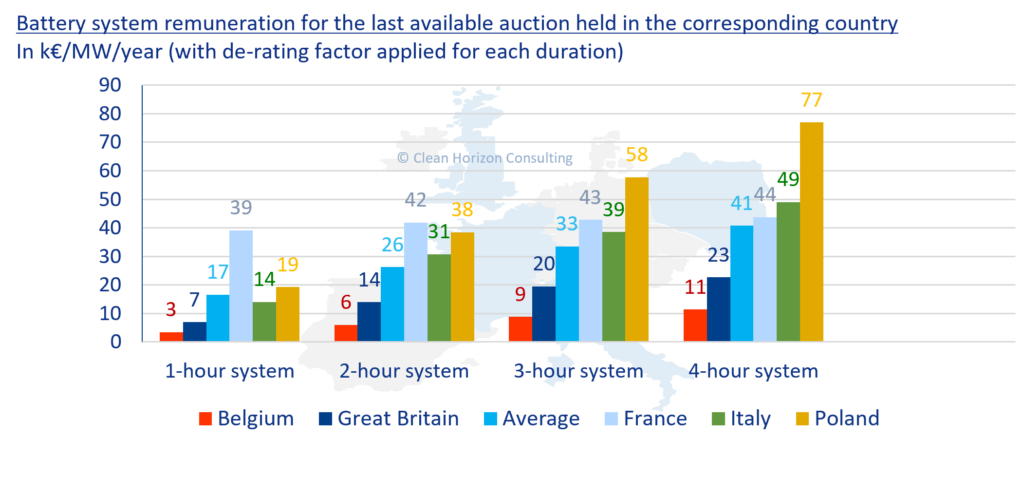

Available payment for a storage system under several capacity markets. Image: Clean Horizon

Energy networks in Europe are united in their common need for energy storage to enable decarbonisation of the system while maintaining integrity and reliability of supply. What that looks like from a market perspective is evolving, write Naim El Chami and Vitor Gialdi Carvalho, of Clean Horizon.

This is an extract of a feature which appeared in Vol.34 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

New opportunities emerge to offer stable revenues as the need for storage in Europe is rampant

As markets in Europe gain in complexity and require extensive trading measures, some opportunities such as capacity auctions and storage-related tenders help ensure a “stable” revenue that supports financing decisions and mitigates market risks.

Capacity mechanisms help solve the missing money problem for generating assets while pushing towards energy decarbonisation

In order to support their decarbonisation efforts while maintaining adequate capacity thresholds to ensure power system security, diverse countries such as Italy, the United Kingdom and Poland (among many others) have created capacity mechanisms.

As most of the revenues for large generating assets operating in a liberalised market come from wholesale energy markets (often led under the pay-as-clear mechanism), expensive thermal peakersare progressively being pushed out of the selection thresholds. As such, these assets risk going out of business due to the lack of sufficient revenues, jeopardising system security.

That is why capacity markets aim to solve this ‘missing money’ problem by providing revenues to new and existing generating capacity without interfering with the wholesale markets by ensuring:• An additional revenue stream to wholesale revenues via a capacity payment (TSOs are not allowed to interfere with the energy markets)• Visibility through long-term contracts for investors.

Among others, the Polish and Italian markets have been gaining remarkable interest from storage developers as they offer long-term capacity contracts for hefty annual payments, which eventuallysupports final investment decisions in their project.

Renewable-plus-storage auctions as a means to accelerate the energy transition

Germany’s ‘Innovation Auctions’

In 2021, Germany’s Federal Network Agency (Bundesnetzagentur) launched Innovation Tenders that provide developers with fixed premiums on energy injected onto the grid for a period of 20 years to encourage renewable-plus-storage deployment throughout the country. This tender is set to occur on an annual basis with an expected procurement of 5,450MW of total capacity by 2028.

Under this process, battery storage systems must be charged from the renewable asset and need to havethe ability to provide aFRR (automatic Frequency Restoration Reserve) services (with no obligation to participate in aFRR).

