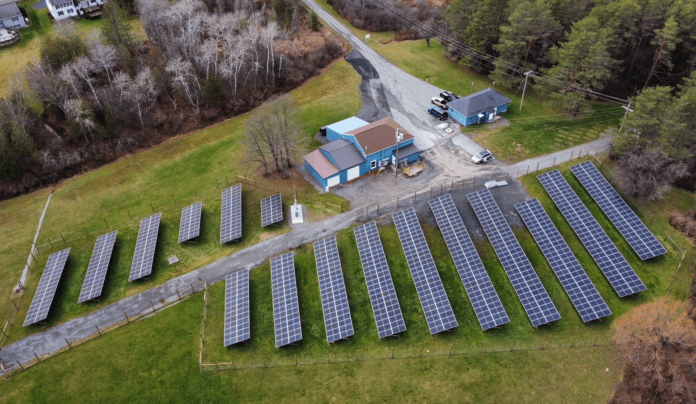

Burns & McDonnell believes workforce shortages will be a big challenge for the industry. Image: Burns & McDonnell.

US-headquartered construction firm Burns & McDonnell supplies answers to the first in our series of Q&A blogs looking back at 2022 and looking ahead to this year in energy storage.

Burns & McDonnell has worked on over 40,000MWh of battery storage projects including the world’s largest at Moss Landing in California, and has a team experienced with a diverse range of other energy storage technologies.

We asked the company for its views at the start of last year too, and various members of its technical, executive, and business development teams contributed views and predictions for the future. You can read that entry from last year here, but to offer the briefest of recaps, senior VP of renewables Doug Riedel said that in 2021, energy storage engineering, procurement and construction (EPC) projects Burns & McDonnell worked on grew significantly in size from previous years and forecast that trend to continue.

Process technology director Tisha Scroggin-Wicker said interest in long-duration energy storage (LDES) would increase in 2022 – and it did – even though in most regions of the world, the market design to attract investment in these technologies would still not be present, which Scroggin-Wicker also predicted correctly.

Meanwhile, energy storage director Chris Ruckman and storage EPC director Matt Domeier predicted supply chain issues would persist and costs, largely tied to logistics as well as soaring materials prices, would increase.

So how did the company see the industry in 2022 and what does its clean energy team think we might see in 2023?

What did 2022 mean for your energy storage business, and how did it compare with the year before that?

In 2020 the market dealt with COVID-19 impacts, and in 2021 we saw a lot of supply chain issues. In 2022, it became the year of inflation and how to deal with it. The past few years have taught us to be flexible and incorporate variables into the way we execute projects. The market has forced us to refresh pricing frequently and keep a pulse on the market to help our clients navigate the uncertainty and market fluctuations.

Matt Domeier, energy storage EPC

The projects we’re building are also getting bigger. We’re in the middle of construction on a 350MW battery storage facility and are starting to see many more mega-scale battery energy storage facilities being deployed. Utility-scale battery storage projects are projected to grow 4x by 2026. At Burns & McDonnell we’ve seen continued growth both in the industry and internally.

Chris Ruckman, VP of energy storage

In 2022, we also saw an uptick in interest in long-duration storage technologies. With the increase in pricing of lithium and incentives from the Inflation Reduction Act (IRA), we’re seeing more interest in alternative storage technologies and we expect to see a lot more opportunities being looked at in 2023 as grant applications are submitted and approved.

Tisha Scroggin-Wicker, process technology director

In a year in which we saw the passing of a monumental piece of legislation in the IRA it is almost hard to compare it to [the] previous year. I think we will talk about before and after the passing of IRA for decades to come.

Adam Bernardi, renewables EPC sales and strategy lead

To support the energy storage industry here in the US, the market has shifted further upstream in the total value chain. Industry in the US is transitioning to produce more of the critical minerals and derivative chemicals that support the manufacturing of the batteries, which is important for the energy security of the country.

Kevin Syphard, chemicals director

What were some of the biggest gains and steps forward made by the industry, including your company, during the last 12 months?

