Construction has already begun on the project, expected to cost a total of AU$1 billion. That includes AU$249 million already committed to it by the SEC, a state-owned entity set up last year by the Victorian government to direct investment into 4.5GW of renewable energy and energy storage.

This was largely aimed at reversing a stagnating trend of energy investment in the state, which the government said was part of the legacy of energy sector privatisation by previous administrations. MREH was the SEC’s first committed investment, announced last year soon after the state government granted key planning approvals.

Equis Australia said this morning that the pair have raised a non-recourse debt financing package from a syndicate including Societe Generale, Standard Chartered, Export Development Canada, and Westpac.

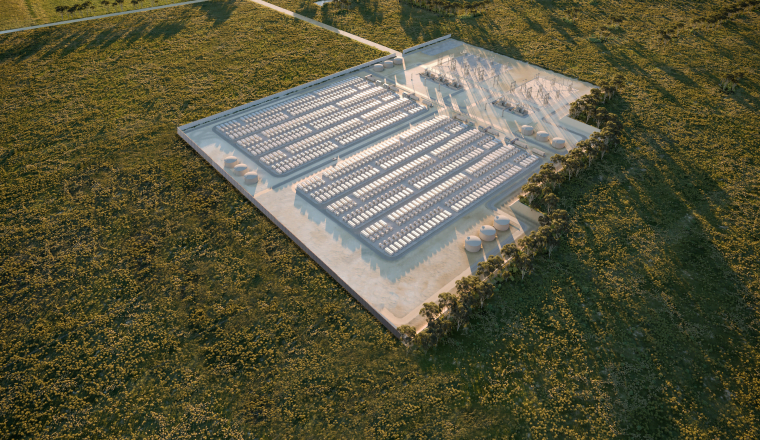

The MREH Debt Financing syndicate will fund one MREH A3, one of the three separate 200MW systems. MREH A3 will have 800MWh capacity and the asset’s operation in the NEM is going to be managed by the SEC, connected to the network via a 500kV transmission line.

Thought to be the largest debt financing package raised to date for a grid-scale BESS project in Australia, Equis claimed it as a “landmark” transaction. It is also the first financial close of a 4-hour duration BESS which will be connecting to the National Electricity Market (NEM).

According to the development partnership, it is also strategically very important for Victoria, given that it will be the only battery resource in the state capable of supporting three of the multi-gigawatt mixed technology Renewable Energy Zone (REZ) developments planned by the government.

This is due to its location at the confluence of key transmission routes, said Equis, which itself is a developer of transmission infrastructure.

Duration, scale ‘enabled by public-private equity partnership’

Having previously remarked that the public-private partnership with Victoria’s new SEC was key to enabling the project’s grand scale, Equis co-founder and managing director David Russell said the developer has found the equity partnership model “to be a very effective vehicle for government industry collaboration to bring forward renewable energy projects”.

“We think this model should be considered by other state governments because it allows their investments to earn sustainable returns that can be reinvested in further renewable energy initiatives.”

The company further noted that SEC’s involvement enabled the developer to go for 4-hour duration rather than the more typical 2-hour duration seen in the NEM recently. It was first announced with the shorter planned duration of 2-hours by Equis in late 2022. BESS suppliers to MREH will be Tesla and Samsung.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.