A possible failed bearing and a software programming error in a heat suppression system caused a cascading incident that damaged 7% of Vistra Corp.’s Moss Landing Energy Storage Facility. February 2, 2022 John Fitzgerald WeaverThe world’s largest lithium ion battery, the Moss Landing Energy Storage Facility, was shut down due to a cascading series of unfortunate events, which may have resulted from a failed fan bearing giving off smoke, per the company’s release:At approximately 6:41p.m. on Sept. 4, smoke was detected by VESDA units in the vicinity of cores 64, 57, 47 and 41, causing water to be released to preaction zone 24 and stopping the flow of electrical current through the affected cores (an automated process referred to as E-Stop). Due to an apparent programming error in the VESDA, these actions occurred at detected smoke levels below the specified design level at which water was intended to be released and E-Stop was intended to be initiated.The very early smoke detection apparatus’ (VESDA) notification set off a water release action. This action caused a water-based battery heat suppression system to activate. Unfortunately, when the couplings on flexible hoses of this system failed, water sprayed directly onto additional battery racks, causing short circuiting and arcing, which damaged the batteries and made more smoke. The additional smoke set off more alarms and caused even more water to spray from the failed couplings.LG Energy — rack level fire suppression systemLGVistra notes that during the construction process, there was some pressure testing that occurred, for instance the preaction header piping and the piping on each battery rack underwent separate pressure testing. However, Vistra has been unable to confirm that the contractor pressure tested the complete heat suppression system after the racks were connected to the header pipes.In the end, 7% of the facility’s batteries were damaged by water, along with other infrastructure. Notably, there was no temperature increase noted in any battery modules at any time during the incident.There are two battery facilities owned by Vistra on the site. The smaller, and newer, 100MW/400 MW facility was not affected. The original, larger, 300MW/1.2 GWh structure was where the incident occurred.The 300MW facility is broken down into three 100MW arrays, with 98 cores, and 4,539 racks, holding 99,858 modules of batteries. Each battery module, part number M48290P5B (4P) on the LG Energy website, is housed within the new TR-1300 double wide form factor. LG’s JH4 battery cell populates these units.Each module holds 14.9 kWh of 72.5 Ah JH4 cells, while the just over 5,000 pound TR1300 holds 327 kWh of energy.A video released by LG Energy showcasing the TR 1300 briefly highlights the fire suppression system (starting at 2 minutes and 46 seconds.)The fire suppression system includes a standard water sprinkler system. A separate water-based heat suppression system that is specifically designed to protect against thermal runaway in individual battery modules is also deployed. This system has carbon steel header pipes that are connected by flexible hoses to piping on each rack.This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingUK investor confidence in battery storage grows, as industry does too

Inside the Bloxwich battery storage plant in the UK. Image: Arenko.

As you may know, in addition to the international sites Energy-Storage.news and PV Tech, our publisher Solar Media has two UK-focused clean energy news websites, Current± (which covers broad energy transition topics) and Solar Power Portal (which covers solar PV).

Across the two sites, deputy editor Molly Lempriere and Alice Grundy bring readers the top UK energy storage news and views and this week we have a bit of an anthology of recent stories for you here.

Battery storage is ‘standing on its own two feet’ as investor confidence rises

31 January 2022

Investors are now becoming more comfortable with battery storage in the UK, with projects being profitable and cost-effective, according to industry experts.

Speaking at the Annual Marketplace event hosted last week by trade group Electricity Storage Network, Alicja Kowalewska-Montfot, commercial manager-energy storage at Gore Street Capital, said the asset owner had established a “very strong” retail base of investors, who would typically be more risk averse to newer technologies and that are now getting comfortable with this sort of asset class.

This in turn is showing that investors are getting more comfortable with the associated merchant risk and understand that in the absence of long-term or government-backed contracts, “they are indeed capable of functioning in the context of the fundamentals that are happening in the market, so the growth of renewables”.

She added that what is “incredible” about battery storage is that it never had a subsidy.

“This to me is one of those very interesting stories of a technology that effectively proved to be capable of being merchant and unsubsidised pretty much from day one,” Kowalewska-Montfot said.

