The new BESS asset is the second to be approved for the site. The organisation is already constructing a 100MW/200MWh BESS, which aims to provide further stability and facilitate the increasing number of variable renewable energy technologies being connected.

Commenting on this, Russell Slaughter, head of project development at Alinta Energy, said the project will specifically “support the introduction of solar and other intermittent renewable energy sources into the existing network”.

“With the continued increase of intermittent energy sources into the state’s main electricity network, the need for dispatchable energy sources that can react quickly to changes in the electricity market is increasing,” Slaughter added.

Alinta said the project is expected to be completed by October 2027 and is being delivered by Shanghai Electric Power Design Institute (SEPD) Australia, a local subsidiary of SEPD, which is in turn owned by Power Construction Corporation of China (POWERCHINA), and Australian solar PV and battery provider Sunterra.

Western Australia CIS tender opens

In other news, Western Australia’s first Capacity Investment Scheme (CIS) tender opened yesterday (22 July). The tender aims to secure 2GW of clean dispatchable capacity across the Wholesale Electricity Market (WEM).

Projects entering into the CIS Tender 2 must have a minimum storage duration of two hours, a minimum size of 30MW, and meet all eligibility criteria. The tender will close on 12 August 2024.

Salim Mazouz, branch head of the energy division at the Department of Climate Change, Energy, the Environment and Water, told Energy-Storage.news in an exclusive interview available for Premium subscribers that energy storage will be a key element of Australia’s energy transition. It is also a technology that the CIS aims to support.

“The more variable renewables we push in, the more there’s opportunity for arbitrage, for storage, and as that accelerates the retirement of thermal assets, that also potentially opens additional revenue sources in terms of some of the ancillary services that batteries and also storage more broadly can bid for.”

Japanese government selects battery aggregators for JPY9 billion subsidy scheme

It is being run alongside a scheme to also increase demand response participation from existing resources, which may also include things like air-conditioning units, onsite power generation from solar, industrial production units and battery storage systems.

The scheme is being administered through the Sustainable Open Innovation Initiative (SII), set up by the government Ministry of Energy, Technology and Industry (METI) and its Agency of Natural Resources.

SII’s other areas of focus include zero-energy buildings and homes (ZEB, ZEH), energy efficiency programmes, building decarbonisation, electrolysers, microgrids and more.

For the scheme ‘Support for the introduction of energy storage systems for home, commercial and industrial use’, the Japanese government has allocated around JPY9 billion (US$57.48 million) from the FY2023 supplementary budget.

The idea is that behind-the-meter (BTM) distributed batteries installed at homes, commercial premises and industrial facilities can be used to adjust supply and demand on the electricity grid.

This will be useful especially in managing peak demand, and also in enabling greater utilisation of renewable energy capacity. Internet of Things (IOT) devices will be placed onto distributed energy storage and demand response resources to coordinate their aggregation.

Earlier this month (2 July), a list of nine aggregators was published, and a few days later (12 July), an approved list of residential energy storage systems featuring 95 different models from 14 manufacturers was published.

Aggregators were selected either for home battery systems or C&I systems, with no companies selected to do both scales of BESS.

Up to JPY300 million per C&I project

One of the chosen C&I aggregators, Eneres Power Marketing, said on Friday (19 July) that companies could apply for subsidies towards battery storage equipment purchases and project construction costs by entering a demand response (DR) agreement with approved aggregators.

Subsidies will fund up to one-third of the capital expenditure (Capex), with up to JPY300 million available per project for C&I batteries. The majority of the total JPY9 billion funding is, however, expected to go towards residential systems, with about JPY1.5 billion for C&I.

The application period is open until 6 December, but it could close sooner in the event that funding is fully allocated.

The full list of aggregators can be found here (in Japanese).

See the residential energy storage system product list, as well as a grant calculator tool (in Japanese).

Japan, which targets renewable energy representing 36% to 38% of the electricity mix by 2030 and 50% by 2050, is seeking to promote energy storage technologies as an enabler of that goal. At the same time, electricity demand forecasts for the coming years have risen due to the expected increased adoption of AI and the growth of data centres.

