The company, founded in 2005, required “significant” equity investment to enable its plans, including the construction of a factory in Queensland, to scale up manufacturing and develop its newest generation of hybrid flow batteries.

Despite receiving commitments from state and federal governments in Australia to support the plans, it was unable to match that investment as required, leading to it entering administration and appointing Richard Hughes and David Orr from consultancy Deloitte as Voluntary Administrators.

In an interview with Energy-Storage.news Premium, to be published later this week, Richard Hughes, a licensed liquidator, said that although he was only appointed to the case last Friday, he is “pretty encouraged by the early interest we’ve had.”

“We’ve got quite a number of parties that approached us, unsolicited, already and we’re only on about business day four. I’m encouraged by the early interest for sure, and we think that there definitely could be parties that come through and do something,” Hughes said.

Trading in the company’s shares remains suspended on the Australian Securities Exchange (ASX), while the administration process effectively protects Redflow and its subsidiaries from creditors.

The Deloitte administrators’ aim is to get concrete proposals for a deed of company arrangement, which is “essentially a contract between the company and its creditors to resolve how those [creditors’] claims will be dealt with in a restructured Redflow.”

Hughes and Orr hope to be able to take a suitable deed of company arrangement to creditors in around a month’s time, with creditors then set to vote to approve it, or not.

“At the moment, I’m calling for people who are interested in essentially leading a proposal like that, or sponsoring a proposal like that, to come forward and have a look and let us know what they would like to do,” Hughes said.

All options could be considered, from investment that injects capital into the company in return for equity, to potential new ownership that could set a new management direction for Redflow, the administrator said, under Australian administration rules, which according to the Deloitte consultant are fairly flexible.

AGL, Neoen to double BESS capacity at Western Downs, Australia, with ‘virtual battery’ contract

Construction on the Western Downs Battery started in late 2023. It will provide essential services to help balance the grid network and is being built adjacent to a 460MWp ground-mount solar PV power plant, with these making up Neoen’s Western Downs Green power Hub.

Neoen hopes the stage one BESS will come online in early 2025 during the Australian summer. The stage two BESS is expected to be operational in July 2026. The combined capacity will reach 540MW/1,080MWh.

Neoen, AGL’s first virtual battery agreement

Readers of Energy-Storage.news will be aware that this is the second agreement the two companies signed, the first formalising in 2022.

The initial agreement pertained to 70MW/140MWh power and energy from the 100MW/200MWh Capital Battery project located in the Australian Capital Territory (ACT).

Under the terms of the first deal, AGL can virtually charge or discharge energy over the five-minute settlement (5MS) trading intervals in the National Electricity Market (NEM). This will help the utility address the increasing difference between times of abundant solar generation and energy demand, as well as the peak demand periods in the evening.

It is unknown specifically what this second agreement will be used for. However, AGL’s chief operating officer, Markus Brokhof, said it will “increase the number of tools we [AGL] can use to support our customers’ needs while also supporting electricity supply into the grid”.

“Virtual battery agreements provide flexibility within our firming portfolio without the requirement to build, operate, and maintain the physical battery,” Brokhof added.

Neoen registers 400MWh BESS as a bidirectional unit

In other news, Neoen last week (21 August) registered its 200MW/400MWh Blyth grid-forming BESS as a bidirectional unit, becoming the second to do so on the Market Management System.

The bidirectional unit can charge and discharge energy to support the grid and provide ancillary services, enhancing overall system flexibility.

The BESS will deliver energy generated by a Neoen-owned wind farm in Goyder, about 60km away, to mining and resources company BHP. This wind farm is part of Neoen’s hybrid renewable energy facility development called Goyder South Renewables Zone. It will eventually comprise 1200MW of wind power, 600MW of solar PV, and 900MW of battery energy storage.

AGL, Neoen to double BESS capacity at Western Downs, Australia, with ‘virtual battery’ contract

Construction on the Western Downs Battery started in late 2023. It will provide essential services to help balance the grid network and is being built adjacent to a 460MWp ground-mount solar PV power plant, with these making up Neoen’s Western Downs Green power Hub.