Indeed, Ben Guest, managing director and head of another major UK asset owner, Gresham House New Energy, said: “It’s a cost-effective technology, and a reliable technology which is resulting in profitable, unsubsidised projects so clearly it’s an area that’s standing on its own two feet.”

Guest went on to detail Gresham House’s revenue model, which he said is focused on three accessible layers, these being trading, frequency response and Capacity Market revenues. He said the Capacity Market revenues are available to every battery, and will be 5-10% depending on the size of the battery and the revenues it is expected to make elsewhere.

Guest added that Gresham has always said from the outset that the ancillary services market including frequency response was going to saturate as it’s naturally a shallower market, while the deepest part of the market is trading.

He said that with the high levels of wind and solar expected on the energy system as the UK decarbonises, and the intermittency of that, storage will be needed and there will therefore be big trading opportunities.

By Alice Grundy

To read the full version of this story visit Current±.

Arenko to optimise a further 455MW of Gresham House battery storage in extended partnership

1 February 2022

Clean energy asset automation and optimisation company Arenko Arenko has been awarded contracts to optimise a further 455MW of Gresham House Energy Storage Fund’s battery storage assets in an expansion of the pair’s multi-year relationship.

Having been working together since 2020, Arenko has now been awarded contracts to carry out asset optimisation on an additional five utility-scale battery storage assets for Gresham House. Totalling 210MW, the contracts are expected to come into force during this year.

An additional framework agreement has also been signed to optimise a further 215MW, while Gresham House has renewed the Byers Brae contract, which Arenko has been optimising since March 2021.

These new agreements mean that Arenko has been awarded contracts for the asset optimisation of over 500MW of Gresham House’s energy storage portfolio in total.

Under the agreements, Arenko will use its end-to-end trade optimisation and automated dispatch software to maximise returns from the battery storage assets.

By Alice Grundy

To read the full version of this story visit Current±.

SMS energises its first 50MW battery energy storage site in 620MW pipeline

31 January 2022

UK smart energy tech company SMS has energised its first battery energy storage system (BESS), the 50MW Burwell site in Cambridgeshire, east England.

The lithium-ion BESS will now deliver a range of balancing and ancillary services to National Grid ESO, providing flexibility for the grid. SMS announced the start of construction of Burwell in February 2021, with the project originally expected to be completed in the final quarter of 2021.

It is the first of a pipeline of 620MW of BESS projects either under construction or being planned by SMS, with a second site – a 40MW system in Barnsley, Yorkshire – also nearing completion. Following on the heels of these sites, are two more 50MW sites in Suffolk and Derbyshire.

SMS’s 620MW portfolio includes 140MW of assets already under construction and 100MW that has been fully secured, while the remaining 330MW is under exclusivity. It is planning to complete this pipeline of projects by 2025.

Established in 1995, SMS is best known for its role in the national rollout of smart meters, where it provides funding, installation, operation and management of smart meters and carbon reduction assets.

By Molly Lempriere

To read the full version of this story visit Current±.

SMS’ Burwell 50MW BESS site. Image: SMS.

RES submits application of 100MW Spennymoor battery energy storage project

1 February 2022

Renewable asset developer RES has submitted a planning application for a 99.9MW battery energy storage project in County Durham, northeast England.

The Spennymoor site forms part of the company’s portfolio of over 700MW of energy storage projects in development or construction in the UK and Ireland currently.

If approved it would sit adjacent to the Spennymoor substation, and provide grid balancing services. It has already gone through several design iterations in response to site surveys, with the version submitted including a number of biodiversity measures.

“As we make the rapid transition to low-cost renewables it’s important that we develop more energy storage capacity on our grid to support a more flexible system,” said Jenna Folkard, RES development project manager.

To date, RES has developed 23 energy storage projects globally and has delivered more than 22GW of renewable energy projects, including onshore and offshore wind, solar, energy storage, transmission and distribution, over its 40-year history.

By Molly Lempriere

To read the full version of this story visit Solar Power Portal.

This is just a small sample of the great UK-focused clean energy content, including energy storage and solar, you will find over at Current± and Solar Power Portal. Subscribe to their newsletters for regular updates.