The market for utility-scale BESS in Japan has opened up through policy and regulatory support, energy trading opportunities, an early-stage ancillary services market for frequency regulation, and a recent low-carbon capacity market auction for which batteries and pumped hydro energy storage (PHES) were eligible.

Italy’s Redelfi spots US BESS opportunities, US’ Bluestar Energy Capital goes in opposite direction

The pair is targeting the development of up to 2.4GW of battery energy storage system (BESS) projects in the US by the end of 2026. Five early-stage development projects totalling 920MW have already been acquired in four states: Texas, Tennessee, Alabama, and Kansas.

Redelfi is listed on the Italian Stock Exchange’s Euronext segment. In addition to developing renewable energy and storage assets, it has a business line in digital technologies for marketing and other sectors.

It acquired its five initial projects from BESS Power Corporation, a US-based developer that the Italian company founded, together with JV partner Elio and another Italian publicly listed developer, Altea Green Power. Publicly announced project activity has included the early 2023 acquisition of a 400MW project in Texas from Aelius Solar Corp.

Earlier this month, Redelio Renewables approved a US$20 million budget over the next four years for the development of those projects, while Redelfi said the sale and handover freed up BESS Power Corporation to focus on more advanced-stage projects.

Redelio is 50% owned by each of Redelfi and Elio, while the Italian partner holds 65% of BESS Power Corporation to Elio’s 30%, with the outstanding 5% stake held by an Italy-based financial consultant Paolo Siniscalco.

European potential

It’s not perhaps surprising that European players like Redelfi are seeing fertile opportunity in the US, where deployment records across the utility-scale segment are consistently surpassed on a quarterly basis.

Redelfi’s Italian home territory is also a fast-rising battery storage market, and last week, the company said it had added six development projects to its portfolio in the country, totalling 500MW.

It did this through another 50:50 JV, called Ribess, formed with fellow Italian developer InfraLab. The pair target bringing their portfolio online within three years, Redelfi said last Thursday (18 July), the day after it announced the US JV’s progress.

On a somewhat related note, US-headquartered renewable energy investment company Bluestar Energy Capital has launched a new development platform, Noveria Energy, to work on European BESS projects.

Noveria is already putting a pipeline of development projects in Germany, where the platform will initially be focused, through interconnection and permitting processes. Bluestar Energy Capital said the pipeline totals more than 2GWh of projects.

Bluestar Energy Capital (BEC), was founded in 2022, the year Redelfi listed on the Italian Euronext exchange, and to date has been working to develop projects in the US and Australia.

Germany and Italy have been identified by various analysts and industry experts as being among the two European markets likely to see the strongest growth in energy storage deployment in the medium-term.

In the recently-published 2024 edition of the Renewable Energy Country Attractiveness Index (RECAI) from Ernst & Young (EY), Germany was selected as the fifth most appealing BESS market globally, and Italy sixth.

Drivers for those markets include the Italian grid operator Terna’s intention to tender for up to 71GWh of energy storage by 2030, and German regulators opening up day-ahead and intraday electricity trading markets to BESS assets.

Enel North America CEO: ‘US BESS industry ultimately needs local manufacturing’

Romanacci previously headed up Head of Enel Green Power North America, the clean energy IPP arm, before taking his current position in December 2023. The larger group he now leads also provides demand response, e-mobility solutions and services, energy trading, advisory and consulting services.

Our interview centres around the firm’s grid-scale BESS activity in the US and his views on the major trends affecting it. Most notably, he says the industry ultimately needs local manufacturing to overcome supply chain uncertainty and that further clarity is still needed for the standalone energy storage investment tax credit (ITC).

Enel North America overview and positioning

Energy-Storage.news: Can you give us an overview of Enel North America’s operational BESS portfolio and its pipeline?