Neoen hopes the stage one BESS will come online in early 2025 during the Australian summer. The stage two BESS is expected to be operational in July 2026. The combined capacity will reach 540MW/1,080MWh.

Neoen, AGL’s first virtual battery agreement

Readers of Energy-Storage.news will be aware that this is the second agreement the two companies signed, the first formalising in 2022.

The initial agreement pertained to 70MW/140MWh power and energy from the 100MW/200MWh Capital Battery project located in the Australian Capital Territory (ACT).

Under the terms of the first deal, AGL can virtually charge or discharge energy over the five-minute settlement (5MS) trading intervals in the National Electricity Market (NEM). This will help the utility address the increasing difference between times of abundant solar generation and energy demand, as well as the peak demand periods in the evening.

It is unknown specifically what this second agreement will be used for. However, AGL’s chief operating officer, Markus Brokhof, said it will “increase the number of tools we [AGL] can use to support our customers’ needs while also supporting electricity supply into the grid”.

“Virtual battery agreements provide flexibility within our firming portfolio without the requirement to build, operate, and maintain the physical battery,” Brokhof added.

Neoen registers 400MWh BESS as a bidirectional unit

In other news, Neoen last week (21 August) registered its 200MW/400MWh Blyth grid-forming BESS as a bidirectional unit, becoming the second to do so on the Market Management System.

The bidirectional unit can charge and discharge energy to support the grid and provide ancillary services, enhancing overall system flexibility.

The BESS will deliver energy generated by a Neoen-owned wind farm in Goyder, about 60km away, to mining and resources company BHP. This wind farm is part of Neoen’s hybrid renewable energy facility development called Goyder South Renewables Zone. It will eventually comprise 1200MW of wind power, 600MW of solar PV, and 900MW of battery energy storage.

AGL, Neoen to double BESS capacity at Western Downs, Australia, with ‘virtual battery’ contract

Construction on the Western Downs Battery started in late 2023. It will provide essential services to help balance the grid network and is being built adjacent to a 460MWp ground-mount solar PV power plant, with these making up Neoen’s Western Downs Green power Hub.

Neoen hopes the stage one BESS will come online in early 2025 during the Australian summer. The stage two BESS is expected to be operational in July 2026. The combined capacity will reach 540MW/1,080MWh.

Neoen, AGL’s first virtual battery agreement

Readers of Energy-Storage.news will be aware that this is the second agreement the two companies signed, the first formalising in 2022.

The initial agreement pertained to 70MW/140MWh power and energy from the 100MW/200MWh Capital Battery project located in the Australian Capital Territory (ACT).

Under the terms of the first deal, AGL can virtually charge or discharge energy over the five-minute settlement (5MS) trading intervals in the National Electricity Market (NEM). This will help the utility address the increasing difference between times of abundant solar generation and energy demand, as well as the peak demand periods in the evening.

It is unknown specifically what this second agreement will be used for. However, AGL’s chief operating officer, Markus Brokhof, said it will “increase the number of tools we [AGL] can use to support our customers’ needs while also supporting electricity supply into the grid”.

“Virtual battery agreements provide flexibility within our firming portfolio without the requirement to build, operate, and maintain the physical battery,” Brokhof added.

Neoen registers 400MWh BESS as a bidirectional unit

In other news, Neoen last week (21 August) registered its 200MW/400MWh Blyth grid-forming BESS as a bidirectional unit, becoming the second to do so on the Market Management System.

The bidirectional unit can charge and discharge energy to support the grid and provide ancillary services, enhancing overall system flexibility.

The BESS will deliver energy generated by a Neoen-owned wind farm in Goyder, about 60km away, to mining and resources company BHP. This wind farm is part of Neoen’s hybrid renewable energy facility development called Goyder South Renewables Zone. It will eventually comprise 1200MW of wind power, 600MW of solar PV, and 900MW of battery energy storage.

