US-based solid-state battery start-up Sparks opened a pilot plant for its patented lithium battery technology based on zero cobalt cathodes. The company wants to challenge China’s dominance in next-gen battery development. February 1, 2022 Marija MaischThe scramble for new battery storage solutions is picking up the pace with news coming from both established players and new entrants. The latest such move has seen US-based start-up Sparkz announce a pilot plant in Livermore, northern California, where it plans to begin construction of a pilot manufacturing facility for its patented solid-state battery technology.The company’s move to establish its first pilot production was spurred by support from the California Energy Commission (CEC). Last year, Sparkz won a $2.6 million grant from the CEC to extend its development into solid-state batteries as the company takes steps to shift its second product line from development to commercialization.“The California Energy Commission’s funding and continued support of Sparkz was an important step towards securing this facility,” said Sparkz CEO Sanjiv Malhotra. “The CEC understands that to challenge China’s domination of next-gen battery production, and reach America’s clean energy potential, we need to build sustainable battery facilities in the US Sparkz is quickly approaching this goal and putting Americans to work.”Founded in late 2019, Sparkz has recently completed the transfer of six patents from the U.S. Department of Energy’s Oak Ridge National Laboratory, which continues to be the company’s R&D partner.Sparks’ lithium-ion batteries are said to offer double the energy density compared to other zero cobalt chemistries, that is lithium iron phosphate (LFP) batteries that are predominantly made in China. Its initial research shows the ability to reduce the cost of cell manufacturing by about 40%, while maintaining energy density and lifecycles comparable to chemistries that utilize cobalt.Sparks’ high-density lithium battery design uses novel cathode and anode compositions, including early transition metal-stabilized high capacity oxidatively stable cathodes. This innovation improves on lithium-ion cathodes by replacing early transition metals, namely cobalt, at relevant sites in cathodes, and by varying the lithium composition.Its other licensed technologies include a nonaqueous electrolyte with lithium bis(fluorosulfonyl)imide salt for fast charging/discharging of lithium-ion batteries, which enables the batteries to perform at a 23% higher capacity during a 12-minute charge than other formulas; as well as a scaling process which enables industrial-scale production of battery materials through a series of chemical processes.Sparkz also operates an R&D and innovation center in Knoxville, Tennessee, and is also exploring new plants in the Appalachia to begin manufacturing its batteries for OEM partners. The company has the exclusive licenses to produce zero cobalt, lithium batteries and is committed to producing them in the U.S.This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingImproving interconnection timelines: The need for data and enforcement

Interconnection is a crucial, yet often overlooked, issue for enabling timely deployment of solar and other clean energy projects. Literally every grid-connected project must go through the interconnection process and delays can thus impact projects of every size and type. Across the country, outdated and cumbersome interconnection policies put the brakes on clean energy development, hindering market growth and the rapid climate action needed to avoid the worst impacts of climate change.Interconnection policy improvements will be central to enabling the rapid deployment of DERs (such as solar PV, energy storage, electric vehicle chargers, and more). As discussed in prior articles in this series, rethinking interconnection policies to make them more efficient and ensure they recognize the unique characteristics of energy storage on the grid can help remediate the situation.However, there is also a significant need for greater accountability in the interconnection process.Why? Because utilities have no incentive to create efficient interconnection processes on their own. In many places, utilities continue to see DERs as either direct competition to utility-owned resources, or at best, are generally neutral on whether they thrive. Utilities have an absolute monopoly on grid access in their territories. As a result, the utilities hold all the cards in the interconnection process and there is no competitive pressure for utilities to improve the service they provide to interconnection customers.In contrast, customers and DER developers experience very real impacts when utilities fail to meet interconnection process timelines. These include potential loss of financing, loss of opportunity to receive incentives or limited spots in procurement programs, loss of revenue from production, and the risk of failing to meet timelines in customer contracts or power purchase agreements.All of this means that the role of regulators is essential in providing