Paolo Romanacci: Enel operates 9 utility-scale BESS with another 5 under final commissioning or construction, all in ERCOT. These 14 sites represent about 1.5 GW of capacity. We have stand-alone and hybrid renewables-plus-storage projects in development in markets across the US.

How much of the BESS development and operational process do you do in-house versus contracting out? Particularly around early-stage development, project design, EPC and optimisation/route-to-market.

Enel does all early-stage BESS development and siting in-house, capitalising on our years of experience in the field. Early project design is also done in-house along with much of our market strategy, while for EPC we work with leading technology providers. Our operations and maintenance is a combination of service agreements with BESS integrators and in-house personnel.

What do you think are the biggest challenges for the US BESS developer-operator industry as a whole in the coming few years?

Years-delayed interconnection queues, along with rampant supply chain uncertainty, are hindering BESS project development. The US BESS industry is still a nascent industry with growing pains. What we ultimately need is increased domestic manufacturing to enable a fast, localised industry, but that won’t happen overnight.

In the interim, we need rules that offer greater supply chain clarity and certainty. We also need regulations that consider the flexibility and the many grid benefits BESS offers compared to conventional energies and, in return, compensate developers and operators fairly.

And what are the solutions that you at Enel are bringing to the market?

Enel’s scale enables us to navigate these headwinds and play a role in leading the BESS industry as it becomes a major component of the energy sector. Enel has tremendous in-house expertise and global relationships with leading suppliers.

We have a diversified BESS development pipeline across geographies, energy markets and plant configurations (standalone or co-located). We also possess the digital sophistication necessary to control our BESS solutions in compliance with grid rules, which improves grid reliability and the BESS unit’s performance and ultimately increases return on investment.

ERCOT, Texas market

Regarding the ERCOT market, what are the learnings you can share from being the biggest BESS operator there?

ERCOT has some of the highest BESS penetration in the world, but it’s still a young market. That means all participants are learning as we go. Developers, suppliers and grid operators are constantly sharing information and evolving. For example, we’re eager to see the outcome of ERCOT’s Real Time Co-Optimisation and Batteries program to more adequately value the unique role of BESS in the energy market.

Our experience as the largest BESS operator in ERCOT reaffirms how critical this technology is to grid operators. As we face increasing load from electrification and data centres, more frequent extreme weather events, and more renewables deployment, BESS plays a unique role in preserving reliability and affordability. When it counts, BESS steps in—Enel is frequently deploying ancillary services to stabilise the grid in periods of high demand.

Staying on ERCOT, what is your strategy to deal with market saturation which appears to be starting to happen already?

As we consider the significant projections of growth in both load and intermittent generation in ERCOT, it’s clear that there’s still a lot of room for new BESS projects. But we need non-discriminating market structures and favorable price signals for energy storage to reach the next level.

In the meantime, we manage the increasingly saturated environment by diversifying our value streams through qualifying for as many BESS-eligible markets as possible. Enel also uses our own proprietary bidding optimisation software and in-house trading desk, which offer a competitive advantage.

Augmentation, BESS providers and wider US market trends, including tax credit incentives

Augmentation is a big topic – have you started to augment BESS projects already, and what can you say about that process?

Augmentation isn’t part of our strategy at this time. However, it’s a young and evolving market, and we’re prepared to evolve with it if needed.

How do you approach choosing a BESS technology provider? It is a highly competitive and fast-moving space, with market forces and US policy measures moving prices around frequently recently. Which BESS providers have you primarily used to date?

At our scale, we don’t work with a single exclusive provider but regularly engage with many of the leading technology providers while monitoring both the regulatory and technology landscape.

The US BESS market appeared to suffer a blip in Q1 2024 – installations were down as well as revenues for most technology providers focused on the US – what would you attribute this to?

I can’t say whether these phenomena are specific to Q1 2024, but the industry is still immature and experiencing growing pains. Insufficient price signals, supply chain constraints, permitting challenges—these are things that can impact the industry’s rate of growth. At the same time, the long-term trajectory is clear: the value of BESS is undeniable and will be an increasingly crucial part of the energy mix.