Sunstone Credit Finances 2.8 MW Project Portfolio for King Energy

Josh Goldberg

Sunstone Credit has financed a $5 million, 2.8 MW project portfolio for King Energy, an energy solutions provider for commercial multi-tenant properties.

The project financed installation of solar systems serving 60 tenants across seven retail shopping centers in California, including locations in Reedley, Stockton, San Mateo, Bakersfield and Half Moon Bay.

“This project is unique because it makes solar energy accessible to businesses that might not be able to afford it otherwise,” says Josh Goldberg, Sunstone Credit co-founder and CEO.

“Our financing, coupled with King Energy’s ability to offer property owners and their tenants discounted solar energy services and consolidated payments, democratizes access to solar while driving a clean, green future for all.”

Continue readingChaberton Energy Starts Construction on Maryland Community Solar Project

A Chaberton Energy’s completed community solar projects (Source: PR Newswire)

Chaberton Energy has commenced construction on Lime Kiln, a 2.9 MW community solar project located in Fulton, Howard County, Md.

The project was developed by Chaberton and is owned and operated by Pivot Energy. It will be part of the Maryland Community Solar program.

“This is another big win for clean energy and for equitable access to renewable energy in our home state of Maryland,” says Mike Doniger, Chaberton co-founder and chief operating officer. “This is a great example of how community solar can work for local residents, and I can’t wait to see this project power up.”

The Lime Kiln project will use 15 acres on a 57-acre tract of land and is expected to include local pollinators. It is slated to be operational next year.

Continue readingClearway Closes Financing, Commences Construction on California Solar+Storage

Brooks Friedeman

Clearway Energy Group has closed on $550 million in construction financing and broke ground on the company’s 140 MW solar and 118 MW storage project in Kern County, Calif., Rosamond South I.

“Kern County has long served as a critical provider of our country’s energy,” says Brooks Friedeman, vice president of Capital Markets at Clearway.

“We are pleased to invest in and help continue Kern County’s energy leadership legacy through our Rosamond South solar and storage project, which will provide reliable and low-cost power when needed most.”

Rosamond South I, referred to as Golden Fields Solar IV by its offtakers, is under 15-year agreements with MCE, University of California, Rancho Cucamonga Municipal Utility, Eastside Power Authority and the City of Moreno Valley.

To finance the construction loan, Clearway assembled a bank consortium consisting of Societe Generale, Australia and New Zealand Banking Group Limited Siemens Financial Services, Commerzbank, CoBank, DNB Bank ASA and Nord/LB.

Construction is being led by EPC contractor McCarthy Building Companies. Labor partners included Laborers Union 220, Southwest Regional Council of Carpenters, Operating Engineers Local 12, IBEW Local 428, Ironworkers Local 416 and Local 433.

The project is expected to reach commercial operations next year.

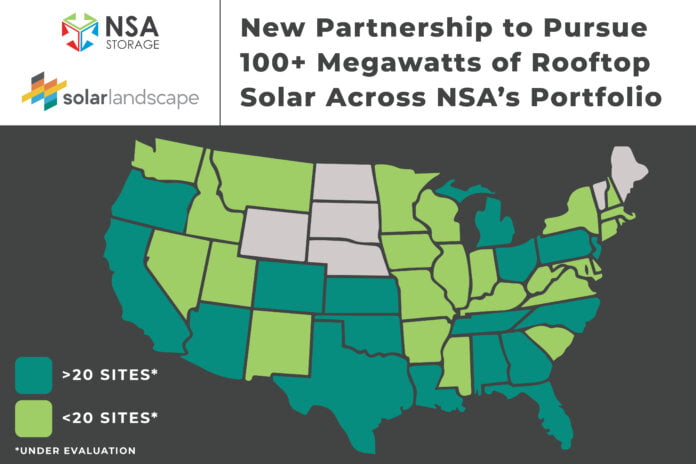

Continue readingNSA, Solar Landscape to Pursue 100 MW of Rooftop Capacity

(Graphic: Business Wire)

National Storage Affiliates Trust (NSA) and Solar Landscape are partnering to pursue the installation of new solar capacity on rooftops across NSA properties.

