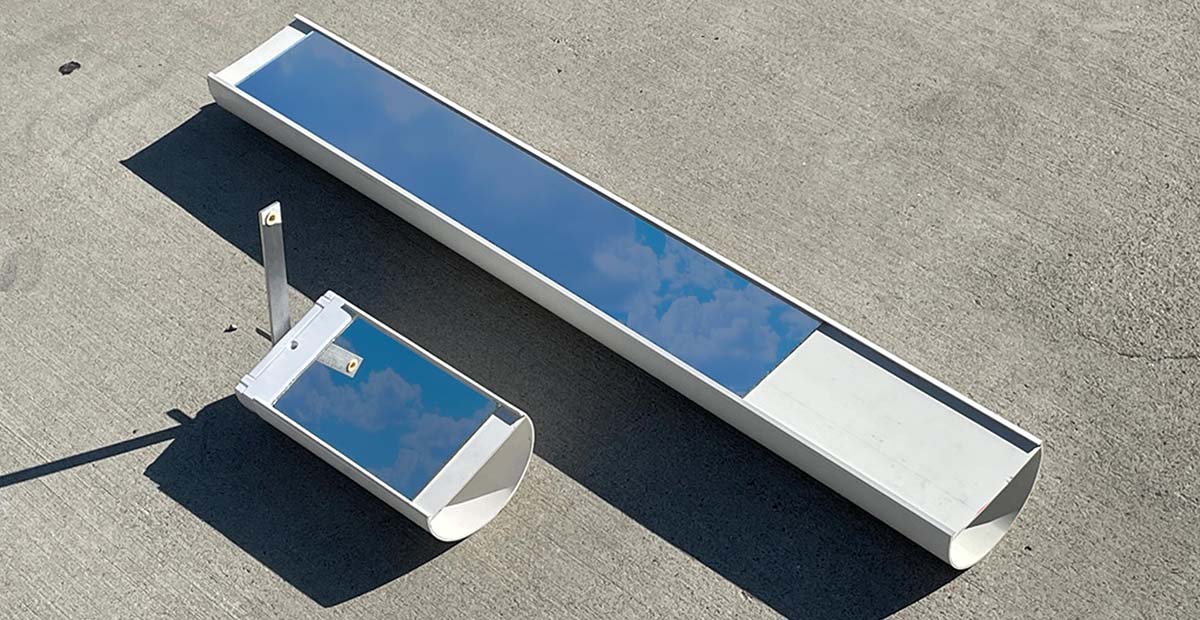

Invinity grid-scale flow battery units at a site in England, UK. Image: Invinity Energy Systems.

Invinity Energy Systems will supply vanadium redox flow battery (VRFB) technology to a solar-plus-storage project in Alberta, Canada.

The project, Chappice Lake Solar + Storage, will combine a 21MWp solar array with a 2.8MW/8.4MWh battery storage system, Anglo-American flow battery company Invinity said today, together with the project’s developer, owner and operator, Elemental Energy.

Alberta is largely synonymous with fossil fuels; it hosts crude oil production from sites including its northern tar sands, produces a large portion of Canada’s natural gas and is largely reliant on the country’s largest coal fleet for electricity.

One of the province’s key climate and pollution pledges is now the phasing out emissions equivalent to 50% of that coal fleet by 2030.

The Chappice Lake project was one of a number of ‘shovel-ready’ projects awarded funding late last year through the provincial government’s Emissions Reduction Alberta (ERA) scheme.

In that round of funding, reported by Energy-Storage.news in November 2021, a 400MW closed-loop pumped hydro project called Canyon Creek was picked out for support too. Also benefiting were a number of projects seeking to reduce the emissions and increase the efficiency of some of the region’s fossil fuel extraction and refining activities.

At the time, ERA said it would administer the award of CA$10 million (US$7.89 million) of the total expected cost of Chappice Lake, just over CA$40 million.

Invinity’s flow battery will be directly DC-coupled with the solar array, improving the project’s efficiency, operational flexibility and costs. Charging from the solar PV modules, it will store and send out low-carbon, low-cost energy.

Being able to deliver power on demand will also help alleviate constraints to deploying more renewable energy on the grid, eliminating bottlenecks in power flow, Invinity said.

The project is expected to go into service later this year.

Developer Elemental Energy is also partnering with local indigenous group Cold Lake First Nations, which will hold an equity interest in the Chappice Lake project and the community will also benefit from the new electricity capacity addition as well as employment opportunities the clean energy industry can bring to the area, Elemental claimed.

“Alberta has a long history of leadership in energy; the fact that this shovel- ready project will expand that leadership in new directions while creating great new jobs is a testament to how Alberta can innovate and build,” Invinity Energy Systems’ chief commercial officer Matt Harper said.

“Clean energy on demand is becoming an increasingly valuable commodity; in delivering solar and storage together at Chappice Lake, we will prove that solar generation plus Invinity’s utility-grade vanadium flow batteries can make Alberta a powerhouse for the North American grid.”

Vanadium flow batteries have been touted as a long-duration, long-life energy infrastructure asset. Capable of being scaled up in energy capacity by increasing the size of their electrolyte tanks, the systems are expected to last decades in services without degradation or fading of battery capacity.

In December, Lockheed Martin announced that the first megawatt-scale pilot for its own flow battery technology — for which the aerospace and defence giant has not revealed the battery chemistry publicly — will also be in Alberta.

Lockheed Martin claimed that a 6.5MW/52MWh unit of its GridStar Flow battery energy storage system (BESS) technology will be paired with a 102.5MW solar farm in development by infrastructure company TC Energy. Lockheed will invest about US$9 million into the Saddlebrook Solar + Storage Project, with an expectation that funding will also come from ERA.

On a broader note, Energy-Storage.news has reported on a number of other Alberta-based energy storage projects in the past couple of years. The province’s first grid-scale battery storage system, a 10MW/20MWh Tesla lithium-ion BESS called WindCharger, went online in late 2020, paired with a local wind farm.

TransAlta, the Canadian company behind that project, has just applied to Alberta regulators for approval for WaterCharger, a 180MW BESS paired with hydroelectric generation facilities.

Alberta’s grid operator AESO is also piloting the use of energy storage resources for fast frequency regulation.

Continue reading