Standalone storage investment tax credit (ITC): can you comment on how much you have utilised this for projects, how much of the investment it has been able to cover and whether the new guidance on the domestic content adder has given the necessary clarity to leverage it?

Young technologies need a thorough incentive structure to achieve meaningful scale. That’s certainly true with BESS. We welcome both the stand-alone investment tax credit and all ITC and PTC adders, including for domestic content, as necessary incentives to speed up the growth of storage technologies and allow more certainty for investors.

Notice 2024-41 offered a more simplified and streamlined approach to qualification; however, our sense is that there won’t be sufficient domestic content for stand-alone storage projects until more cell production is achieved in the U.S. We’ve also found that some of our suppliers prefer the previous direct-cost method that in some cases may increase the likelihood of bonus eligibility.

The Inflation Reduction Act is an enormously complex and consequential law. Enel is eager to continue leveraging IRA policies to help build a modern, low-carbon grid in the US. We welcome additional rulemaking on IRA provisions, including clarification on domestic content bonus parameters for storage co-located with wind. We are also seeking clarity from the IRS that the treatment of standalone storage, in its qualification for the ITC, would mirror the ITC requirements for storage that is coupled with wind and solar generation assets.

Ameresco completes 313MWh of BESS projects for Colorado utility

Ameresco and United Power will hold a ribbon-cutting ceremony for the completed projects later in July, Ameresco said in a media advisory last week (18 July). The two firms entered into the contract for the projects around a year ago, reported by Energy-Storage.news at the time.

The system integrator built four BESS arrays of 11.75MW each, and another four of 7.84MW each, at eight substations across Adams, Broomfield and Weld counties owned by United Power, a not-for-profit electric cooperative.

United Power will use the BESS to balance its load as it brings more renewables online, particularly during peak demand periods. The utility is active across Colorado’s Northern Front mountain range, and is one of around 50 smaller utilities that operate in areas not covered by the state’s two large investor-owned utilities, Xcel Energy and Black Hills Energy.

The utility was behind what was, at the time, Colorado’s largest BESS, when independent power producer (IPP) Engie deployed a 4MW/16MWh system for it using Tesla Megapacks in 2018.

Ameresco, meanwhile, is active in the US grid-scale BESS market as a system integrator across numerous projects but is also looking to move into owning its own projects, as we covered last year in a Premium piece.

Its most notable project has been a 2.1GWh order from California utility Southern California Edison (SCE), although that has been beset by delays as recently covered in another piece (also Premium access).

Sodium-ion startup Peak Energy closes Series A, targets mass production in 2027

The investment round was led by Xora Innovation, an early-stage tech venture capital (VC) arm of Singapore government-owned investment group Temasek, with participation from critical infrastructure industries investor Eclipse, strategic partner TDK Ventures and other parties.

Sodium is a much cheaper and more abundant material than lithium. Na-ion batteries are not capable of energy densities as high as lithium-ion (Li-ion) and are expected to last fewer cycles.

However, they have the potential to be low-cost if produced at scale, coupled with an expectation of a lower risk of thermal runaway.

Na-ion batteries can also use many of the same production methods as Li-ion batteries. They have been identified as a potential solution for less demanding applications, such as shorter-range electric vehicles (EVs) and stationary battery energy storage systems (BESS).

Peak Energy, led by CEO Landon Mossburg, who was formerly with the North American arm of Swedish battery startup Northvolt and Tesla Energy before that, emerged from stealth mode in October 2023, announcing the raise of US$10 million in a round led by Eclipse and participated in by TDK Ventures.

At that time the company said it wanted to offer grid-scale BESS technology at 50% lower cost than incumbent Li-ion solutions.

It will manufacture its products in the US, Peak Energy said, with a group of six customers set to be involved in the pilot programme it hopes to launch next year. While the customers were not named, they include three of the country’s biggest independent power producers (IPPs), and an electric utility, the company claimed.

It aims to open a large-scale factory in 2027 and achieve the industry’s lowest cost per kilowatt-hour by 2030.