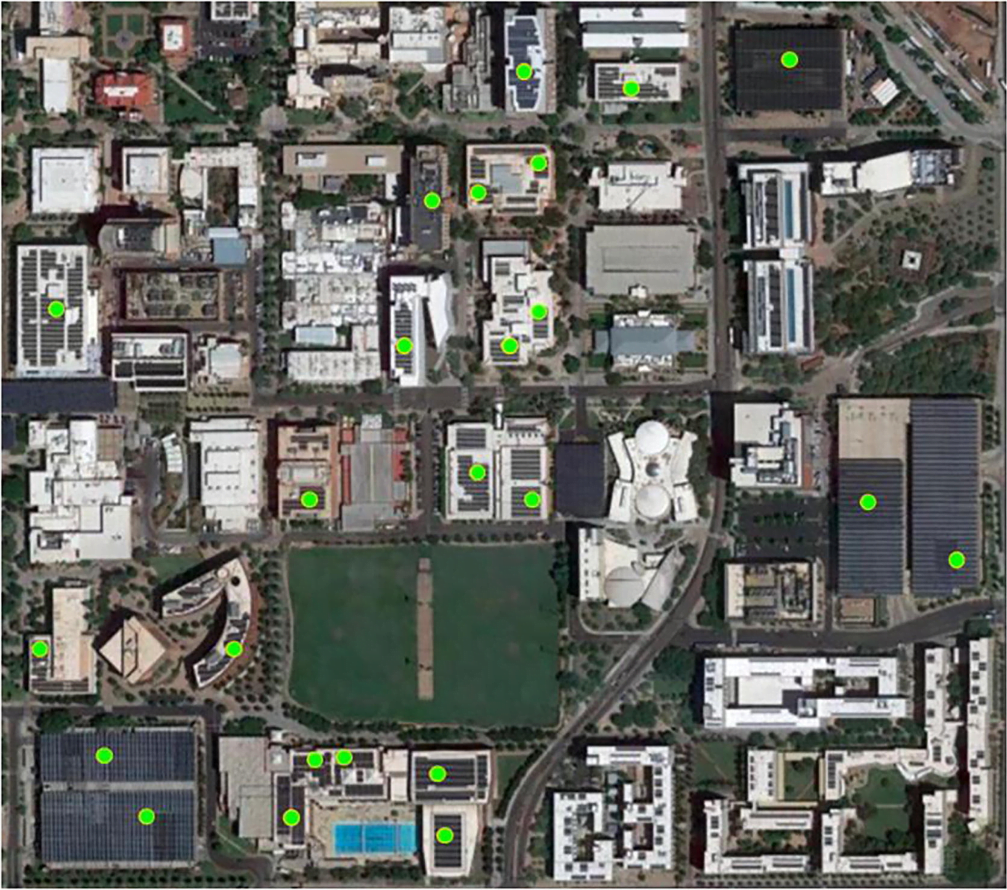

Continue readingAppeals court ruling could bring Phoenix solar market back to life

A U.S. district court must rule on federal antitrust claims made by four plaintiffs against Arizona utility SRP’s anti-solar rate, and must consider “injunctive relief” that could immediately halt the anti-solar rate. February 2, 2022 William DriscollFour customers suing Arizona utility Salt River Project (SRP) over its anti-solar rate “adequately allege antitrust injury,” said the U.S. Ninth Circuit Court of Appeals in a ruling on Monday. Now the U.S. district court that had originally dismissed the lawsuit must take up the case anew, which could result in an end to the anti-solar rate.Halting the anti-solar rate could revive the rooftop solar market in the Phoenix area, where SRP serves about one million households.Four SRP customers with rooftop solar had sued the utility in federal district court after their bills went up an average of $600 a year, which they claimed unlawfully discriminated against customers who added rooftop solar. When the district court dismissed the case, the four plaintiffs appealed.“Applications for solar-energy systems in SRP territory decreased by between 50 and 96 percent” after the anti-solar rate went into effect in 2015, the appeals court noted.If the district court grants injunctive relief on the plaintiffs’ federal antitrust claims, that could mean halting the discriminatory rate structure immediately, “which could have the effect of allowing rooftop solar to flourish in SRP territory,” said Jean Su, an attorney and director of the Center for Biological Diversity’s Energy Justice Program. The Center had filed a “friend of the court” brief in the case along with four other groups.Because SRP was established as an agricultural improvement district and is thus a subdivision of the state, the appeals court ruled that SRP is exempt from damage claims under antitrust law.The appeals court’s antitrust ruling hinges on two factors specific to SRP and Arizona. First, SRP does not file its rates with a regulatory agency for approval, so the “filed rate doctrine” that “prohibits individuals from asserting civil antitrust challenges to an entity’s agency-approved rates,” did not apply, the court said.Second, Arizona law promotes competition in the retail electricity market, the appeals court found. If Arizona law instead aimed to displace such competition, the court said that SRP, as a political subdivision of the State of Arizona, could be entitled to “state-action immunity.”Su explained that although anti-solar rates that gain approval from state-appointed utility commissions “are largely protected from antitrust claims, under both the file-rate doctrine and state-action immunity defenses,” other public power providers like SRP “may not be able to use those defenses, particularly if the anti-solar rates contradict state policy as was the case for SRP.”The appeals court also ordered the lower court to rule on plaintiffs’ federal equal protection claims, finding that those claims were filed on a timely basis.The appeals court upheld the lower court’s dismissal of plaintiffs’ claims under state law, as it found the plaintiffs did not meet Arizona’s notice-of-claim statute.The U.S. Department of Justice had also filed a “friend of the court” brief in the case. The appeals court’s decision is available here..This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingSaft supplying BESS to France’s first grid-connected colocated solar and battery storage project

