“The range of technologies for LDES are still under development, and I’d say the most commercially mature at present are pumped hydro energy storage (PHES) and compressed air energy storage (CAES),” he says.

“I do see more technologies coming to the fore that will play in the 10–20-hour space, but beyond one day duration, I think the number that will be viable is much more limited – you could count them on one hand.”

A developer not a technology provider

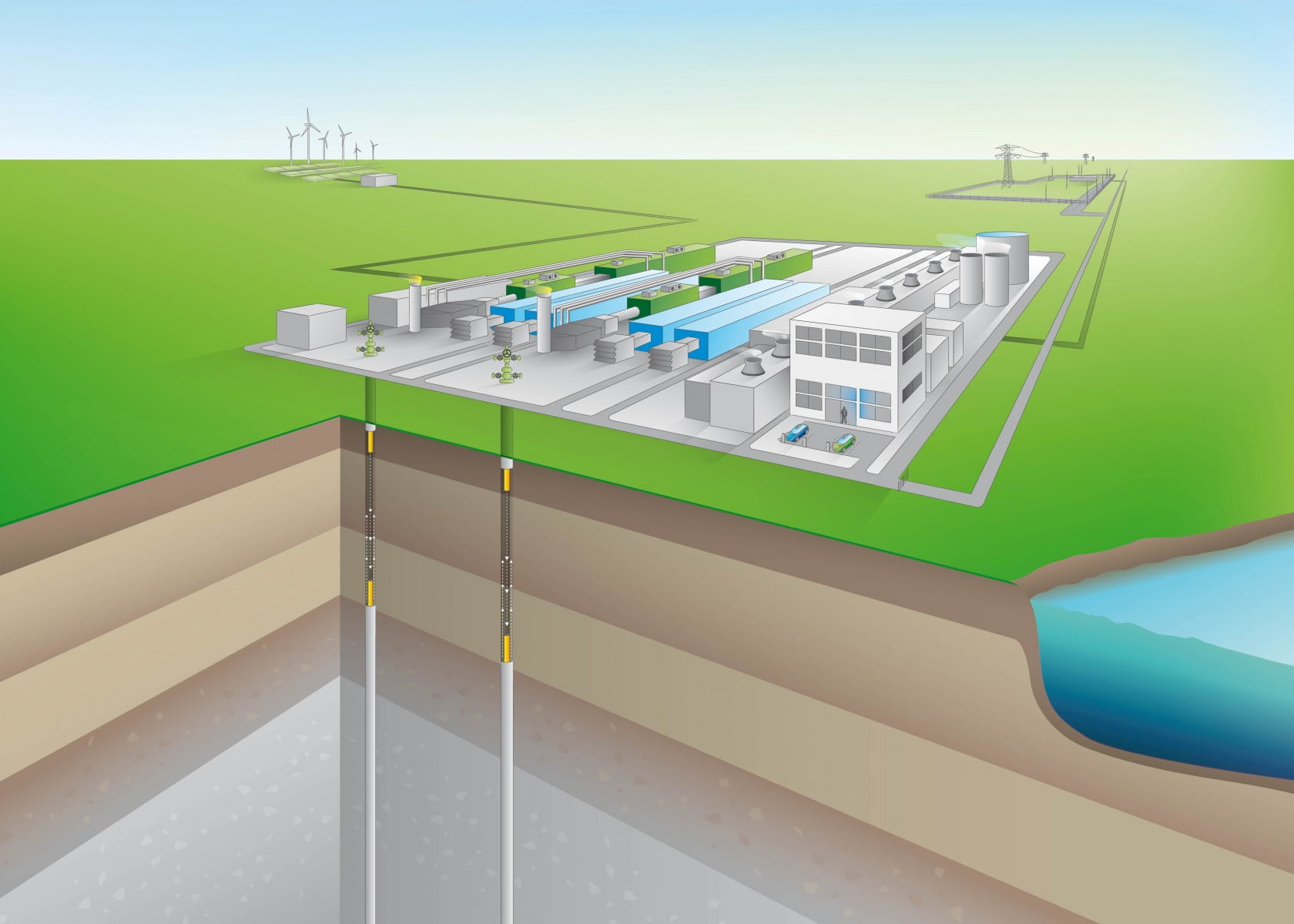

The company designs and develops large-scale projects using its CAES technology platform and salt caverns, with Siemens Energy its main design partner and engineering, procurement and construction (EPC) arranger for construction.

Corre is ‘patent-pending’ on the design of the solution and its interaction with the wholesale market, McGrane says.

The technology charges by pressurising air into a storage medium and discharges by releasing the air through a heating system, expanding and funnelling it through a turbine generator.

The firm recently claimed to be Europe’s largest energy storage developer, based on its five projects which exceed 100GWh, a pipeline recognised in the Ten-Year Network Development Plan (TYNDP) of the European association of transmission system operators (TSO) ENTSO-E .

The furthest ahead are roughly similarly sized projects in the Netherlands and Germany, at 300-320MW of power with a discharge duration of 3.5 days, meaning close to 30GWh of potential energy storage capacity.

Utility Eneco is involved in both projects, going as far as co-investing in the Germany project while Infracapital will provide construction equity for the Dutch project. The projects will cost around US$400-450 million to build, each.

“We know where LDES plays, it’s in the larger utility space with entities that have an ambition for 5GW+ of renewables,” McGrane says.

This along with things like capacity market schemes are key to getting LDES off the ground, he adds:

“Capacity payments are a really important part of facilitating LDES. Those capacity payments recognise the value of providing large amounts of energy over a long period of time with low-carbon emissions, and these payments will help our solution and other LDES solutions.”

IPO and potential private investment

McGrane also discusses Corre’s recent announcement that it has engaged investment bank Rothschild & Co to manage the process of potential investment in the company, which is listed.

The long and short of it is that the company went public to raise development capital, which is not easy in Europe for a startup like Corre, and that the need for capital is the driving force behind the decision, not the desire to be a listed company.

“We’re in the financing of the storage business. This industry is about financing, and that’s not to say that technology isn’t important, but technology without financing is just an interesting engineering project. I don’t think this is understood well enough,” McGrane says.

“My observation was that it is difficult to raise growth capital in Europe. Europe basically doesn’t have a VC industry.”

“Our listing was to raise development capital, not to have a share price. Our progress in the last six months has drawn a lot of attention and strong interest in investing into the company. People are recognising that our solution is commercialising in the LDES industry.”