The signing ceremony took place in front of attendees and media at RE+ 2022 in Anaheim, California. Image: Andy Colthorpe / Solar Media

FlexGen has signed a multi-year supply deal with CATL that the energy storage company’s CEO said puts it ahead of the queue in a crunch time for battery supply.

Kelcy Pegler spoke exclusively to Energy-Storage.news immediately after signing the 10GWh, three-year deal with the Chinese battery manufacturer, live at the RE+ 2022 tradeshow in Anaheim, California.

Throughout the show, supply chain constraints for battery storage have been a constant topic of discussion among the 20,000 attendees.

While the sector has long benefited from the scale and cost reductions coming from mass production of electric vehicles (EVs), demand from the EV market has now grown so much that it is eating up nearly all available supply, leaving little to none left for battery energy storage systems (BESS).

“The market has become clear that there will be haves and have nots of battery supply, and we’ve really made it our intention to make sure that our customers will be in the have column,” Pegler said.

“This capacity agreement ensures that our customers’ projects will have batteries on time and will lead to successful projects.”

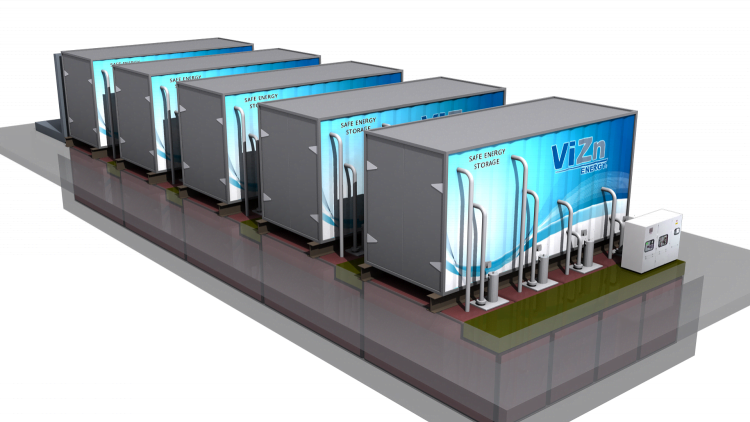

FlexGen’s Master Supply Agreement covers the delivery of CATL’s containerised liquid-cooled battery system, EnerC, which the energy storage integrator and software specialist will use for customer projects in the US.

EnerC is claimed to have an energy density of up to 259.7kWh per square metre and is targeted for multi-megawatt-hour applications, with an expected 20-year system lifetime.

Model of CATL’s EnerC system at the RE+ tradeshow. Image: Andy Colthorpe / Solar Media.

CATL is one of the world’s biggest battery manufacturers, and crucially has also pursued a strategy of building up dedicated manufacturing capacity to serve the BESS market, which FlexGen’s Kelcy Pegler said was “at the forefront of our attraction to this partnership”.

Also key was CATL’s reputation and bankability as a Tier 1 supplier, Pegler said.

CATL’s hardware will be integrated with FlexGen’s Hybrid OS energy management system (EMS) software platform to create turnkey BESS solutions for utilities, merchant electricity markets and cooperative and municipal energy suppliers.

FlexGen’s current projects include integration work at a 2.15GWh, three-project BESS portfolio clean energy company Ameresco is building for utility Southern California Edison (SCE). In August it announced that it will provide software and battery storage systems to a 100MW Texas BESS portfolio owned by sustainable investment group SUSI Partners.

The firm has drawn significant recent investment: in August 2021, a US$150 million equity investment was arranged by asset manager Apollo and in July this year a Series C funding round closed with US$100 million raised from investors including Dutch energy trader Vitol.

FlexGen and CATL have already worked together on around 2.5GWh of energy storage system projects and Pegler said customer demand is so high that the contracted 10GWh will be “absorbed” into the energy storage integrator’s project pipeline with “reasonable ease”.

“This agreement allows everyone to plan more transparently together, not just for this quarter or this year, but through that portfolio visibility of several years,” Pegler said.

Continue reading