could provide 1.5GW of power for up to 30 hours.

The Balliemeanoch project will create a new ‘head pond’ in the hills above Loch Awe. When full, it will hold 58 million cubic meters of water.

ILI Group has engaged AECOM, an infrastructure consulting firm, as technical consultants for the Balliemeanoch PHES project. AECOM’s expertise in large-scale infrastructure projects has been “instrumental in developing the detailed plans for this ambitious scheme”, ILI said.

ILI Group’s project is not the only recent development in the PHES space in recent weeks. On 9 July, Solar Power Portal reported that Drax had appointed global technology and engineering firm Voith Hydro to move its plans forward for its proposed 600MW underground project called Hollow Mountain.

By George Heynes.

To read the above stories in full, and much more from the UK and Ireland solar PV and energy storage sectors, visit Solar Power Portal.

The UK Battery Storage Project Database, produced by our in-house team at Solar Media Market Research, tracks over 1,350 project sites across all stages of development and onto fully operational assets including a full audit-trail of each site.

EDP Renewables North America completes California solar-plus-storage project

EDPR NA added that it is “actively exploring” the possibility of incorporating agrivoltaics – the practice of using land for the dual purposes of solar generation and farming – at the site, particularly looking at sheep grazing.

The developer – a subsidiary of Portuguese utility EDP Renewables – is currently engaged in a module supply deal with US cadmium telluride (CdTe) thin-film module manufacturer First Solar, signed in April 2023. The 1.8GW deal was expected to support EDPR NA’s US solar projects through 2026.

“California remains a priority state for EDPR NA’s development efforts, and we are pleased to finalise this significant solar-plus-storage project in The Golden State,” said Sandhya Ganapathy, CEO of EDP Renewables North America. “Scarlet I will be a benchmark project as we look to develop additional hybrid multi-technology renewable projects across our portfolio and contribute further to grid resiliency.”

According to data from a PV Tech Premium report earlier this year, Fresno County has the longest interconnection queue for renewable energy of any county in the US. As a whole, California has around 440GW of capacity in its interconnection queue, more than half of which is energy storage.

EDPR NA already has 248MW of operating renewable energy assets in California, notably the Lone Valley PV project in San Bernadino County.

To read the full version of this story, visit PV Tech.

Hydrostor proposes 500MW long-duration A-CAES facility for second Ontario IESO procurement

As well as a general update, Azis informed town officials of Hydrostor’s intentions to submit the project to the Ontario Independent Electricity System Operator’s (IESO’s) Long-Term 2 (LT2) RFP which is expected to launch later this year.

Hydrostor A-CAES patented technology

Hydrostor’s patented A-CAES technology, which Energy-Storage.News recently discussed with company president Jon Norman, uses excess grid electricity to produce heated compressed air. The heat produced during the process is stored above ground and the cool compressed air is forced underground pushing water stored in a cavern into an above-ground reservoir, storing potential energy in the form of compressed air and heat.

When required, the process can be reversed, discharging electricity back onto the grid.

Ontario 500MW/8,000MWh long-duration storage facility

The Quinte ESC long-duration storage facility is a proposed 500MW/8,000MWh project utilising Hydrostor’s A-CAES technology located in Galts Corner, Greater Napanee adjacent to Ontario Power Generation’s Lennox Generating Station.

Hydrostor is partnering with the Mohawks of the Bay of Quinte on the development of the project and has executed a Memorandum of Understanding (MOU) with the First Nations community.

The long-duration storage specialist has also secured the project site, completed an interconnection feasibility analysis study and carried out an environmental critical issue analysis study.

Interconnection to the IESO grid will be via the nearby Lennox transformer station or adjacent 230kV circuits.

Inaccurate communication

At the 25 June meeting, Azis explained that during recent initial surface-level geology studies, on-site technicians had incorrectly told neighbours of potential water scarcity linked to the project’s development. Azis stated that Hydrostor had since been in contact with these neighbours and that it isn’t possible to comment on the impact on local water supply before a hydrology study has been carried out.

Azis stressed to Greater Nappanee officials that Hydrostor is not only testing the area to ensure suitability for its technology, but to also find a site with minimal impact on the surrounding area.

If initial testing looks favourable for the project location, Azis said that Hydrostor would return to the council requesting its support for the project in the form of a Municipal Support Resolution (MSR), as mandated by the Government of Ontario for new build energy projects.

2GW Ontario storage procurement

Following the province’s largest ever energy storage procurement, the IESO is launching a second procurement (LT2 RFP) which the system operator will split into three different streams to secure capacity and energy into the 2030s and beyond.

After receiving feedback on its previous LT1 procurement, the IESO decided to create two separate streams for capacity resources: one targeting regular battery storage facilities and a second aimed at longer duration resources.

Hydrostor plans to submit its Quinte facility into the long lead time resource procurement stream where the IESO is seeking 500MW-1,00MW of capacity from new non-emitting resources expected to be in-service by 2034/35 for a period of 40 years.

Under a second capacity stream, the IESO is seeking another 500MW-1,000MW of capacity from non-emitting resources expected to be in-service by 2031 for a shorter 20 years.

The IESO is also seeking 2GW from non-emitting energy producing resources (such as solar and wind) expected to be online before 2030 under a third and final stream.

The final RFPs for each stream are expected to be released in the fourth quarter of 2024 with developers needing to submit their proposals by the third quarter of next year. The IESO expects to issue contracts for the LT2 RFP during the first quarter of 2026.