Spanish Innovative Hybrid Tender for renewable-plus-storage projects

Eligible energy storage systems must be larger than 1MW or 1MWh with a minimum discharge duration of 2 hours. The storage-to-plant capacity ratio (in MW) must be larger than 40% and smaller than 100%. Selected entities will benefit from grants of up to €15 million per project and €37.5 million per company. The grant value will be assessed based on the company size, location and a series of evaluation criteria.

Volumes of Germany Innovation Tender auctions out to 2028. Image: Clean Horizon

As energy storage systems become less expensive and competition grows, trading strategies gain in complexity

Until recently, energy storage systems in Europe relied on “traditional” revenues that were mostly reliant on frequency control services such as the Frequency Containment Reserve (FCR) in countries like France or Germany.

In some cases, arbitrage revenues were also considered as an additional revenue – even though their impact on project profitability has been somewhat limited over the past few years, especially before the start of the Russo-Ukrainian War and the tensions that hit the energy markets.

However, the ever-growing competition among market players has pushed towards more complex trading strategies that aim to capture a maximum of revenues – both existing and new.

The secondary reserve market: a new opportunity to storage systems

Frequency control reserves are crucial in order to maintain system stability by countering frequency drifts then restoring it to normal levels. Among these services is the automatic Frequency Restoration Reserve(aFRR), which has witnessed an overhaul over the past few years under the ENTSOE’s PICASSO (Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation) project.

Across Europe, 26 states have already expressed their interest in joining the PICASSO platform with each having its own timeline, presented in the image below. What follows is a look at the opening of the secondary reserve market in Europe, taking Germany’s example as a reference.

Map of the PICASSO implementation timelines. Image: Clean Horizon.

The aFRR provisioning is remunerated via two market mechanisms:• Capacity reservation bids to reserve assets. Capacity reservation is not symmetrical,meaning that two bids are possible for an energy storage system:

1. aFRR UP (or positive): to help counter an under-frequency event

2. aFRR DOWN (or negative): to help counter an over-frequency event• Energy activation (UP and DOWN) bids in real time to remunerate the energy injected or withdrawn from the grid by the energy storage system.

On the national level, every prequalified asset can place a capacity bid (in € per MW per 4 hours) for up to six four-hour slots and for the UP, DOWN or both directions. This asset may or may not get “reserved” based on the local transmission system operator’s (TSO) specific selection process (pay-as-bid in this case).

On a supra-national level, reserved assets can be activated via the PICASSO platform over a pay-as-clear process that is based on activation prices that each bidding asset placed simultaneously with the capacity bid.

Average aFRR reservation price. Image: Clean Horizon.

The figure to the left shows the rolling average over seven days for the aFRR PICASSO historic prices since May 2022 when the PICASSO platform was launched. As the prices have a 4-second step, the 7-day rolling average is the method to show trends in both markets.

Relying on a high-level approach, the average activation price over 15-minute timeslots can help assess the average daily spread. As such, Since the launch of the PICASSO platform on May 1st 2022, theaverage German daily spread on a 1-hour basis is €760/MWh. Assuming a BESS does one cycle per day over a year, it can generate a revenue of €235,000/MW aFRR so a revenue of €115k/MW installed/year assuming an efficiency of 85%.

This is an extract of a feature which appeared in Vol.34 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Cover image: A recently-completed solar-plus-storage project in Saxony, Germany, the subject of a winning bid in an Innovation Tender. Leipziger Stadtwerke.

About the Authors

Naim El Chami is Training Manager and Senior Energy Storage & Hydrogen Analyst at Clean Horizon. His main expertise covers market and regulatory analyses, techno-economical and financial assessment of energy storage and hydrogen systems as well as the management of GWh-scale procurements.

Vitor Gialdi Carvalho is an optimisation support and market analyst at Clean Horizon. He has participated in the sizing of energy storage projects in various regions including Africa, Europe, and the Middle East. Clean Horizon offers a wide variety of services spanning from market & regulatory analysis to technical consulting and project procurement.

Continue reading