Saft Intensium Max BESS at the company’s standalone battery project in Dunkirk, France. Image: Saft.

France’s first high-voltage transmission grid-connected battery project colocated with a solar PV plant will be equipped with a battery energy storage system (BESS) from Saft.

The battery manufacturer and energy storage system integrator announced today the award of an engineering, procurement and construction (EPC) contract by renewable energy developer and independent power producer Neoen.

Saft will provide a modular, plug-and-play 8MW/8MWh BESS to Neoen’s solar PV project in Antugnac, southern France. The battery storage will perform frequency regulation ancillary services for the grid of national transmission operator RTE after Neoen won a seven-year contract through RTE’s AOLT tender process.

The France-headquartered battery storage provider, a subsidiary of TotalEnergies, will engineer, manufacture, construct and integrate the full BESS solution, based on four of Saft’s Intensium Max containerised units, along with power conversion system (PCS) equipment, controls and SCADA systems.

Saft said the project will be delivered this Spring, within 10 months of contracts being signed.

While Neoen has a strong background in the global wind and solar renewable energy markets, it is perhaps best known in the energy storage industry for its large-scale battery projects in Australia.

These include — among others — the recently inaugurated Victorian Big Battery (300MW/450MWh) and the Hornsdale Power Reserve, which for a long time after commissioning in 2019 was the world’s biggest lithium-ion battery storage project. BESS supplier to both those projects was Tesla.

Neoen’s French development director Guillaume Decaen said Saft was selected due to its “deep knowledge of battery technology and proven experience in energy storage globally, its ability to manage a complete EPC scope including civil works and grid connection requirements from project inception to end-of-life dismantling”.

Decaen also noted that the performance of the asset is guaranteed throughout its lifetime by Saft. Saft meanwhile said that although the initial and primary function of the BESS is frequency regulation, the asset will be flexible enough to be used for additional services over the next 15 years, optimising project revenues.

In a recent webinar hosted in partnership with Energy-Storage.news, Saft’s energy storage team members including director of innovation Michael Lippert discussed the need for energy storage systems and their operators to be agile to meet the changing needs of the market, with digital technologies the key enabler of that agility.

Recently, commissioning was completed on an expansion project for France’s largest standalone BESS project, a Saft system deployed at a TotalEnergies refinery site in Dunkirk. The project was expanded from 25MW/25MWh inaugurated in January 2021 to 61MW/61MW, unveiled in December last year. The project was also discussed in detail as part of the Saft webinar with Energy-Storage.news.

Saft said today that its contract with Neoen guarantees high availability and performance, claiming that the BESS will be adaptable to changing operating patterns and able to perform more than two full discharges daily. The company will also support the system remotely from its energy storage system operating hub in Bordeaux, France, one of three such centres it has around the world.

The majority of battery systems paired with solar PV in France have been on the European country’s various island territories around the world, for which annual capacity tenders have been conducted for a few years.