utility accountability to interconnect projects in a timely fashion.Interconnection Delays in the News Highlight the ProblemDelays in the interconnection process are common and translate to higher costs for developers (and thus customers) and can even result in lost projects. In a dramatic example of how severe these delays can be, Xcel Energy in Minnesota this year made headlines for having over 300 projects waiting for interconnection approval.One Xcel customer was told they would have to wait 15 years for interconnection, and an analysis by the Minnesota Solar Energy Industries Association estimated it would take 260 years to clear the backlog at the utility’s current pace of review.Similar issues with interconnection backlogs were reported in Maine early this year (in addition to significant increases in grid upgrade costs for some developers, though these were later rescinded). Interconnection delays in Massachusetts have also received media attention, with a letter from legislators to the Department of Public Utilities describing anticipated waits of over five years for some projects.Unfortunately, while media attention to cases like these helps shed light on the problem, a dearth of public data on the turnaround times for most clean energy interconnection requests makes it more challenging to quantify the situation and pinpoint solutions.The Need for Better Data and Regulatory Follow-ThroughFew regulators require utilities to keep strong records tracking their performance on interconnection timelines. This makes it harder to understand what’s working, what’s not, and what the best solutions are.Commissions who regulate utilities need information to make decisions. Without tracking, it can be both difficult to determine the actual pain points in the process and there can be no accountability for failure to comply with the processes adopted by the regulator.The need for interconnection timeline accountability has two parts: The need for better data on utility interconnection timelines, and follow-through from regulators to require compliance with reasonable turnaround times.Better Data is Essential for AccountabilityIf regulators do want to hold utilities accountable for a fair and efficient interconnection process, then having data on how that process is actually going is essential. Unfortunately, many Commissions do not even have basic requirements for collection and retention of interconnection related data, let alone regular reporting requirements.A recent experience in California illustrates the consequences of failing to adopt clear requirements for the collection and reporting of interconnection data. The California Public Utilities Commission (CPUC) commissioned an outside consultant to conduct an independent evaluation of utility practice in adherence to the state’s interconnection rules, including current performance, successes, and challenges.CPUC BuildingImage: Creative Commons via WikipediaWhat the resulting report found was glaring gaps, disorganization, and inconsistencies in the records of California investor-owned utilities on interconnection. In some cases, records were so bad that it was impossible for the consultant to assess the utility’s compliance. Each of the utilities had different methods for tracking data in place, at times the data that was tracked did not actually comport with the steps required in the interconnection rules, and often certain steps or information were not recorded at all.The California experience illustrates that efforts to understand how the interconnection process is going and whether utilities are in compliance with the processes established in interconnection rules are not always possible if data has not been collected or organized in an accessible fashion. As this case highlights, regulatory commissions need to take seriously the need to clearly define requirements for data collection, organization, and reporting on utility performance in the interconnection process as a first step towards establishing accountability.Multiple Paths to Timeline AccountabilityThe second part of this process is to define the metrics and carrots and/or sticks that can be used to actually hold utilities accountable for a fair and efficient interconnection process. There are multiple different types of metrics that can be used.The most obvious method is to measure compliance with each utility timeline in the interconnection process. This is achievable if high quality reporting requirements are in place, but there are a few aspects of this that regulators will want to consider as they think about timeline tracking.Interconnection procedures are growing in complexity and may have many different timelines that need to be tracked in order to capture the entire process. However, paying attention to only a small segment of the timelines is not likely to reveal whether the process as a whole is working and may even incentivize utilities to use shortcuts in some steps that they then make up for with delays elsewhere.For example, if a Commission applies a metric to “completeness review”, but does not track