A week prior to that, vanadium redox flow battery (VRFB) manufacturer Stryten Energy was visited at its offices and factory in Georgia by US Representative for Georgia’s 6th congressional district, Rich McCormick.

In both cases, the companies involved manufacture their products within the US: ESS Inc’s factory in Wilsonville, Oregon, already has an annual production capacity of 800MWh, while Stryten Energy – which also makes advanced lead acid and lithium devices – has just cut the ribbon on a project featuring the first-ever VRFB made at its Georgia site.

“What I saw here at ESS only reinforced the importance of the clean energy provisions that I fought to get passed in the Inflation Reduction Act — strengthening domestic supply chains and supporting clean technology innovation,” Wyden said during his visit to ESS Inc.

Regular readers will recall the rocky road to finally getting the IRA across Joe Biden’s desk for the president to sign it into law. Once it passed, one of the more celebrated aspects, as far as energy storage is concerned, was the introduction of investment tax credit (ITC) incentives for standalone storage facilities.

However the legislation was also aimed at stimulating domestic manufacturing and development of those technologies as well as downstream deployment, including higher rates of ITC and other tax credits for energy storage projects that utilise domestically produced components.

According to the American Clean Power Association (ACP), a total of US$270 billion in clean energy projects and manufacturing have been announced, and 85GW of planned manufacturing facilities, in the year since the IRA passed.

As reported by Energy-Storage.news yesterday, research by the national trade group found that 14 manufacturing facilities relevant to utility-scale storage, from lithium hydroxide and battery cell production to complete system integration, are included among those investments.

While naturally the most activity is to be found around lithium-ion, the main incumbent technology for both energy storage and electric vehicles (EVs), the US Department of Energy (DOE) and by extension the government have long talked about the need for cost-effective long-duration energy storage (LDES) technologies.

Flow batteries are among those technologies, and Secretary of Energy Jennifer Granholm has previously talked up the potential of flow batteries for grid storage, and in fact has previously also visited ESS Inc’s headquarters.

“Expanding the domestic manufacturing and global deployment of innovative new clean energy technologies, such as iron flow batteries, were key goals of the Inflation Reduction Act. American clean technology manufacturers are already delivering against these goals, creating jobs and secure supply chains here in the US to build the global clean energy future,” Dr Christopher Saldaña, director of the DOE’s Advanced Materials and Manufacturing Technologies Office (AMMTO), who also visited ESS Inc, said.

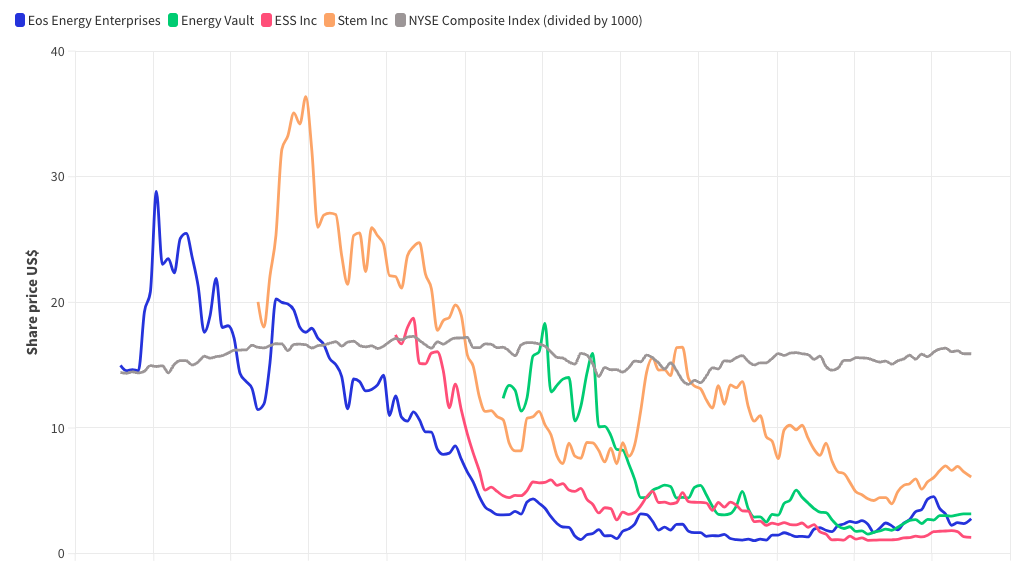

ESS Inc is among a number of energy storage-focused companies to have listed its shares publicly following a special purpose acquisition company (SPAC) merger in the last couple of years. Like some of the others, it has seen its share price plummet since going public, as noted in a special report from Energy-Storage.news today (Premium access required).

However, the company said in reporting its most recent financial results that it has sufficient funding to stay in business, and that it has dramatically improved its revenue recognition ability as orders and deliveries start to stack up. It also claimed the IP it holds for the iron flow battery will be safe “for years to come”.

Stryten’s first Georgia-made VRFB

On Representative Rich McCormick’s visit to Stryten Energy’s HQ in Alpharetta, Georgia, the politician made similar remarks commending the company’s battery development being “100% domestic” and for being a “large employer of hard-working men and women right here in Georgia’s 6th district”.

A few days before McCormick’s visit on 9 August, Stryten Energy and utility company Snapping Shoals EMC cut the ribbon to inaugurate a VRFB energy storage demonstration project. The project was announced at the beginning of this year.

It is relatively small, at 20kW/120kWh. It was designed that way specifically to fit the needs of the utility so that the pair can conduct testing of the VRFB to deliver applications requiring more than 6-hour durations of storage, a Stryten Energy representative told Energy-Storage.news.

Ribbon-cutting for the Stryten Energy-Snapping Shoals EMC demonstration project. Image: Stryten Energy.

The system can simulate “almost any operating schedule,” to be gauged for its compatibility to meet DOE National Laboratory definitions of the tech’s compatibility with renewable energy integration and front-of-the-meter (FTM) and behind-the-meter (BTM) applications alike.

“The project at Snapping Shoals EMC is testing a wide range of applications such as energy cost control, peak shaving, avoiding curtailment and renewable integration,” the spokesperson said, adding that although the experimental nature of the demonstration means the VRFB will be tested for both FTM and BTM applications, “future batteries of this scale would be mostly applied behind-the-meter”.

Stryten Energy, one of the few vanadium flow battery providers in the US market – Invinity Energy Systems is probably the most high profile other, with a range of companies such as ESS Inc or Redflow providing flow batteries with different electrolyte chemistries.

“The Department of Energy has indicated that flow batteries particularly match up to the needs of long-duration energy storage because the discharge times from a few hours to a few days can be achieved simply by adjusting the electrolyte volume to meet the application’s needs,” the spokesperson said.

“VRFB systems support a near-infinite cycle life with proper maintenance and high-capacity stability, lasting more than 20 years without the electrolyte losing energy storage capacity. With such a long lifespan, these battery systems can match the lifetime of the renewables they are paired with, thus providing a sustainable energy storage solution for on-demand power needs.”

Last August, a few days after the IRA’s passing, Energy-Storage.news posed the question ‘Will the US Inflation Reduction Act boost demand for flow batteries?’ in an Editor’s Blog.

Our publisher Solar Media is hosting the 10th Solar and Storage Finance USA conference, 7-8 November 2023 at the New Yorker Hotel, New York. Topics ranging from the Inflation Reduction Act to optimising asset revenues, the financing landscape in 2023 and much more will be discussed. See the official site for more details.

Continue reading