Further information on the procurement can be found on the IESO website.

5GW pipeline

Hydrostor claims to have a 5GW development portfolio which includes its 500MW/4,000MWh Willow Rock A-CAES facility in Kern County, California which secured its first offtake agreement last year, as reported in Energy-Storage.News.

After completing more favourable geological investigations outside of Hydrostor’s application with the California Energy Commission (CEC) for the Willow Rock project site, the developer submitted a supplemental application with the California regulator in March of this year.

Hydrostor has also secured an interconnection agreement for the project with Southern California Edison (SCE) and CAISO (queue no. 1782).

The company’s 200MW, 8-hour (1,600MWh) Silver City project in Broken Hill, New South Wales (NSW), Australia, appears to be moving towards construction after a binding agreement was signed with mining firm Perilya in Q3 last year to leverage the latter’s existing mining assets to support the project.

This followed the Silver City project being chosen in 2022 by transmission operator Transgrid to provide backup to the local grid. A 250MWh portion of the facility’s stored energy would be played into the Australian National Electricity Market (NEM), helping the otherwise capacity-constrained local network integrate a higher share of renewable energy.

Trisha Doyle, local MP for the Blue Mountains constituency of NSW talked up the project and its potential to firm up renewable energy capacity in the region, in a speech at Solar Media’s Energy Storage Summit Australia in May.

In a January 2022 interview with Energy-Storage.news, Hydrostor CEO Curtis VanWalleghem explained that after the company’s first megawatt-scale demonstration project went online in 2019, it was decided that in addition to providing the technology to third parties, Hydrostor would be best placed to kick off development of its own projects.

Additional reporting by Andy Colthorpe.

Intersect Power closes US$837 million financing for ‘portfolio-balancing’ Texas battery projects

Designed to add fleet-level flexibility to the developer’s 1.2GWp of operational solar PV capacity in Texas, they all qualify for investment tax credit (ITC) incentives which were opened up to standalone battery storage projects under the Inflation Reduction Act (IRA).

Intersect Power said the transactions cover portfolio-level construction debt, tax equity and term debt financing. Morgan Stanley will provide tax equity financing, while construction debt and term debt financing will come from funds and accounts managed by New York-headquartered HPS Investment Partners.

Additionally, Deutsche Bank is partnering with HPS in the construction debt facility and also providing operational letters of credit for the three projects.

“These standalone batteries are much-needed infrastructure that will increase grid reliability and improve energy security as the US transitions to a low-carbon economy,” Morgan Stanley managing director and renewable energy investment head Jorge Iragorri said.

Intersect CEO: ‘Projects enable more consistent financial performance’

Previously, Morgan Stanley and HPS Investment Partners were among the financiers participating as Intersect Power raised US$2.6 billion across eight transactions, as reported by sister site PV Tech in November 2021.

This was for a six-project portfolio of solar PV and energy storage projects: three in California and the same three Texas projects that were subject to the latest financing, totalling 2.2GWdc of PV and 1.4GWh of energy storage.

At that time, Intersect CEO Sheldon Kimber claimed that the financing structures put in place around the company’s portfolio were preferable to “today’s long-term contract structures,” which the CEO claimed “destroy value”.

The combination of different kinds of finance, such as construction financing, tax equity, land financing and portfolio-level term debt, allowed Intersect to seek “more valuable offtake structures,” Kimber said three years ago.

Speaking yesterday, the Intersect Power chief executive said that the three Texas BESS assets, “should allow us to provide more consistent financial performance from a diversified fleet of renewable generation and storage, benefiting from increasing market volatility and periods of high prices while protecting us from periods of low market prices.”

86 Tesla Megapacks at each site

The Texas projects, named Lumina I, Lumina II and Radian, will utilise Tesla Megapack BESS solutions, with each comprising 86 Megapack units. Two of them, Lumina II and Radian, will be operated in the market using Tesla’s Autobidder optimisation and trading platform.

At the beginning of 2023, Intersect Power announced that its Athos III solar-plus-storage project in Riverside County, California, had been brought online shortly before the end of the previous year.

Athos III was one of the other projects financed with that earlier US$2.6 billion set of transactions, and featured 112MW/448MWh battery storage and 224MWac/310MWp solar PV.

Around the same time its start of commercial operations at Athos III was announced, the company also brought online the 828MWp/640MWac Lumina PV project in Texas, from which Renewable Energy Credits (RECs) are being sold to two undisclosed Fortune 100 companies.

rPlus Energies raises over US$1 billion for Utah solar project with 1,600MWh battery storage

The company obtained the construction debt financing for its project subsidiary from five financial institutions, including Crédit Agricole Corporate and Investment Bank, KeyBanc Capital Markets, MUFG Bank, Truist Securities and Wells Fargo Securities.

Luigi Resta, president and CEO of rPlus Energies, said that the Green River Energy Centre was rPlus Energies’ debut as an independent power producer (IPP).

The company described the Green River Energy Centre as one of the largest planned solar-plus-storage facilities in Utah. Engineering, procurement, and construction (EPC) services of the project will be provided by Sundt Renewables.

In March 2024, rPlus Energies announced that it had amended the PPA with PacifiCorp, quadrupling the storage capacity from 400MWh to 1,600MWh. Green River Energy Centre is the seventh largest solar-plus-storage project under development in the US, according to trade body American Clean Power Association (ACP) figures cited by rPlus Energies.

To read the full version of this story, visit PV Tech.