when a utility puts an application “on hold” while it requests more information from an applicant later in the process, the utility could be incented to expedite the initial completeness review because they know they can just ask for more information later (which essentially slows down the process).Keeping this in mind, for the most part interconnection customers are primarily concerned with how long it takes for the project to be approved to operate and may not care as much about whether Step A goes slowly if Step B makes up the difference. Tracking the total time it takes for a project to go from application to an interconnection agreement or to obtain “Permission to Operate” will provide the greatest insight, but there are also many customer steps in this process that need to be taken into account.In short, regulators will need to be creative in the ways they choose to establish metrics and be aware of the big picture as they do so.Another approach that could be considered for interconnection accountability, either in addition to or instead of timeline tracking, is to think about establishing customer service-based metrics.A recent decision by the Minnesota Public Utilities Commission recently took that approach and in January, the MNPUC fined Xcel Energy $1 million for exceeding a maximum number of customer complaints filed, the majority of which were about interconnection delays.The ruling emphasized that clean energy customers are indeed part of the utility’s customer base and failure to deliver reasonable interconnection times is a failure to deliver satisfactory service.Commissions in other states could take a more expansive view of utility interconnection timelines as a form of customer service and employ similar requirements for satisfactory service as an alternative or additional means of requiring compliance with reasonable interconnection timelines. Such an approach would also give renewable energy customers an avenue of recourse when faced with unacceptable interconnection delays.Ultimately, it is likely that a combination of different metrics may be the most effective way of encouraging utilities to prioritize their role in ensuring DERs are interconnected efficiently.Once the metrics are established, regulators can then decide whether to tie them to financial penalties or other forms of incentives and process changes. The Minnesota Commission’s decision to actually fine the utility for failure to perform certainly had the effect of bringing attention to the issue, but whether it will be enough to really result in a substantial shift in behavior remains to be seen. Regulators may need to consider other methods beyond simple financial carrots and sticks in order to keep the interconnection process flowing smoothly.A Multifaceted IssueData on and enforcement of interconnection timelines is one key element of the interconnection reforms that will be needed to enable efficient deployment of distributed clean energy projects. But there are many others.The first article in this four-part series discussed why a significant rethinking of how interconnection reviews are conducted will be needed to make the process more streamlined and efficient as the number of solar and other distributed energy interconnection requests grows rapidly. The second explored how interconnection policies need to evolve to effectively deal with energy storage interconnection requests and unlock the full potential of storage on the grid.The final article in this series will explore how improved data transparency on grid conditions will also be imperative to improving the interconnection process. Such data can help developers select optimal locations for new clean energy projects and tailor their operation to grid conditions.While there are a number of aspects of meaningful interconnection reform, there are established solutions for each that regulators can draw from. The key will be for regulators to be proactive in tackling these issues so that interconnection does not bottleneck—and can enable—clean energy growth.Gwen Brown is communications director at the Interstate Renewable Energy Council. Sky Stanfield is an attorney for IREC and partner at Shute, Mihaly & Weinberger. This article is the third in a four-part series on interconnection reform. In the next article, we will explore the need for increased data access and transparency.The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingCanadian hydropower dam to be coupled with 180MW of lithium-ion battery storage

