But there is a disproportionate focus on the battery manufacturing side and less on the upstream material production and mining segment needed to serve it, said Bernardo Gross, COO of Lifthium Energy, a company looking to build a large lithium refining project in Portugal. Lithium is the critical metal needed for lithium-ion batteries.

Lots of focus on gigafactories, less on the upstream

“People are looking at lot at the downstream with gigafactories and investing a lot in that space but not that many people are interested in the upstream part. There are very few projects focused on lithium refining, and mining is also really hard to get permits for,” Gross told Energy-Storage.news.

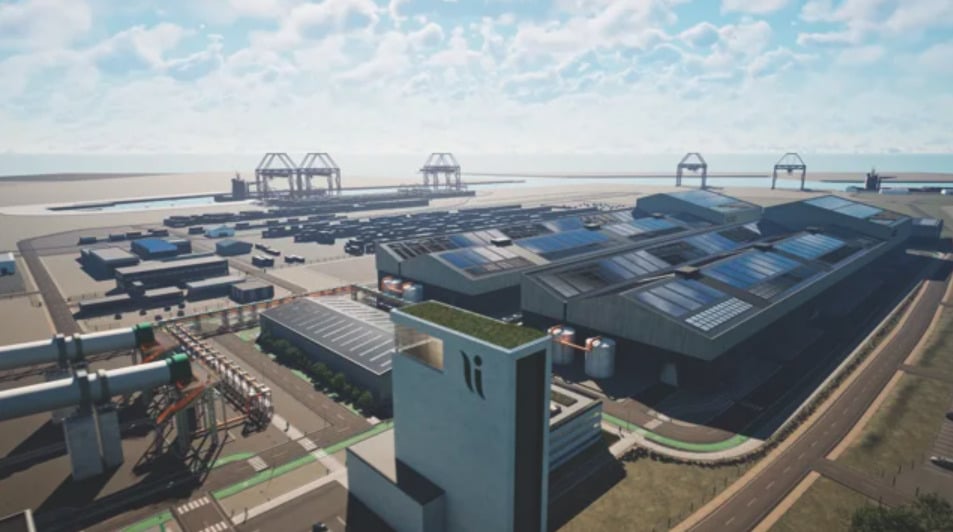

Lifthium is hoping to take a final investment decision (FID) on a project in Portugal that will convert lithium carbonate into lithium hydroxide for the European market using electrochemical processes, with a 25,000 tonne output capacity targeted by 2027.

The location for the project is still under evaluation, a spokesperson for Lifthium said. One option is to build it at an existing chemicals plant in Estarreja, owned by chemicals conglomerate Bondalti which has also developed the lithium refining technology Lifthium intends to deploy. Bondalti owns 15% of Lifthium while Bondalti’s parent company, Portuguese family office investment firm Jose de Mello Group, owns the other 85%.

The total investment in the lithium refining project will be half a billion euros, Gross said, and the company is working with banks to structure project financing with potential equity partners and industrial partners.

“There’s a lot of willingness to install refining capacity and a lot of projects that need to see the

light of day for the European battery ecosystem to flourish. We could definitely cover a big

chunk of our demand for lithium hydroxide internally,” Gross added.

“There’s another challenge to access relevant government support such as grants or loans.

Europe seems to be slower and less bold than other markets, namely the US.”

Market dominated by China

China dominates the lithium-ion battery production market with some 80-90% of manufacturing capacity, a fact that anyone in the energy storage industry will be familiar with. But not all may realise that its market share of lithium refining is even higher at well over 90%. Most lithium mining is done in Australia and South America.

Europe and the US are both aiming to build up their own battery and clean energy technology ecosystems to reduce dependence on China and East Asia.

The US’ Inflation Reduction Act has had a huge impact on the number of projects – upstream and downstream – underway there and many are calling for a substantial EU response to prevent an outflow of investment.

Gross said its lithium hydroxide will be greener than conventional products in the market today but indicated it may cost more: “We’re aiming for our products to be competitive with China’s but it’s hard when you are not playing by the same rules. We’ve done an internal lifecycle assessment and estimate our process will be at least 50% less carbon intensive than market standards.”