Peak Energy not the only horse in sodium-ion race

The company will have some competition. Despite Peak Energy’s claim to be an American first, rival Natron Energy opened a manufacturing plant in Michigan, US, in April.

Once ramped, the Natron factory will have 600MW annual production capacity of patented battery technology featuring ‘Prussian Blue’ electrodes. Like Peak Energy, Natron sees data centres as a potential high-demand end market for Na-ion batteries.

In China, the country which currently leads the world for Li-ion production as well as technology development, the first 50MW/100MWh phase of the first grid-scale sodium-ion BESS project in the world went into operation earlier this year.

That project now comprises 42 BESS containers utilising 185Ah Na-ion batteries with 21 power conversion system (PCS) units and the plans are for it to be expanded to 100MW/200MWh.

Various other startups and established battery manufacturers are targeting supremacy in the sodium-ion space. Germany’s Varta in May announced it was leading an R&D consortium supported by the German government.

Peak Energy’s former employer Northvolt is also looking into the technology, two other European startups, Tiamat, and Altris, raised funding in January, while the world’s biggest battery manufacturer, CATL, again based in China, is also developing Na-ion batteries and a gigawatt-hour scale factory was opened in the Asian powerhouse by state-owned power company China Three Gorges Corporation late last year.

UK’s Harmony Energy to build France’s largest BESS

The project site was previously occupied by the Cheviré oil, coal and gas power station which operated until 1986. Retired legacy power plants make ideal locations for clean energy projects thanks to their existing grid infrastructure.

Harmony Energy COO for France Clément Girard said: “It’s an exciting location given the historical importance of the fossil fuel coal power station, but looking ahead, the delivery of the Cheviré BESS will transform the site into exactly the opposite, facilitating the green electrification of the French energy system, whilst offsetting several hundred thousand tonnes of CO2.”

The firm didn’t give an expected commercial operation date (COD) for the French project.

Harmony Energy is a developer and investment advisor to the Harmony Energy Income Trust (HEIT), a UK-listed fund which owns and operates BESS projects in the UK/GB market, including the two largest operational units in Europe, sized similarly to the Cheviré project. Harmony Energy is a separate entity that develops projects which can be sold to HEIT or to other owner-operators, and its team manages HEIT.

Like other UK BESS owner-operators, it has sought to diversify internationally as revenues on home soil plummet. In February, Harmony Energy chief investment officer Paul Mason told an audience at Solar Media’s Energy Storage Summit 2024 in London that it had a ready-to-build portfolio in France, Germany and Poland. Its Poland head discussed that market with us a year ago although it has yet to announce major projects there.

The market outlook in the UK has become so negative – rightly or wrongly – that HEIT said it was considering selling its portfolio entirely.