TransAlta has planned to start construction on the storage facility in March 2023 and to complete it within nine months. The 180MW battery facility is designed to be charged by the existing Ghost Hydroelectric facility when demand is lower. February 1, 2022 Emiliano BelliniCanada-based power provider TransAlta Corporation recently submitted an approval request to the Alberta Utilities Commission (AUC) for its WaterCharger battery storage project, which would connect 180MW of battery storage capacity to its 51MW Ghost Hydroelectric Dam located at the confluence of the Bow and Ghost Rivers, in the Canadian province of Alberta.In December, TransAlta had published an environmental evaluation, an environmental protection plan, and a noise impact assessment on the project, and the three documents were now added to the approval proceedings. The reports are intended to bring clarity to issues such as the risk of battery fires, the risk of leaching or leaking from the batteries, noise concerns, and the environmental impact of the construction of power lines.“Our initial assessment indicates that no additional power lines are needed and the connection for the facility would be limited to modifications within the existing substation,” the company said in a recent statement to its stakeholders. “However, given TransAlta is not a transmission facility owner in this area, we are currently working with the Alberta Electric System Operator (AESO) to identify, study, and verify feasible transmission voltage connection options to connect WaterCharger to the Alberta Interconnected Electric System at, or adjacent to, the Ghost substation.”In the environmental evaluation, the company specified it wants to use lithium-ion batteries and that a battery sub-chemistry of lithium-iron phosphate (LFP) is currently being considered. ” The project will consider various technical factors when selecting the final battery vendor, including safety, life span, performance, and cost,” the document reads. “The size and number of modular battery units is expected to vary by vendor, with the project expecting up to 220 units to be installed. The final layout and number of battery units will be confirmed once the battery manufacturer is selected.”The storage system will include bi-directional inverters, protection equipment, direct current (DC) and alternating current (AC) circuit breakers, waveform filter equipment, equipment terminals, and a connection cabling system. The modular battery units are each expected to measure 7 x 2 x 2 m and to embed a heating, ventilation, and air conditioning (HVAC) system.TransAlta plans to start construction on the storage facility in March 2023 and to complete it within nine months. The batteries will be remotely operated by TransAlta’s Hydro Control Centre located in Calgary, approximately 50 km east of the hydropower dam, over their 25-year lifecycle. This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingSunrise brief: Daimler, NextEra, and BlackRock fund investment in EV and hydrogen trucks and charging stations across the US

Also on the rise: Nova Scotia utility proposes net-metering fee. Research into how rooftop PV systems may affect air and building temperature in urban environments vice versa. Vanadium redox flow battery in microgrid project. Important step for Indiana solar: Utility’s net metering calculation overturned in court. Maxeon to offer IBC solar panels in the US.

Continue readingThe relationship of PV and metal roofs: Service life comparisons

In the first of a three-part whitepaper series, S-5! and the Metal Construction Association take a look at symbiotic nature of solar systems and metal roofs, exploring it from a system lifespan perspective. February 1, 2022 Tim SylviaS-5!, a manufacturer of metal roof attachment solutions with non-penetrative solutions for attaching solar systems to metal roofs, has joined with members of the Metal Construction Association (MCA), an organization of manufacturers and suppliers looking to promote the use of metal in construction, to release a three-part series of white papers examining the relationship between solar and metal roofs.The papers, which feature contributions from MCA members and S-5! staff, are all available through MCA’s Metal University online learning service, and part one focuses on solar and roof service life compatibility, a topic that the authors perceive to be commonly-overlooked.The paper begins by outlining the idea that a rooftop solar system and the roof housing it are inextricably codependent and must be regarded as a single asset. Because of this codependency, the authors lay out that consideration must be given to the durability, longevity and service-life compatibility aspects of the roof to the PV system, as oversight of this relationship can compromise the PV value proposition and grossly diminish the financial return of the system.What makes the relationship particularly interested is that, with the exception of more specialized and expensive alternatives, metal is the only roof material type that will match or outlive the expected 30-year service lifetime of a solar array. Most metal roofs have a 40-year warranty, and a prior MCA study found that metal roofs can achieve a 70-year lifetime in most non-coastal US environments. This helps to mitigate the higher initial cost that metal roofs present over alternatives, since the PV system will have to be removed and reinstalled entirely once, or multiple times over its lifespan, depending on the age of the roof when solar is installed.Solar installation costs on metal roofs are typically lower than other roof types, even though they require the use of specialized mounting and