Ukraine’s first and only grid-scale battery system is at the site of the now-occupied nuclear power plant in Zaporizhzhya. Image: DTEK.

RePowerEU, the European Commission’s plan to increase energy security and lower dependency on Russian gas imports, needs to focus on pairing renewable energy with energy storage.

The argument has been put forward by the European Association for Storage of Energy (EASE) after the European Commission (EC) revealed the RePowerEU strategy earlier this month.

The invasion of Ukraine begun by Russia in February prompted the commission into making proposals to become independent of Russian gas, which accounts for 40% of imports into the EU. About 45% of its coal and 25% of its oil also come from Russia.

The plan as proposed would drive forwards development of renewable energy and energy efficiency — sister site PV Tech noted that 420GW of additional solar PV capacity would be deployed in the EU by 2030 — with speedier permitting, encouraging electrification of industry and creating power purchase agreement (PPA) financing structures among measures to be taken.

RePowerEU nonetheless sees gas playing a big role, suggesting a 90% target for filling up underground gas storage before next winter and diversifying suppliers of gas to include higher shares of liquid natural gas (LNG) and pipeline imports from non-Russian sources.

Europe was already experiencing surging electricity prices before the war began and the EC is looking into how to limit the impact of gas price rises in electricity markets and could work with regulators to figure out changes to electricity market design.

The plan also includes an emphasis on hydrogen, with EC president Ursula von der Leyen having said that the “quicker we switch to renewables and hydrogen, combined with more energy efficiency, the quicker we will be truly independent and master our energy system”.

However, trade association EASE said last week that the diversification of gas suppliers as a strategy risks locking in dependency on fossil fuels. Instead, RePowerEU should make renewable energy paired with energy storage its major focus, EASE argued.

Gas plants are increasingly being called on to enable the integration of variable renewable energy generation from solar PV and wind onto the European grid network, providing flexible backup generation as more and more coal retires off the system.

Therefore, increasing renewable energy targets will not in itself make the EU independent from gas imports — which account for 90% of consumption already — as gas peaker plants will continue playing that grid flexibility role.

Energy storage however can shift energy from when it gets produced to when it is demanded and EASE said it “must be a pillar of an energy secure, decarbonised Europe”.

The association also noted that the growing procurement of dispatchable backup generation from gas means electricity prices will continue to rise. Renewable energy produced at times of surplus is being curtailed and wasted and in the end homegrown energy is thrown away by Europe, “only to pay [Russian gas company] Gazprom to fill the gap,” EASE said.

EASE said the humanitarian and climate crises unfolding have to serve as a wakeup call for policymakers in Europe that enabling a true energy transition is the only way to become “truly energy independent”.

Policy is needed that supports diversification in the profile of energy storage deployed: in particular, market structures do not exist that value long-duration energy storage of the type that can support generation during periods when renewable energy production is low and can enable shifting of energy demand from peak to off-peak.

EASE called for changes in European energy market rules that don’t value decarbonisation and mean that capacity auctions are still won by gas peaker plants.

A factsheet on the proposed RePowerEU plan can be found here.

Ukraine, Moldova grids synchronise with European network

Meanwhile, Ukraine and Moldova’s power grids have been synchronised to the Continental European Power System in partnership with other national transmission system operators, two years earlier than originally planned.

The European Network of Transmission System Operators (ENTSO-E) has been working with counterparts in the Ukraine-Moldova power system since 2017 on bringing the pair into the Continental Europe Synchronous Area (CESA) — the world’s largest synchronous electrical grid in terms of connected power.

Ukraine’s Ukrenergo and Moldova’s Moldelectrica made the emergency request to speed up the project, which was meant to be completed in 2024. Successful islanding trials for their grids, which had already been scheduled to take place, went ahead amid the start of the invasion in late February.

It means the pair will share the platform for maintaining grid frequency at 50Hz — which provides common markets for the primary containment reserve (PCR) ancillary service, also known as frequency control reserve (FCR) that battery storage competes in.

The CEO of DTEK, Ukraine’s largest energy sector investor, described the technical synchronisation as a “key step towards energy independence from the aggressor”. It means Ukraine’s energy sector has an “airbag” to minimise any disruptions, DTEK’s Maxim Timchenko said.

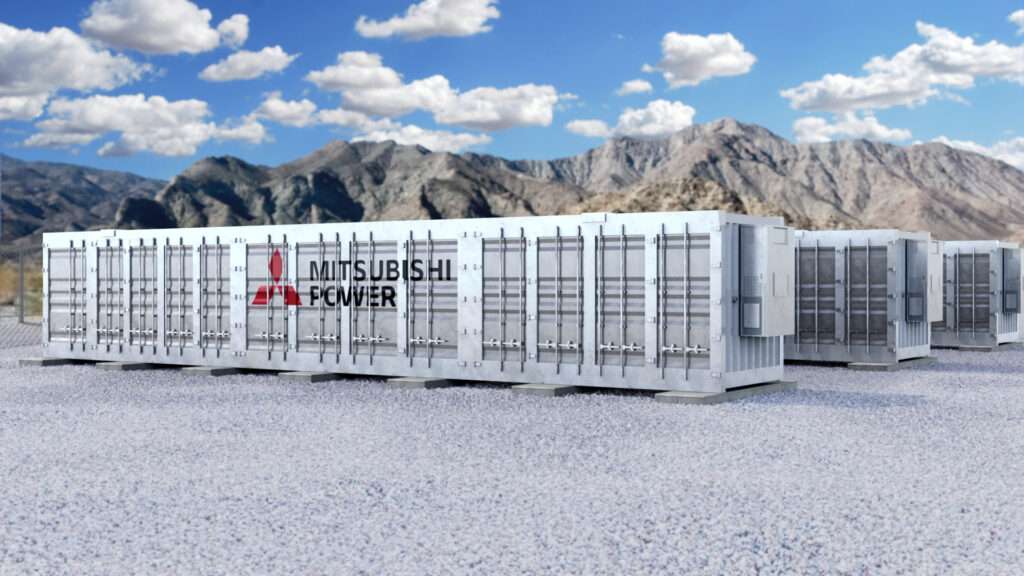

DTEK inaugurated Ukraine’s first-ever grid-scale battery energy storage system (BESS) project in May 2021, supplied by Honeywell with support from SunGrid and other partners.

Timchenko has described energy storage as being vital for Ukraine’s energy security and decarbonisation efforts. However the fate of DTEK’s first BESS is uncertain — it is located at the site of the company’s nuclear power plant at Zaporizhzhya, which has been seized and occupied by Russian forces.

Continue reading