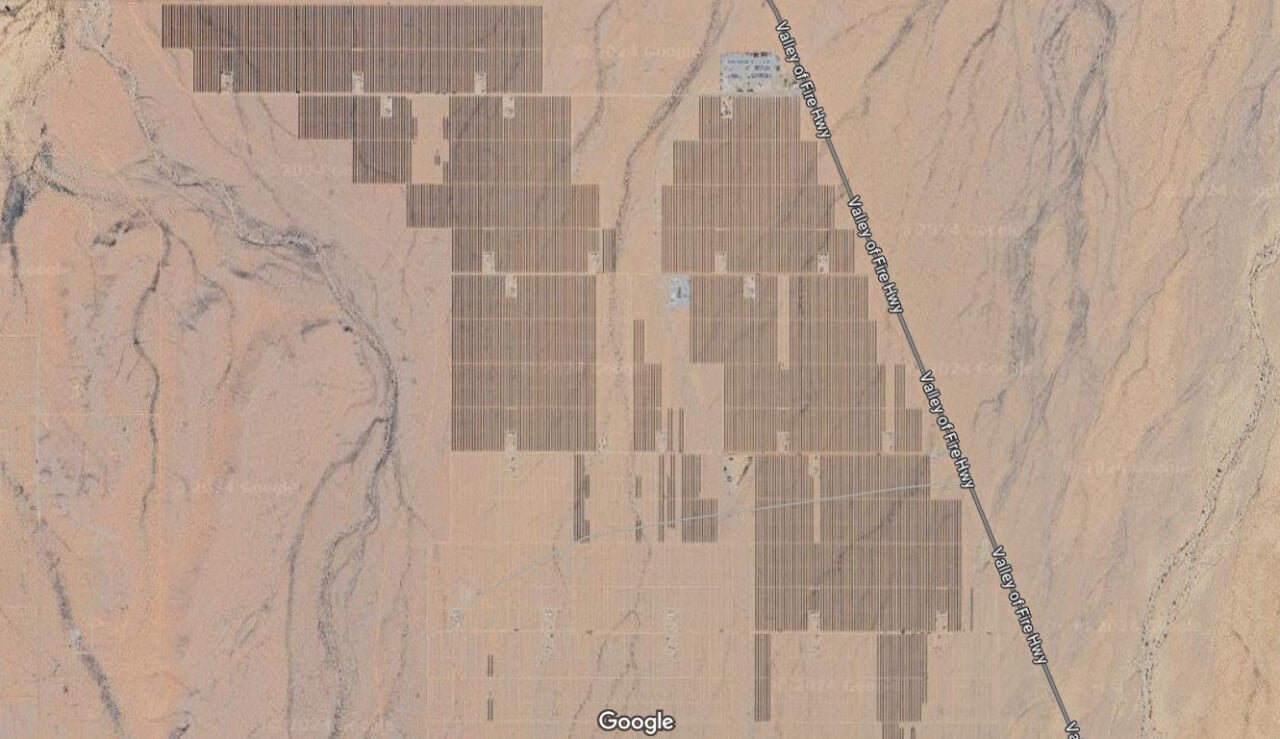

‘US’ largest’ solar-plus-storage project, Gemini, comes online in Nevada

It was developed and built by investor Quinbrook Infrastructure Partners and independent power producer (IPP) Primergy Solar, which sold a 49% stake in the project to Dutch pension fund manager APG in late 2022.

Primergy reported that same year that lithium-ion battery and BESS manufacturer CATL would provide its technology for the BESS portion of the whole project, while system integrator IHI Terrasun put the project together.

“Gemini creates a blueprint for holistic and innovative clean energy development at mega scale, and we are proud to have brought this milestone project to life and to have delivered so many positive impacts across job creation, environmental stewardship, and local community engagement,” said David Scaysbrook, co-founder and managing partner of Quinbrook.

Primergy said that as part of the project it implemented an ‘unprecedented’ framework for ecosystem management, including leaving vegetation in place, matching the solar’s installation with the ground’s natural contours and reducing land footprint by 20%.

‘Largest solar-plus-storage project in the US’

Quinbrook and Primergy claimed the Gemini is the ‘largest co-located solar plus BESS project in the US’.

That claim may be contested by IPP Terra-Gen which reached full completion on its 875MWdc solar PV and 3,287MWh BESS Edwards & Sanborn solar-plus-storage project in California, at the start of this year.

Gemini could be making the claim based on the DC (direct current) size of the solar PV portion, or that it was brought online in a single phases whereas Edwards & Sanborn was brought online in multiple phases. It could also be claiming to be the largest DC-coupled solar-plus-storage project, a difference explained in the next section.

Primergy also said its US$1.9 billion financing for Gemini back in 2022 was the largest financing of its kind.

Energy-Storage.news has asked Primergy and Quinbrook to comment and will update this article if and when a response is received.

DC-coupled architecture

The solar and BESS at Gemini are DC-coupled, which the companies said allows the BESS to charge directly from the solar and increases the efficiency and capture and storage of the solar energy. That is because the solar energy does not need to pass through a DC-AC inverter, which involves some loss of energy, to go from the solar to the BESS.