fastening equipment that doesn’t penetrate the roof. The authors also outline that installation times on metal roofs are generally shorter, and the whole process can improve financial returns on a solar system by 10-15%.The authors present metal roofs and PV systems in a similar light, as both assets present a high initial cost, long expected service life, and economically prudent payback. Payback presents itself in the form of net-metering reimbursement and bill savings for solar systems, and as lower lifetime maintenance and replacement costs for metal roofs.The cost of roof replacement includes the labor and materials cost of the new roof, the labor costs of dismantling and reinstalling the solar PV array, the cost of lost electricity production while the system is down, and the replacement of wiring and any damaged components during the process, which is not a guaranteed cost but is a possibility.The authors claim that aggregated sum of those costs can approach the original cost of the solar system, and installing a new roof on roof types other than metal before solar is mounted, even if the existing roof is only at 50% or less of its useful life, is often recommended. Since this same recommendation would only apply to metal roofs already 10-30 years old, depending on if the customer is focused on roof warranty or total expected life, the study presents maintenance and replacements costs as the greatest lifecycle benefit for installing solar on metal roofs.When taking a look at the full financial value, the report states that the solar system and the roof should be considered as a single asset. Typical financial analysis offered at the point of sale for a solar system presumes the roof will last for the entire life expectancy of the solar system, and the commonly-presented assessment that a system will become cash-positive within the first seven years of operation is founded on this presumption. So are the promises that a system will deliver rates of return in the range of 15-40% over a 30-year period.In the next two installments of the comparison series, S-5! and MCA analyze the common types of PV mounting systems for metal roofs, with a look at associated risks and pros/cons of each, and the critical technical factors for mounting solar PV systems specific on metal roofs.This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingNova Scotia Power net-metering fee may stall industry in its tracks

Sierra Club Canada calls on Nova Scotians to demand energy democracy after the utility proposes to charge a premium on net-metered solar installations. January 31, 2022 Anne FischerNova Scotia Power recently announced a proposal to charge fees to customers who sell renewable power back to the grid. According to a report by The Canadian Press, Nova Scotia Power president and CEO Peter Gregg said that without the fee, homeowners who generate their own electricity using solar panels are currently being subsidized by other customers. Gregg justifies the fee, saying that it will ensure fairness for all customers.Nova Scotia Power, a subsidiary of Emera Inc., applied to the provincial regulator last week to charge solar customers about $8 per kilowatt of electricity. For a typical 10kW net-metered installation, the fee would amount to $960 per year, essentially doubling the payback period for solar customers who currently take in about $1,800 in annual savings.“Nova Scotia Power is acting like it just found out it has to get off coal, and now they want Nova Scotia residents to foot the bill,” says Tynette Deveaux with Sierra Club Canada Foundation’s Beyond Coal Atlantic campaign. “They’re treating clean renewable energy as a luxury that the company can’t afford—and we know that’s not true.”Nova Scotia’s solar industry is in its early stages, with only about 4,000 installations to date. Opponents of this proposal say it could decimate the industry before it’s even started, and it is not in alignment with the Sustainable Development Act passed in 2019. The Act calls for carbon levels in 2030 that are 53% below what they were in 2005; and net zero by 2050. Since then, the provincial government announced commitments to power all government offices with 100% renewable energy by 2025 and to close coal plants by 2030.“This announcement makes it very clear we need to work together to break Nova Scotia Power’s monopoly and make it possible for municipalities and individual homeowners and businesses to participate in a rapid transition to clean renewable energy—without being penalized,” said Gretchen Fitzgeral, Sierra Club Canada’s National Program Director.In a media release issued on Friday, “Time to Break Up with Nova Scotia Power“, Sierra Club Canada announced its Power to the People campaign, calling on Nova Scotians to demand energy democracy.This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingDaimler, NextEra, and BlackRock to deploy nationwide US electric trucking network