Continue readingSunrise brief: Greater accountability is needed to improve interconnection timelines

Also on the rise: Solid-state battery start-up Sparks opened a pilot plant for its patented lithium battery technology based on zero cobalt cathodes. Hyperion will invest in a new facility in Ohio to manufacture its hydrogen fuel cell. Pennsylvania may have to sell RECs and use the cash to cap abandoned oil and gas wells. Sol Systems acquires 540MW Illinois solar portfolio. Greenskies moves agrivoltaics forward in Connecticut. FranklinWH chief sales officer shares views on distributed storage.

Continue readingCAISO drafts 20-year plan to get California on-track for 100% renewables

Saticoy, a 100MW/400MWh battery project commissioned in California in 2021. Image: Courtesy of Arevon.

California’s energy transition will need 53GW of solar PV by 2045, with the state’s transmission system requiring a US$30.5 billion investment alongside major increases in energy storage to accommodate the extra power.

A draft version of California ISO’s (CAISO) 20-Year Transmission Outlook report providing a roadmap for the next two decades and a draft 2021-2022 Transmission Plan covering the next 10 years, was issued today.

It outlined that by 2045, the state would require 53GW of utility-scale solar, 37GW of battery energy storage systems (BESS), 4GW of long-duration storage and more than 2GW of geothermal, alongside 24GW of wind power reserves, all of which need to be connected to the grid.

Created in collaboration with the regulatory California Public Utilities Commission (CPUC) and the state government’s California Energy Commission, the draft plan will be voted on in March by CAISO’s Board of Governors.

To read the full version of this story, visit PV Tech.

Continue readingMicrosoft and Google join Long Duration Energy Storage Council

Solar PV array outside a Google data centre in Belgium, at which the company is trialling the multi-application use of battery energy storage. Image: Google.

Microsoft, Google and 10 other companies have joined the Long Duration Energy Storage (LDES) Council, a CEO-led organisation launched at COP26 in November to push for the global deployment of technologies that can store and discharge energy for eight hours or longer.

Along with Danish energy company Ørsted, the tech giants are among five new ‘anchor’ members, bringing the total to 13. These comprise a mix of large conglomerates with interests in the renewable energy space, from Indian renewable energy giant Greenko to BP and Rio Tinto.

It has also welcomed seven new ‘technology’ members, companies focused on developing new forms of long duration energy storage, bringing the total to 23.

New technology members include heavy industrial group Sumitomo SHI FW, flow battery company VoltStorage and nickel-hydrogen battery company EnerVenue.

The Council says that LDES has the potential to deploy 1.5-2.5 TW power capacity globally by 2040: 8-15 times the total storage capacity deployed today. LDES could deliver 85-140 TWh by that year which would mean the ability to store up to 10% of all electricity consumed and would account for over half of all installed power flexibility capacity.

Achieving this, it says, will need investment of US$1.5-3 trillion — equal to the current global investment in Transmission & Distribution (T&D) infrastructure made every 2-4 years — and has set out a roadmap of how to get there.

It forecasts US$50bn cumulative investment by 2025 achieving 1 TWh of LDES; US$200-500bn by 2030 achieving 5-10 TWh; and $1.1-1.8bn by 2035 achieving 35-70 TWh before the 2040 target. It concedes that LDES costs must decrease by 60% for it to be cost optimal, but notes that even larger cost savings have been achieved in wind and solar.

Maud Texier, leading carbon-free energy activities at Google, commented that: “…we view long duration energy storage as a key pillar on the path to a carbon-free future”.

The Council’s modelling says the average system duration for LDES will increase over this period, with 24-hours-plus duration going from 40% of all TWh of cumulative installed energy capacity in 2030 to 80% by 2040. The average installed duration globally is expected to reach 14 hours by 2030 and a whopping 64 hours between 2030-2040.

The US is expected to account for one-third of LDES capacity with Europe (including UK) and India around 10% each, and Japan the next-largest at around 3%, according to data from the Council’s knowledge partner McKinsey. It does not give a figure for China.

