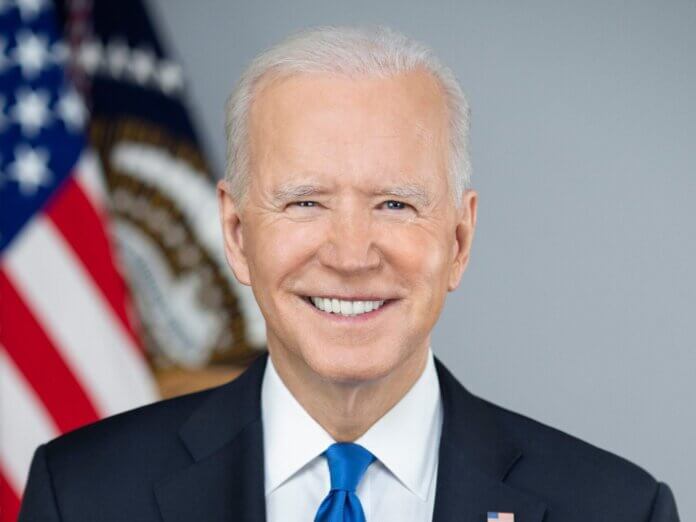

Sumitomo’s 2MW/8MWh flow battery storage project in the SDG&E trial. Image: Sumitomo / SDGE.

4 February 2022: Microgrid trial anchored by vanadium flow battery concludes in California

San Diego Gas & Electric (SDG&E) and Sumitomo Electric Industries (SEI) have successfully completed a zero-emissions microgrid pilot using a 2MW/8MWh vanadium redox flow battery (VRFB) energy storage system.

The battery system powered 66 homes and businesses in the California investor-owned utility’s service area for five hours in a test run.

California has been keen to improve grid reliability using zero-emission sources in light of numerous power shutoffs due to the recently increased wildfire risk. Sumimoto managing director Hideo Hato highlighted vanadium’s noteworthy non-flammable qualities in the pilot announcement.

Commencement of the year-long pilot was reported by Energy-Storage.news early last year. It involved two successful test types carried out in various weather conditions.

The first involved the battery providing a seamless transition for customers as they were transitioned to the microgrid. The second saw microgrid operators establish and sustain service using the battery after a complete loss of power, with customers experiencing a ‘momentary’ outage.

Sumitomo supplied the battery which was installed at an SDG&E substation in Bonita in 2017 and connected to the state grid in 2018, since which it has participated in the state’s wholesale electricity markets. In that time, it has helped the grid mitigate some summer peaks in electricity demand due to air conditioning use.

7 February 2022: Acciona selects Gelion’s zinc-bromide battery for trial at solar plant

Acciona will trial UK technology group Gelion’s Endure zinc-bromide non-flow energy at its Montes del Cierzo solar plant in northern Spain.

Gelion will provide a 25KW/100KWh system to the 1.2MW-peak solar plant, a company spokesperson told Energy-Storage.news.

“The Gelion Endure battery will be assessed in various real-world ambient conditions completing various photovoltaic integration functions,” they added.

“These include ‘ramp rate control’ to minimise the grid impact of PV plants, ‘frequency regulation’ to improve overall grid stability and ‘solar firming’ to produce dispatchable renewable power and reduce the need for backup fossil fuel generators.”

The 6-12 month test and supply contract will start with an installation in Q3 2022 and, if successful, the Endure battery will form part of Acciona Energía’s supplier portfolio as a renewable energy storage provider. Its success will be measured based on pre-defined battery test performance criteria.

Gelion’s is one of four emerging energy storage solutions which Acciona selected to proceed to trial, through the company’s programme IM’NOVATION.

Other technologies the Spanish infrastructure and energy group has tried out at the Montes del Cierzo test bed include a stationary battery storage system assembled using second-life electric vehicle batteries.

Endure’s fire resistance is such that the battery has been demonstrated suffering “no catastrophic loss of battery function with no failure hazards” after being placed on a BBQ hotplate at up to 700°C for 30 minutes.

[embedded content]

Sydney University spinout Gelion listed on the AIM stock exchange in London in November 2021, raising £19m (US$25m) for a market cap of £155m. The company mostly targets off-grid applications although the Montes del Cierzo plant is connected to the Spanish grid.

7 February 2022: Zeta Energy raises US$23m for lithium sulfur battery technology

Zeta Energy has raised US$23m in a series A from Moore Strategic Ventures to develop and commercialise its lithium-sulfur (Li-S) battery system.

The announcement comes 18 months after the company raised an US$1.8 million seed round investment from another lithium-sulfur battery developer, Li-S Energy.

The Texas-based technology group claims its lithium-sulfur battery system does not suffer the polysulfide shuttle effect that has long held back advances in the field, thanks to its proprietary carbon materials.

It adds that its propritery cathodes offer superior stability and higher sulfur content than current metal-based cathode materials and are inexpensive, have high capacity, and use no cobalt, nickel or manganese. The money will go towards expanding its Houston lab facility and further commercialisation activities.

Sulfur is more abundant and inexpensive than the underlying materials of lithium-ion so the technology holds potential, but commercialisation has been found difficult. UK-based Oxis Energy completed several fundraising rounds for its lithium-sulfur technology but entered into administration in May last year.

It is not Moore Strategic Ventures first investment in companies looking to disrupt the energy market.

In September 2021 it led a US$26m financing round for Indian AI-based energy analytics startup Bidgely Inc, which works with utilities and energy companies to create personalised energy profiles for customers, including around decarbonisation. A year earlier, it led an undisclosed Series C investment into Canadian lithium-ion battery recycler Li-Cycle.

Continue reading