An initial investment of about $650 million divided evenly among the group will launch the deployment of EV and hydrogen medium- and heavy-duty trucks and charging stations across the US. January 31, 2022 Ryan KennedyDaimler Truck North America, associated with the Mercedes-Benz brand, NextEra Energy Resources, and BlackRock Renewable Power announced the signing of a memorandum of understanding to develop a joint venture in the design, development, installation, and operation of a nationwide charging network for medium- and heavy-duty battery electric vehicles and hydrogen fuel cell vehicles.Operations of the joint venture are expected to begin this year. Initial investment in the venture included an evenly split $650 million from the three parties.Lack of publicly available EV charging infrastructure for commercial fleets, especially in long-haul operations, remains one of the most significant hurdles to the electrification of trucking, said Daimler. The parties shared plans to deploy a network of charging station routes along the east and west coasts and in Texas by 2026. The plans call for leveraging existing infrastructure and amenities while adding greenfield sites in anticipation of a rising customer base. The first phase of construction is planned for 2023, said Daimler. Image: Daimler The project will initially focus on medium- and heavy-duty battery EV, followed by hydrogen fueling stations. The sites are also planned to be accessible to light-duty passenger vehicles.NextEra Energy Resources, a global solar and wind generator, has significant investments in EV charging infrastructure, and will bring experience in optimizing renewable energy, resiliency and grid integration. The group of three said it seeks to invest over $9.5 billion in total commitments across 350 solar and wind projects, as well as battery energy storage and charging infrastructure.Daimler plans to begin the production of the battery electric freightliner eCascadia and eM2 in 2022-23, and additionally builds walk-in vans, school buses, and other fleet vehicles. The automaker partnered with Portland General Electric to build the nation’s first public charging site for commercial electric vehicles.Investment manager BlackRock has over $65 billion in client commitments. Its renewables arm is one of the largest renewable power equity investment platforms globally. “The commercial transportation sector is a significant contributor to carbon emissions and we firmly believe that decarbonization of transportation will be a critical societal focus for the next decade.,” said David Giordano, head of BlackRock’s Renewable Power Group.This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingMicrogrid project using vanadium redox flow battery

“Climate conditions increasingly threaten the continuity of essential services that our customers expect and deserve from us, which is one of the many reasons we are so focused on innovation and technology,” said SDG&E CEO Caroline Winn. “There is a critical need to develop breakthrough solutions like zero-emissions microgrids to not only minimize disruptions, but to also support the transition to a cleaner, safer and more reliable energy grid of the future.”Different from more prevalent stacked lithium-ion battery cells, VRF batteries consist of tanks of liquid electrolytes and pumps that charge and discharge electrons to the grid. According to the U.S. Energy Department, VRF technology has several upsides including the potential to store MWh of power in simple designs, the ability to discharge power for up to 12 hours at a time, and the fact that VRF batteries do not present a fire hazard and use no highly reactive or toxic substances, can sit idle for long periods of time without losing storage capacity, and more. Downsides include the fact that VRBs generally have lower energy densities than other battery types (although increased energy density would help reduce costs and broaden applications), the standby current drain can lead to power loss, the technology’s small operating temperature window requires the use of air conditioning systems that can result in significant energy losses, and the cost of the vanadium electrolyte.During the pilot, the batteries charged when solar energy was abundant and discharged during peak hours to meet demand.The microgrid demonstration project was completed late last year and included two successful tests. One was a seamless transition in which customers did not experience any loss of power when they were transitioned to the microgrid for electric service. The other was a black start, where microgrid operators established and sustained service after a complete loss of power. Customers experienced a momentary outage before they were transitioned to the microgrid, which operated in island mode separate from the power grid. The microgrid provided energy service as expected, even on a cloudy day when solar power output was not optimal.SDG&E began operating the first utility-scale microgrid in America in 2013 in Borrego Springs and is currently in the process of upgrading it to run on 100% renewable energy. The utility is building four additional microgrids and is on track to integrate about 145MW of utility-owned energy storage with the local grid in 2022.