Continue readingPeople on the Move: NREL, ACORE, Green Lantern Solar, and more

The National Renewable Energy Laboratory (NREL) has selected Craig Turchi to serve as the manager of its Concentrating Solar Power Program. With more than 30 years of industry experience, Turchi has been selected to lead NREL’s expanding research, development, demonstration, and deployment portfolio focused on concentrating solar-thermal power. He will develop the portfolio’s strategic agenda, working closely with senior laboratory management and the U.S. Department of Energy.Turchi received his doctorate in chemical engineering from North Carolina State University and his bachelor’s in chemical engineering from Texas A&M University. Previously, he served as the acting laboratory program manager for the NREL Geothermal Program. He spent 10 years as a principal investigator and program leader with ADA Technologies, collaborating with the U.S. Environmental Protection Agency, National Institutes of Health, U.S. Department of Defense, U.S. Department of Energy, Electric Power Research Institute, and several private companies.The American Council on Renewable Energy (ACORE) announced that Elise Caplan has joined the organization as Director of Electricity Policy. In this role, Caplan will be responsible for leading ACORE’s Transmission and Markets Working Group and driving the organization’s work involving the Federal Energy Regulatory Commission (FERC), RTO/ISOs, and state utility commissions.Caplan’s background includes more than a decade as the Director of Electric Markets Analysis for the American Public Power Association (APPA), the trade association representing the nation’s public power utilities. Most recently she consulted on electricity market issues for the Natural Resources Defense Council’s Sustainable FERC Project (SFP) and the World Resources Institute (WRI).Geoff Sparrow, P.E. has been appointed Vice President of Development for Green Lantern Solar, a leader in renewable energy development and financing focused on turn-key commercial-scale solar PV and energy storage systems. Sparrow was previously Director of Development for the company.In his new role, Sparrow will oversee the identification of viable projects and coordinate efforts to successfully move them to completion as Green Lantern Solar continues to pursue solar project development, financing and operations and management opportunities in the Northeast and Mid-Atlantic.Sparrow began his career in renewables in 2005 and has broad experience developing and executing commercial, residential and utility-scale solar projects in New England. Prior to Green Lantern Solar, Sparrow served as a member of the senior leadership team at ReVision Energy. He holds a B.S. in Mechanical Engineering from the University of New Hampshire.ClearVue Technologies, an Australian technology company that operates in the Building Integrated Photovoltaic (BPIV) sector, announced that it has appointed Basil Karampelas as CEO for North America to continue expanding its footprint across the United States, Canada and the Western Hemisphere in general.Karampelas will commence with the Company beginning February 1, 2022. Karampelas has spent nearly three decades in a variety of senior financial, operational and advisory roles. Most recently, Karampelas served as Managing Director and leader of a national advisory firm’s energy and sustainability practice.Karampelas received his Master of Business Administration from the Stanford University Graduate School of Business, where he was an Arjay Miller Scholar. He has also earned a Bachelor of Arts in Economics and History, with distinction, from Stanford University.Li-Cycle Holdings Corp., an industry leader in lithium-ion battery resource recovery and the leading lithium-ion battery recycler in North America, has announced the appointment of Elewout Depicker as VP, Commercial & Corporate Development, EMEA. Depicker will oversee the execution of Li-Cycle’s commercial activities and corporate development strategy for the Europe, the Middle East and Africa regions. His appointment is effective immediately.Before joining Li-Cycle, Depicker was Business Head Lithium, Manganese, Additives and Supply Chain Management at Umicore’s Rechargeable Battery Materials division. At Umicore, he was in charge of growing the global sourcing portfolio of battery raw materials going into Umicore’s PCAM and CAM products. He holds his Master of Commercial Engineering from Ghent University in Belgium.NRG Systems, Inc., announced that Enrique Lopez Salido has joined the company as its new Vice President of Operations. As NRG’s Vice President of Operations, Lopez Salido oversees the company’s manufacturing operations, integrated supply chain processes, and quality program.Lopez Salido has nearly 30 years of experience running and redefining global operations for a range of technology sectors, including aerospace, automotive, telecommunications, medical, and renewable energy. He most recently served as Supply Chain Transformation Lead at Daikin Applied Americas, where he led the evolution of the company’s procurement process into an integrated supply chain; helped establish long-term commodity strategies to support a customer-driven, configure-to-order business model; and assisted in achieving a significant year-over-year cost reduction.Lopez Salido holds a bachelor’s degree in Electrical Engineering from ITESO – Universidad Jesuita de Guadalajara, an Advanced Manufacturing Systems degree from Instituto Tecnológico de Monterrey, and an MBA and Executive Certificate in Global Management from Thunderbird School of Global Management.Celebrating 10 Years as North America’s leading renewable energy executive search and staffing firm.Sponsored: Junior Electrical Engineer, Kahului, HawaiiThe ideal candidates for the role of Junior Electrical Engineer will support the Commercial Development team providing clients with optimal PV and Storage system proposals. This person will provide solutions to complex electrical and mechanical site conditions, as well as multiple design solutions with associated costs analysis. This position will be mainly based in the office and will review work across the entire state.Responsibilities:Visit sites for all commercial projects, test electrical systems and continuity of circuits in electrical wiring and equipment using testing devices. Document properly for design purposes.Review and coordinate with engineer to make plan revisions based on site visit findingsInspect electrical systems, equipment, and components to identify hazards, defects, and ensure compliance with codes. (Ex. Main services needing a replacement, upgrades, or bad breakers)Review structural integrity of roof/carports/etc. to identify hazards, defects, and ensure compliance with codes.Read, design and confirm that blueprints, SLDs or technical diagrams to install solar systems are up to code and to manufacturer specificationsProvides solutions on determining how to determine how something is going to be built both structurally and electrically. BeReviews and confirms material call outs and respective budgets based off of finalized designsMaintain documentation of designs progression per project for tracking purposesProposes code and manufacturing compliant equipment layouts for each unique commercial site location while considering budget and feasibilityProvides solutions to complex build outs with detailed directions on structural and electrical challenges; I.E structural support for systems, able to size/recommend changes: transformers, breakersProvide support in fine tuning design and engineering processAddress issues in design to correct course of development if necessaryIncorporate new products sold by sales into the design of solar projectsStay informed on latest solar developments related to code, product functionality, utility interconnections, etc.Follow state and local building regulations based on the National Electric CodeQualifications:Electrical Engineer degree or Licensed Journeyman Electrician transferable to the State of HawaiiExperience working on commercial and utility grade systems (i.e high voltage, 3 phase, etc)5-10 years of construction and able to apply and understand industry standards and code complianceCandidate works well in a small team and has a positive outlook even when challengedDemonstrates strong computer skills, detail oriented work, organized, and shows pride in their workMore information is available here.This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingIndia’s Union Budget ‘addresses energy storage industry’s biggest financing concerns’