However, DC-coupling is a less flexible configuration for a solar and storage project and can result in the BESS being unable to charge from the grid. Generally, projects in the US were DC-coupled in this way as co-located BESS could not charge from the grid to qualify for investment tax credit incentives (ITCs).

However, the ITC for standalone energy storage under the Inflation Reduction Act (IRA) changed this and ended the need for such solar-charging only projects, projects which a lawyer at the time of the IRA’s passing in August 2022 described as ‘dumb’. DC-coupling has generally only been used to capture specific subsidies or incentives, with AC-coupling – generation and storage sitting independently behind a DC-AC inverter – opted for in most other market-driven use cases.

Edwards & Sanborn’s grid connection of 1.3GW – higher than its solar PV – implies it is AC coupled, meaning the solar and BESS can discharge to the grid independently of each other.

Tesla signs 15.3GWh Megapack BESS supply deal with US developer

The deal was announced in a short social media post by Tesla, which famously doesn’t engage with the press. It was also separately announced in a little more detail by the customer in a press release.

The systems will be deployed at Intersect Power solar-plus-storage projects in the US. To date, the company’s projects have concentrated in California and Texas, the country’s two leading energy storage markets by state.

The agreement builds on an existing relationship between the pair, with Intersect Power having already ordered 2.4GWh of systems from Tesla to date, for projects already in operation or currently under construction.

That represents what Intersect Power called its Base Portfolio, through which it developed 2.2GWdc of solar PV alongside the BESS assets, financed in 2021 through a variety of structures with big-name financiers including Morgan Stanley and Deutsche Bank.

Energy-Storage.news reported yesterday (18 July) that the developer has raised a further US$837 million for three 160MW/320MWh Texas BESS projects, all set to comprise Megapacks. Two of those will be optimised by Tesla’s Autobidder software platform.

The biggest Intersect project brought online to date with Tesla battery hardware appears to be Oberon, a California solar-plus-storage project featuring 679MWp of solar PV and 250MW/1000MWh of battery storage. It went into commercial operation in late 2023.

Size of deal exceeds Tesla’s 2023 storage shipments

To give an idea of scale for the latest deal, Tesla’s full-year energy storage shipments for 2023 totalled 14.7GWh. The company’s Megapack factory in Lathrop, California, is scheduled to ramp up to 40GWh annual production capacity by the end of 2024, according to the company in its Q1 2024 results announcement.

More than half of the 15.3GWh order will be utilised across four projects in California and Texas which are expected to be in operation by the end of 2027, according to Intersect Power.

The current iteration of the Megapack features up to 3.9MWh energy storage capacity, as listed on Tesla’s site, a little short of the increasing trend for manufacturers to pack as much as 5MWh or even more into a 20-foot ISO standard containerised format.

Megapack does, however, come integrated with Tesla’s power conversion system (PCS) hardware. with Tesla Energy senior director Mike Snyder talking up the “plug-and-play” capabilities the company’s vertical integration enables.

ROUNDUP: UK BESS and pumped hydro projects in planning and progress

The 200MW/400MWh, 2-hour duration Harker project was granted “full planning permission for the construction and installation” for the system and “boundary dancing, access track, landscaping and other associated infrastructure” by local authority Cumberland Council yesterday (18 July), having been granted partial approvals last month.

The project, a joint development between Canadian Solar subsidiary Recurrent Energy and Northeast England-headquartered developer Windel Energy, will now be able to begin construction, although this is not expected to be until Q4 2029 unless an accelerated grid connection date is agreed. Located between the villages of Todhills and West Linton near Carlisle, the project will connect to the Harker National Grid substation via an underground 400KV cable.

Under the approvals, the developers have agreed to several conditions, including the use of specific paving materials, limiting construction to between 7:30am and 6pm on weekdays, the use of lighting design that does not disturb local bat populations, and strict noise mitigation measures.

In May, Recurrent Energy successfully landed a €1.3 billion (£1.1 billion) multi-currency revolving credit facility from ten major banks, to finance projects in the UK and across the EU.