Continue readingIndiana utility’s net metering calculation overturned in court

An attempt to circumvent the state’s already-limited net metering guidelines has been overturned in court, in a decision that distributed generation advocates see as an important step in strengthening the state’s market. January 31, 2022 Tim SylviaIt has been nearly five years since Indiana Senate Bill 309 was signed into law as Senate Enrolled Act 309 (SEA 309) by Gov. Eric Holcomb in May 2017, a law which significantly reduced the rates that the state’s net metering customers received and which contributed to the relatively limited rooftop solar and larger distributed generation (DG) market within the state.SEA 309 phased out retail rate net metering and replaced the former 1:1 kilowatt-hour bill credit with a much smaller credit based on 125% of the utilities wholesale rate. That change in compensation resulted in a bill credit that is approximately 70-80% lower than what customers receive for retail rate net metering.While this changed the level of compensation that solar homeowners would receive, it did not change the method by which the compensation rate would be applied. Homeowners would still be credited at that rate, multiplied by the kWh difference between the electricity that they imported from the grid and the electricity they exported to the grid.One of the state’s investor-owned utilities, CenterPoint, attempted to change how the bill credit was calculated on customers’ monthly bills by eliminating this netting altogether, replacing it with a tariff provision that charged DG customers the retail rate for every kWh delivered by the utility and credited customers at the much lower 125% of wholesale rate for every kWh of energy delivered by the customer to the grid.This change was initially approved by Indiana Utility Regulatory Commission, but was challenged in the Indiana Court of Appeals by a broad coalition of solar companies, environmental and consumer advocates, led by the Indiana Office of Utility Consumer Counselor. On January 28, the coalition won their appeal, and the decision was overturned.CenterPoint’s proposed calculation had the potential to be approved and become the calculation methodology used by all investor-owned utilities within the state. Advocates argued that if the approval was achieved, the tariff provision was expected to drastically slow down rooftop solar adoption in the state.“Fair, accurate compensation is the key to expanding residential solar,” said Vote Solar’s Regulatory Director of the Midwest, Will Kenworthy, who served as an expert witness in the proceeding. “CenterPoint’s proposal was neither fair nor accurate, and I’m glad the court recognizes that. Monthly netting makes sense and is a win for Indiana ratepayers who use their hard-earned money to add more solar to the grid.”Where does Indiana stand?With nearly 1,350MW of solar in all forms installed in the state thus far, according to the Solar Energy Industries Association (SEIA) and Wood Mackenzie, Indiana has been by no means a national leader in supporting the resource, but is one of the handful of states to have more than 1 GW of installed capacity. Over the next five years, however, the state is expected to add 5,971MW of new solar, good for 4th in the nation over that period, though the vast majority of these additions are expected to come on the utility-scale side, as the state’s utilities begin to retire their expansive coal fleets.To date, the state’s residential solar market has been relatively tame, as illustrated by the graph below, and Indiana’s newfound love for large-scale solar likely won’t reflect an increased commitment to installing DG. Image: SEIA/Wood Mackenzie While the recent CenterPoint decision prevented further harm to the state’s DG industry, advocates have pointed out that there is still considerable work to be done if that industry hopes to achieve the same success that large-scale solar has found in the Hoosier State.“This decision comes at a critical time for the Indiana solar industry,” said President of Indiana Distributed Energy Alliance, Laura Ann Arnold. “Solar companies testified that CenterPoint’s proposal would have a devastating impact on both solar/DG providers and their customers. Because there are other similar tariffs already approved or pending, this decision has potential statewide impact much larger than SW Indiana where CenterPoint operates.”This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue readingThe panel and the city

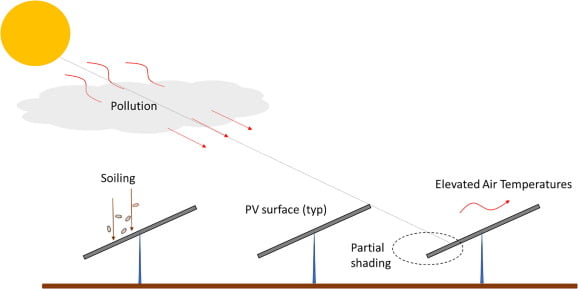