Minister of Finance Nirmala Sitharaman holds the budget’s iconic red cloth folder in 2021. Image: Gov’t of India Press Bureau.

The Indian government’s decision to classify grid-scale energy storage as infrastructure addresses the industry’s “biggest concerns” by making investments easier to facilitate, Energy-Storage.news has heard.

As part of the Union Budget 2022-2023 speech and announcements yesterday by Minister of Finance Nirmala Sitharaman, energy storage and data centres were awarded the status. Minister Sitharaman said that this will “facilitate credit availability for digital infrastructure and clean energy storage”.

India’s banks and financial institutions have a standard, government-identified list to follow when it comes to choosing what qualifies for infrastructure loans, Ulka Kelkar, director of the climate programme at non-profit research group WRI India, told Energy-Storage.news.

“This list includes five types of infrastructure, which are more in the nature of public goods than private goods,” Kelkar said, from energy, transport, communications, water & sanitation to social and commercial infrastructure.

“Specifically adding grid-scale energy storage to this list should make it easier to access infrastructure credit.”

Kelkar explained that this showed the range of policy instruments a government can deploy is much wider than budgetary allocations and fiscal incentives like taxes or subsidies, but includes other forms of de-risking, from mandates and standards to procurement, aggregation, credit aggregations and more.

The budget also included direct support for the upstream end of the clean energy value chain. As reported yesterday by our sister site PV Tech, an allocation of funding for solar PV manufacturing within the country through a scheme called the Production Linked Incentive (PLI) was quadrupled with an addition of Rs19,500 crore (US$2.6 billion).

There was also a commitment to establishing battery recycling and battery swap programmes for electric vehicles (EVs), while a separate Production Linked Incentive programme already in place for advanced chemistry battery cell manufacturing is ongoing, aimed at supporting 50GWh of domestic production capacity.