The partnership plans to develop 100 MW of solar capacity, with NSA granting Solar Landscape rights to evaluate approximately 1,000 properties in 42 states and Puerto Rico for community solar hosting potential.

Under the partnership, solar installations on NSA property rooftops will power nearby homes and businesses at a discount.

Development on the first sites in the partnership has already begun. The projects require no capital expenditure by NSA. Solar Landscape, will develop, own and operate the projects and make a monthly lease payment to NSA.

“This is an exciting step toward our corporate responsibility goals and demonstrates our commitment to building a more sustainable future,” says David Cramer, NSA president and CEO.

“NSA has long been customer- and community-focused. This partnership will enable us to increase that value by generating clean energy at a discount for the households surrounding our facilities, while also generating value for NSA shareholders.”

The companies have worked together since 2022.

Continue readingMatrix Renewables, SOLV Energy Break Ground on Texas Community Solar Project

Project stakeholders and community members gathered on site to celebrate the start of construction on Stillhouse Solar in Bell County. (Source: PRWeb)

Project owner Matrix Renewables and EPC contractor SOLV Energy have started construction on the 284 MW Stillhouse Solar project in Rogers, Texas.

The project is expected to be operational in the second half of next year.

“Matrix Renewables is thrilled to commence construction on the Stillhouse solar project bringing this project into existence supporting the renewable energy goals of our offtakers, stakeholders as well as the power grid,” says Cindy Tindell, Matrix managing director and head of U.S.

“We are delighted to make this investment in Bell County working with local Bell County landowners and officials.”

Matrix owns a 7 GW pipeline of projects in operation and various stages of construction and development in the U.S. Matrix selected SOLV Energy as the EPC and O&M partner on the project. SOLV has built and operates 12 GW of solar capacity in the U.S.

Continue readingSungrow in 1GWh+ BESS deal with US developer Spearmint Energy

The two companies announced the deal last week (23 August). PowerTitan 2.0 will be installed at Texas projects through 2025.

It builds on an existing relationship which has seen Sungrow BESS units power Spearmint’s first major project, also in Texas.

Completed at the end of last year, Spearmint’s 150MW/300MWh Revolution project features 134 Sungrow BESS containers and 45 Sungrow power conversion system (PCS) units.

Spearmint acquired Revolution from Con Edison in 2022 before breaking ground on it in December of that year.

It was thought to be one of the US’ first-ever BESS projects to leverage the investment tax credit (ITC) for standalone storage as the developer secured US$92 million in tax equity financing.

While a release from Sungrow and Spearmint did not disclose details of the projects to be included in the scope of the new agreement, in March 2023 Spearmint acquired a 900MW three-project portfolio in Texas from an unnamed developer, set to come online during 2025.

Research firm Wood Mackenzie ranked Sungrow as the second-top energy storage system integrator globally for 2023 in a recent report. Sungrow had been top in 2022 but lost out to Tesla last year. Meanwhile, Sungrow, Tesla and Fluence, the top three in Wood Mackenzie’s rankings for the US market, increased their combined market share of the US market to 72% last year from 60% the year before.

Thanks to ERCOT’s deregulated wholesale electricity market, Texas has the second largest installed base of grid-scale battery storage assets by state in the US after California, with about 5GW participating in ERCOT, to more than 10GW already online on California’s CAISO grid.

ERCOT also appears to be growing faster than California’s CAISO market and is due to close in on around 9.5GW of cumulative installs by the end of this year, by some projections.

BESS revenues in ERCOT average at about US$200,000/MW/year in 2023, according to Modo Energy ERCOT lead Brandt Vermillion. Speaking to Energy-Storage.news Premium for a recent interview, Vermillion said that revenues will be lower in 2024, but the wholesale price volatility that battery storage assets are well-placed to capture will increase.