Researchers have investigated how rooftop PV systems may affect air and building temperature in urban environments and, conversely, how the urban heat island (UHI) effect may have a negative impact on PV system performance. Their work considered urban air temperature, urban air pollution, the partial shading of the PV system, soiling, building heating and cooling loads, and outdoor shade. January 31, 2022 Emiliano BelliniScientists from Arizona State University have conducted research to evaluate how urban settings affects the performance of PV systems and, conversely, how PV systems affect their surrounding urban environment.The researchers explained that solar modules are sources of radiative heat for all structures beneath them and, at the same time, are convective heat sources that can considerably increase the temperature of the ambient air in cities, contributing to the so-called urban heat island (UHI) effect, which occurs when cities absorb and retain heat, due to a high concentration of pavements, buildings, and other surfaces.Their analysis was based on a review conducted on 116 scientific articles for review, through which seven different types of PV-urban climate interactions were identified. For the impact of the urban environment on the PV system, it considered urban air temperature, urban air pollution, the partial shading of the PV system, and soiling. To evaluate how the solar array affects the urban environment, it took into account urban air temperatures, building heating and cooling loads, and outdoor shade.Impact of urban environmentThe scientists found that all analyzed parameters have a “non-trivial role” in affecting PV power generation, although the impact of the elevated temperatures caused by the UHI is difficult to quantify, as it varies seasonally and diurnally.Air pollution was described as one of the main factors reducing PV performance in urban environments, with power yield spanning from 5 to 15%. “Particle deposition on PV panels results in absorption and backscattering of insolation, reducing the transmittance of the panel surface,” the academics explained. “While this effect is most notable in highly polluted urban environs, it can also manifest itself in rural installations downwind of urban and industrial pollution sources.”Schematic representation of the aspects of the urban environment that influence PV performance.Image: Energy and Buildings, Elsevier, Creative Commons license CC BY 4.0, https://bit.ly/3AKRH20As for the effect of soiling, the scientists said that cities often have impervious surfaces such as roads, parking lots, and buildings, which are not detrimental to PV power generation, as these are less prone to high atmospheric loading of particulates from soils. “Nevertheless, other sources of soiling in urban environments, including soot from vehicles and industry and dust from construction activities may significantly contribute to soiling of PV,” they further explained. “However, research suggests that periodic cleaning of PV surfaces, either from precipitation or from routine maintenance can maintain the generation penalty of soiling at less than 10%.”The shading effect, which for PV systems in urban environments is often unavoidable, is described in the study as the most significant issue affecting PV system performance in dense urban areas. “The average effects of this penalty can be on the order of 20%,” the researchers emphasized. “However, careful design of urban installations, accounting for current, and potential future shading, can greatly reduce this issue.”Impact of photovoltaicsThe analysis of how PV impacts the urban environment showed conflicting results and highlighted the need for further studies, although it confirmed that solar panels have an influence on urban energy balance and affect urban air temperatures.Their thermal and electrical characteristics are key parameters to assess this influence. The shadow that the panels can produce on the surrounding areas and air gap between the panels and the surface beneath them, which results in convective heat transfer from both surfaces of the PV panel to the air, were identified as two main factors increasing air temperature. “Further controlled empirical studies and validated modeling efforts are needed, particularly because the conflicting studies differ not simply in magnitude of their projections, but in terms of the sign of the anticipated impact of PV on air temperatures,” they further explained.Their analysis also showed that current scientific literature is also divided on how rooftop PV positively affects the energy performance of buildings by reducing the need for cooling at night, taking into account that solar panels can cool down faster than the roof cover or other architectural elements. “The magnitude of this savings depends significantly on the assumption of the albedo of the roof surface being shaded, the level of building insulation, and other building construction and operation characteristics,” the also stated.“As our synthesis suggests, photovoltaics in urban settings offer many benefits, but also are fraught with challenges — both in terms of how the urban environment affects their performance and how they can adversely affect the urban environment and energy consumption for air conditioning,” they concluded. “These complexities are often difficult to convey to the general public or to local/regional decision-makers who are typically seeking simplified summaries regarding the evaluation of technologies.”Their findings were presented in the paper “Photovoltaics in the built environment: A critical review,” published in Energy and Buildings.This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Continue reading