India Energy Storage Alliance welcomes ‘progressive budget’

The India Energy Storage Alliance (IESA) told Energy-Storage.news it welcomed the “progressive budget,” which it said addressed many key requests from the industry and would make faster adoption of energy storage and e-mobility in India possible.

“Infrastructure status for energy storage sector will address the biggest concerns of industry related to ease of financing,” IEAS president Dr Rahul Walawalkar said.

“IESA believes that over the past decade energy storage technologies have made tremendous advancements in improving performance and reducing capital cost, so availability of financing was identified as the key hurdle for rapid adoption.”

Infrastructure status for energy storage had been among requests IESA had made to the Ministry of Finance, covering both manufacturing and deployment and Dr Walawalkar said.

“We are glad our submission was considered positively,” he said.

“As the Harmonised Master List of Infrastructure sub-sectors already includes Electricity Generation and Electricity Transmission, the inclusion of Energy Storage will help cover all the important segments of energy under the Infrastructure Status.”

IESA also welcomed that increase in funding for solar PV manufacturing as a close ally sector of energy storage. According to Walawalkar, the Ministry of Finance can be expected to also consider increasing the 50GWh allocation for advanced chemistry cell (ACC) manufacturing support in the coming months.

Applications for the ACC incentive had been oversubscribed, with a total of 130GWh of competing bids received and the Ministry may increase the targeted capacity “to ensure India can keep up with the global increase in advanced cell manufacturing,” the IESA president said.

WRI India’s Kelkar said the PLI funding increase for solar could have a positive impact on energy storage adoption.

The allocation specifically related to “manufacture of high efficiency modules, with priority to fully integrated manufacturing units from polysilicon to solar PV modules”.

However, Kelkar said, it might help reduce the combined cost of solar and storage for each unit of electricity generated, even though the scheme itself may not directly affect storage.

“With such schemes, the focus seems to be on nurturing the indigenous manufacturing industry, creating jobs, and driving down costs,” Kelkar told Energy-Storage.news.

IESA also welcomed other measures announced, or referred to as under consideration by the government, that could have a positive impact on India’s energy storage manufacturing and supply chain.

For example, while the budget broadly emphasised support for domestically-made goods and included duties on imported products, reforms on customs and duties rates for raw materials that are being discussed could ease supply chain constraints and support domestic makers, Dr Walawalkar said.

A concessional 15% tax rate for newly incorporated domestic manufacturers has been extended by a year from 31 March 2023 to 31 March 2024, which will help facilitate investments required in the next two years to get PLI-backed companies —as well as potential component suppliers — up and running.

IESA also warmly welcomed measures to support start-ups, green energy sector job opportunities for young people and skills training in digital and other industry sectors and e-mobility. The group also said support for grid-connected microgrids was a positive step, helping boost agribusiness in remote areas.

The group did say, however, that a reduction in the General Sales Tax for EV batteries to 5% that is suggested had not been included in the budget, which IESA asked the Ministry of Finance to reconsider.

The green hydrogen sector is also “missing in the budget,” Dr Walawalkar said. IESA has suggested the creation of a special fund for green hydrogen and PLI support for green hydrogen electrolyser manufacturing.

Nonetheless, the budget appears to have been well received. It follows the announcement a few days ago that India’s Ministry of Power has clarified the role and status of energy storage within the power sector, which again could accelerate adoption.

The country already has over 150GW of renewable energy capacity installed and to reach its 2030 target of 500GW, will need about 28GW/108GWh of energy storage, the Central Electricity Authority has forecasted.

Previous budget announcements covered by Energy-Storage.news in 2020 and 2021 were welcomed by IESA for their broad support of renewable energy and the green economy, but yesterday’s announcement appears to be the first instance of specific, directly supportive policy announcements pertaining to energy storage by Minister Sitharam.

Additional reporting by Sean Rai-Roche.

Continue readingFuel cell manufacturer moves HQ to green hydrogen hub in Ohio

Hyperion will invest more than $297 million in the new facility in Columbus, Ohio, where it will manufacture its next-generation hydrogen fuel cell, which will power its new line of stationary and mobile energy storage products, including its XP-1 hypercar. February 1, 2022 Anne Fischer

Continue reading