We think the IRA will prove to be one of the biggest steps forward the industry has seen in many years. We’ve been working with clients that have projects in-flight to help them figure out how to apply the tax credits and other incentives unlocked by the IRA. Helping them explore and understand the difference between investment tax credits and production tax credits for solar has only been one aspect of the process. The ability to take advantage of direct-pay and opportunities to sell tax credits is also creating a market allowing a range of players to leverage these incentives.

This is exactly what we need as an industry to build the amount of storage we’ll need to successfully navigate the energy transition and meet decarbonisation goals, while providing reliable power.

Lastly, but I think most importantly, we’re seeing the fruits of our labour in California and the storage market is being validated. As the world’s largest concentration of grid-connected lithium-ion batteries, this storage system helped CAISO avoid grid blackouts during the extreme heat wave last summer.

Chris Ruckman, VP of energy storage

Battery OEMS have increased their offering by also providing containers and in some cases the full system. This will continue to squeeze the integrator’s role in the market. The rate of change and the increase in new solutions and technologies coming to market is also telling of forecasted adoption and growth.

Jason Barmann, energy storage technology manager

The industry faced some well-documented challenges during the year, with the highest profile being supply chain constraints. How have those challenges affected the industry and how should they be confronted?

With the demands and IRA incentives spurring more projects, we’re also forecasting that labour availability will be a huge theme. There are huge battery, EV, chip, and solar module factories being planned and all will compete for the same labour pool we use for solar and storage construction.

Matt Domeier, energy storage EPC director

The resurgence in onshoring is going to put the squeeze on labour. This squeeze will then result in higher wages and benefits packages. This should be thought of as a market issue and not a project issue, meaning if we only do what is in the best interest of the project and pay a dollar more than the next guy, that cycle could spin out of control and support more inflation, not less. We need to remember that the same labour that is going to build these energy storage projects are also going to be used to build the factories that will supply US made batteries.

Adam Bernardi, renewables EPC sales and strategy lead

The market continues to grow at an ‘unprecedented rate’, which brings new challenges as well as opportunities. Image: Burns & McDonnell.

Which technology and industry trends would you recommend our readers keep a close eye on in 2023?

We see lots of opportunities for the advancements of control systems. The BESS market is still relatively new, and a lot of systems installed earlier in the market cycle as well as some going in today, don’t have the same level of sophistication that traditional industrial systems have. We see an opportunity to move the market from these “home-made systems” to more sophisticated, reliable systems.

Another interesting thing to keep an eye on is the advancements of battery technology. Instead of repurposing EV batteries we’re seeing some companies looking to develop batteries with characteristics specifically manufactured for standalone storage markets. We’re at a point where the industry is large enough and there’s enough investment in it that we start optimising production of batteries specifically for standalone storage.

Jason Barmann, energy storage technology manager

As the energy storage market continues to grow at an unprecedented rate, so will the volume of lithium-ion batteries at the end of their lives. We need to immediately start considering what to do when those times come.

Bailey Semeniuk, energy storage engineering and development manager

Historically the production of lithium carbonate and lithium hydroxide has been in China, South America, and Australia, but everyone is watching the critical minerals and associated chemical derivatives market here in North America find its legs.

But close behind is the need to advance the technologies to recycle batteries and create a circularity in the energy storage market.

Kevin Syphard, chemicals manager

What are the biggest priorities for your company, and for the wider industry, in 2023 and beyond?

Reliability. Improving performance and flexibility for both lithium and non-lithium solutions.

Jason Barmann, energy storage technology manager

We’re constantly learning in this new, rapidly growing industry. Learning how to deploy and finding out which solution will be best for the use-case. What’s that next-gen technology?

Tisha Scroggin-Wicker, process technology director

Flexibility. Being able to pivot quickly on technologies, execution strategies, and navigating the IRA.

Adam Bernardi, renewables EPC sales and strategy lead

Seeing larger scale projects moving forward into bid-phases, that we hadn’t traditionally seen moving forward in the US.

Chris Ruckman, VP of energy storage

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 28-29 March 2023 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.

Continue reading