By Kit Million Ross.

Ethical Power and Varco Energy build on development partnership

Ethical Power has partnered with Varco Energy to deliver an almost 50MW battery energy storage system (BESS) project in Cornwall, South West England.

Varco Energy’s 47.5MW Sambar Power BESS project, located near Newquay, Cornwall, is expected to come online by Q2 2025. Energy storage asset owner and operator Ethical Power will provide Balance of Plant (BoP) work to install BESS equipment on the site, which Varco Energy announced last week will be provided by GE Vernova. GE Vernova will provide its FLEXIQ Controls, FLEXINVERTER central inverters and Battery DC-Blocks products for the development.

A digital render of one of GE Vernova’s FLEXINVERTER systems, which it will supply for the Sambar project. Image: GE Vernova.

Ethical Power will also undertake the electrical, mechanical and civil infrastructure required for connection to the National Grid transmission network.

This is not the first time that Ethical Power and Varco have partnered for UK BESS projects, having previously collaborated on the Native River project near Liverpool and the Sizing John Project south of St Helens, each of which has a 57MW capacity.

By Kit Million Ross.

RES Group submits proposal for 49.9MW Scotland BESS

RES has submitted planning permission for the Corshellach energy storage proposal to Moray Council in Scotland.

If approved, the proposed 49.9MW BESS project will be situated on land adjacent to Berryburn substation near Dunphail. RES noted that this places it near existing transmission infrastructure, which minimises the need for additional construction. The proposal is expected to go before Moray Council’s Planning Committee in the next few months; if approved, it will take around a year to construct.

Environmental concerns sit at the heart of this planning application, with RES expressing how the Corshellach Energy Storage System had been designed to fit sensitively into the landscape, following multiple surveys and assessments surrounding environment, landscape, heritage and the welfare of local residents.

Milo Amsbury-Savage, development project manager for RES, remarked upon how the community consultation process impacted the final proposal, commenting: “We’ve taken time throughout the project’s development to listen to people’s feedback in order to improve the project; for example, using the same delivery route as Berryburn Wind Farm construction to avoid the narrow Divie Viaduct. Everyone who took the time to provide feedback following our community consultation exhibitions was either supportive or neutral towards the project, with many approving of the choice of location.”

By Kit Million Ross.

Planning application submitted for 1.5GW pumped hydro project

Scottish energy storage developer ILI Group revealed on 11 July that it has lodged a Section 36 planning application with the Scottish government for a 1.5GW pumped hydro energy storage (PHES) project.

Dubbed Balliemeanoch, the project aims to provide a flexible and renewable energy resource and bolster the grid’s stability, particularly as Britain increases the amount of variable energy entering the system. It will be located at Argyll and Bute and will be able to supply 45GWh of power, making it one of the largest PHES projects in Europe.

With a planned connection date of 2031, Balliemeanoch PSH is well-positioned to contribute to the UK’s long-term energy strategy.

Plans for the project first appeared in February 2022, with Solar Power Portal having previously reported that it could provide 1.5GW of power for up to 30 hours.

The Balliemeanoch project will create a new ‘head pond’ in the hills above Loch Awe. When full, it will hold 58 million cubic meters of water.

ILI Group has engaged AECOM, an infrastructure consulting firm, as technical consultants for the Balliemeanoch PHES project. AECOM’s expertise in large-scale infrastructure projects has been “instrumental in developing the detailed plans for this ambitious scheme”, ILI said.

ILI Group’s project is not the only recent development in the PHES space in recent weeks. On 9 July, Solar Power Portal reported that Drax had appointed global technology and engineering firm Voith Hydro to move its plans forward for its proposed 600MW underground project called Hollow Mountain.

By George Heynes.

To read the above stories in full, and much more from the UK and Ireland solar PV and energy storage sectors, visit Solar Power Portal.

The UK Battery Storage Project Database, produced by our in-house team at Solar Media Market Research, tracks over 1,350 project sites across all stages of development and onto fully operational assets including a full audit-trail of each site.